Barrow, Hanley, Mewhinney & Strauss Q2 2023 13F Filing Analysis

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), a Dallas-based investment firm, recently filed their 13F report for the second quarter of 2023. The firm, led by Executive Director Mr. Barrow, is known for its value investing philosophy and has a strong track record of performance. For instance, the Selected Value Funds, managed by Mr. Barrow, averaged 9.33% a year for the 10-year period ended 3/31/2010, during a time when the market had negative returns.

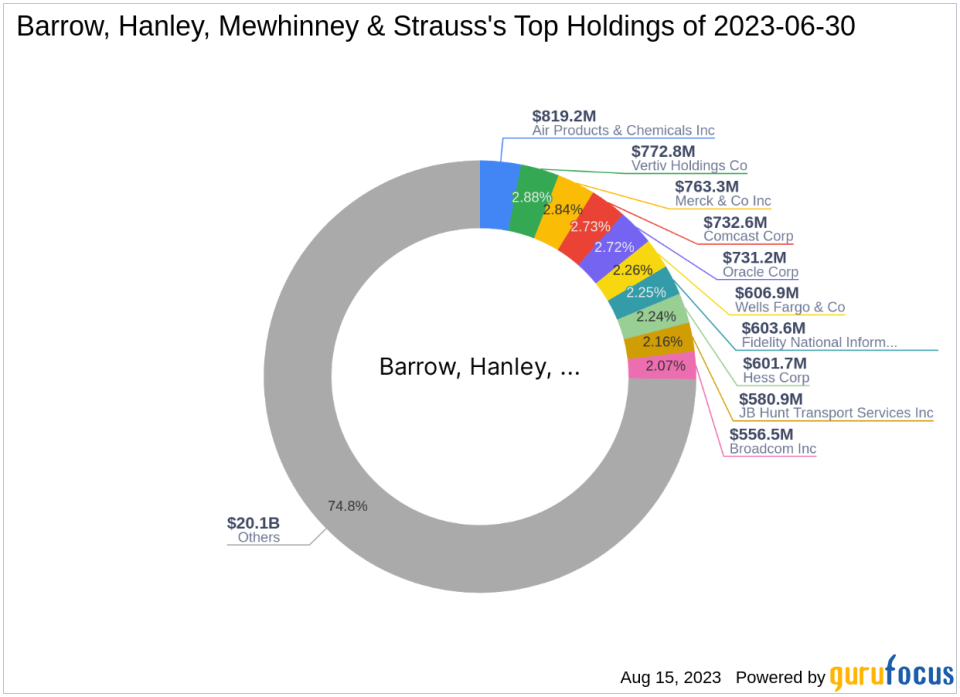

Portfolio Overview

The firm's portfolio for Q2 2023 contained 282 stocks with a total value of $26.85 billion. The top holdings were APD (3.05%), VRT (2.88%), and MRK (2.84%).

Top Trades of the Quarter

The firm's top three trades of the quarter were Skyworks Solutions Inc (NASDAQ:SWKS), Southwest Airlines Co (NYSE:LUV), and Entergy Corp (NYSE:ETR).

Skyworks Solutions Inc (NASDAQ:SWKS)

The firm established a new position in Skyworks Solutions Inc (NASDAQ:SWKS), purchasing 3,367,093 shares, which accounted for 1.39% of the equity portfolio. The shares were traded for an average price of $105.7 during the quarter. As of August 15, 2023, SWKS had a market cap of $16.89 billion and a stock price of $105.96. The stock has returned -3.67% over the past year. GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10. The company's valuation ratios include a P/E ratio of 16.33, a P/B ratio of 2.87, a PEG ratio of 1.54, a EV-to-Ebitda ratio of 9.53, and a P/S ratio of 3.39.

Southwest Airlines Co (NYSE:LUV)

During the quarter, the firm bought 8,430,739 shares of Southwest Airlines Co (NYSE:LUV), bringing the total holding to 11,291,288 shares. This trade had a 1.13% impact on the equity portfolio. The stock was traded for an average price of $31.37 during the quarter. As of August 15, 2023, LUV had a market cap of $19.74 billion and a stock price of $33.14. The stock has returned -15.33% over the past year. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10. The company's valuation ratios include a P/E ratio of 37.66, a P/B ratio of 1.83, a EV-to-Ebitda ratio of 7.03, and a P/S ratio of 0.83.

Entergy Corp (NYSE:ETR)

The firm also bought 2,864,564 shares of Entergy Corp (NYSE:ETR), bringing the total holding to 3,940,599 shares. This trade had a 1.04% impact on the equity portfolio. The stock was traded for an average price of $103.7 during the quarter. As of August 15, 2023, ETR had a market cap of $20.04 billion and a stock price of $94.75. The stock has returned -19.11% over the past year. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 7 out of 10. The company's valuation ratios include a P/E ratio of 14.44, a P/B ratio of 1.51, a PEG ratio of 3.61, a EV-to-Ebitda ratio of 9.72, and a P/S ratio of 1.50.

In conclusion, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)'s Q2 2023 13F filing reveals a diversified portfolio with a focus on value investing. The firm's top trades of the quarter reflect a strategic approach to investing in companies with strong financials and potential for growth.

This article first appeared on GuruFocus.