Barrick (GOLD) Reports Strong Preliminary Q3 Sales & Production

Barrick Gold Corporation GOLD released its preliminary results for the third quarter, reporting sales of 1.03 million ounces of gold and 101 million pounds of copper, with production of 1.04 million ounces of gold and 112 million pounds of copper. Although third-quarter production exceeded the second quarter's, it fell short of initial plans for the quarter, notably at Pueblo Viejo, where equipment design issues caused delays in the expansion project. The company anticipates a significant increase in production during the fourth quarter.

During the third quarter, the average market price for gold was $1,928 per ounce, while copper averaged $3.79 per pound.

The rise in preliminary third-quarter gold production from the second quarter’s levels can be attributed to increased output at Cortez, driven by higher oxide production from the Crossroads open pit and Cortez Hills underground. Planned autoclave maintenance at Turquoise Ridge in the previous quarter and improved grades at Kibali contributed to higher production. However, Carlin experienced lower production due to reduced ore grades from processed stockpiled ore.

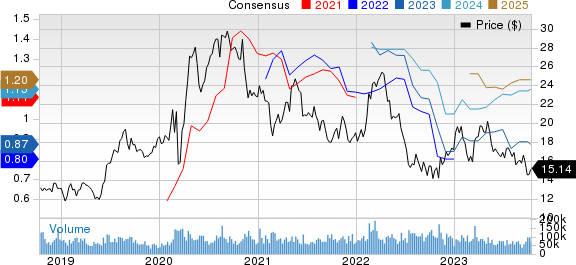

Barrick Gold Corporation Price and Consensus

Barrick Gold Corporation price-consensus-chart | Barrick Gold Corporation Quote

Compared with the second quarter, third-quarter gold cost of sales per ounce is expected to be 2-4% lower, total cash costs per ounce are anticipated to be 4-6% lower and all-in sustaining costs per ounce are expected to be up to 6-8% lower.

Preliminary third-quarter copper production was higher than the second quarter, primarily driven by increased output at Lumwana. In comparison to the second quarter, third-quarter copper cost of sales per pound is expected to be 5-7% lower, C1 cash costs per pound are expected to be 9-11% lower. However, all-in-sustaining costs per pound are projected to be 2-4% higher, mainly due to increased capitalized stripping at Lumwana.

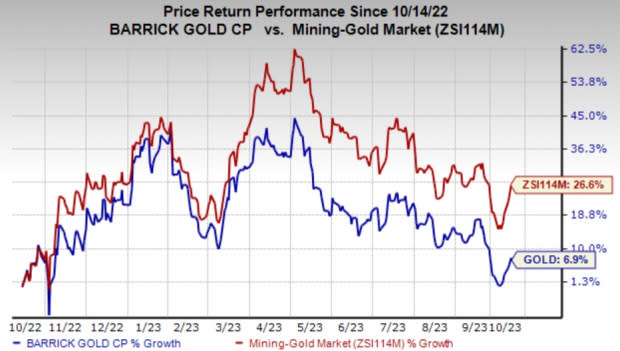

Barrick stock has gained 6.9% in the past year compared with the industry’s rise of 26.6% in the same period.

Image Source: Zacks Investment Research

Other Key Picks

Barrick currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are WestRock Company WRK, sporting a Zacks Rank #1 (Strong Buy), and Air Products and Chemicals, Inc. APD and The Andersons Inc. ANDE, carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Westrock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 16.2% in the past year.

The consensus estimate for Air Products’ current fiscal year earnings is pegged at $11.47, indicating year-over-year growth of 10.2%. APD beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 1.8%. The company’s shares have surged 22.9% in the past year.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 52.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report