Barrow, Hanley, Mewhinney & Strauss Adjusts Portfolio, Major Moves in Dollar General Corp

Insight into the Investment Firm's Latest 13F Filings for Q3 2023

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), a distinguished Dallas-based investment firm, is known for its conservative value investment philosophy. The firm, led by Executive Director Mr. Barrow, has a track record of focusing on stocks that exhibit below-market price-to-earnings ratios, below-market price-to-book ratios, and above-market dividend yields. With a history of outperforming the market, as evidenced by the Selected Value Funds' 9.33% annual return over a decade, the firm's recent 13F filing for the third quarter of 2023 offers valuable insights into its latest investment decisions.

New Additions to the Portfolio

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) expanded its portfolio with 21 new stocks. Noteworthy additions include:

Public Storage (NYSE:PSA), purchasing 1,123,312 shares, which now comprise 1.13% of the portfolio, valued at $296 million.

CRH PLC (NYSE:CRH), with 3,898,576 shares, making up 0.82% of the portfolio, valued at $213 million.

Wynn Resorts Ltd (NASDAQ:WYNN), adding 2,237,094 shares, accounting for 0.79% of the portfolio, valued at $206 million.

Significant Position Increases

The firm also raised its stakes in 77 stocks, with the most significant increases being:

Enbridge Inc (NYSE:ENB), with an additional 5,483,078 shares, bringing the total to 19,557,249 shares. This represents a 38.96% increase in share count, impacting the portfolio by 0.7%, and valued at $650 million.

Allstate Corp (NYSE:ALL), with an additional 1,129,653 shares, now holding a total of 5,344,741 shares. This adjustment marks a 26.8% increase in share count, valued at $595 million.

Exiting Positions

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) completely sold out of 14 holdings in the third quarter of 2023, including:

Perrigo Co PLC (NYSE:PRGO), selling all 7,698,520 shares, impacting the portfolio by -0.97%.

Fomento Economico Mexicano SAB de CV (NYSE:FMX), liquidating all 1,045,324 shares, with a -0.43% impact on the portfolio.

Key Position Reductions

The firm reduced its position in 88 stocks. The most significant reductions include:

Dollar General Corp (NYSE:DG), cutting 1,974,380 shares, resulting in an -81.54% decrease and a -1.25% portfolio impact. The stock traded at an average price of $149.07 during the quarter and has seen a -28.31% return over the past 3 months and -51.71% year-to-date.

Oracle Corp (NYSE:ORCL), reducing by 2,553,137 shares, marking a -41.58% decrease and a -1.13% portfolio impact. The stock's average trading price was $115.75 for the quarter, with a 1.50% return over the past 3 months and a 42.01% year-to-date return.

Portfolio Overview

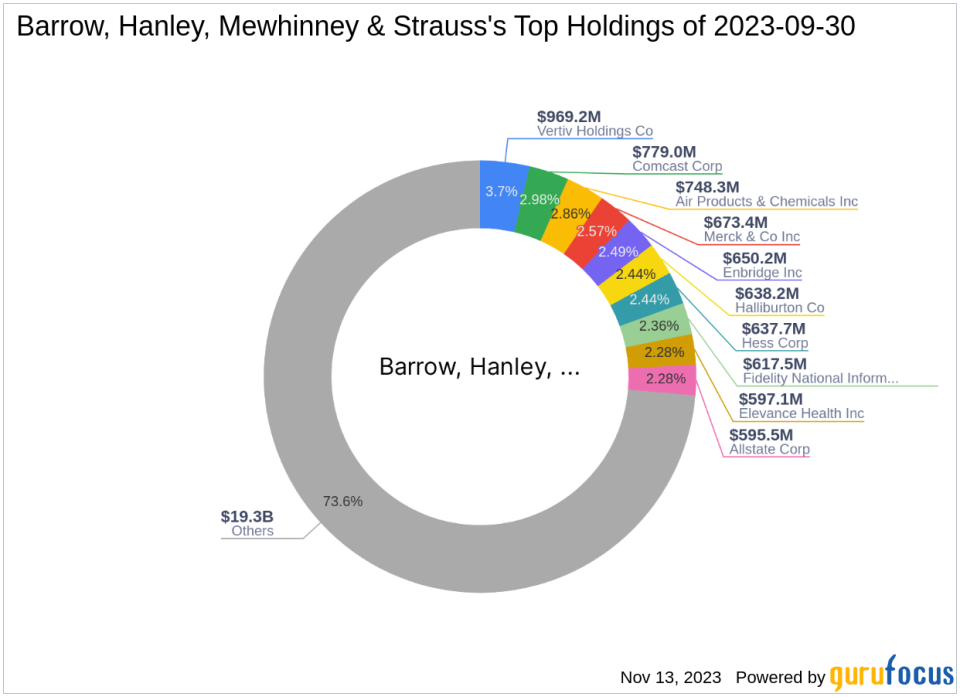

As of the third quarter of 2023, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)'s portfolio included 290 stocks. The top holdings were 3.7% in Vertiv Holdings Co (NYSE:VRT), 2.98% in Comcast Corp (NASDAQ:CMCSA), 2.86% in Air Products & Chemicals Inc (NYSE:APD), 2.57% in Merck & Co Inc (NYSE:MRK), and 2.49% in Enbridge Inc (NYSE:ENB). The investments span across all 11 industries, with a focus on Financial Services, Industrials, Healthcare, Technology, Energy, Basic Materials, Consumer Cyclical, Communication Services, Utilities, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.