Bassett (BSET) Hikes Dividend by 12.5%, Boosts Investors' Value

Bassett Furniture Industries, Incorporated BSET inched up 0.38% in the after-hours trading session on Jul 12 after it hiked the quarterly dividend by 12.5%, maintaining its commitment to regularly boost stockholders’ value.

This leading manufacturer and marketer of high-quality home furnishings announced a quarterly cash dividend hike, paying a dividend of 18 cents per share on Aug 25, 2023, to shareholders on record as of Aug 11. The company has a dividend payout of 36% and a dividend yield of 4.08%, based on the closing share price of $15.69 on Jul 12.

This move reflects the company’s sound and stable financial position and commitment to rewarding shareholders in this unprecedented economic condition.

Enhancement of Shareholder Value

Bassett has been actively managing cash flows and returning considerable free cash to investors through share repurchases and dividends. On Jul 14, 2022, it increased its quarterly dividend to 16 cents per share, marking a 14% rise from the year-ago period’s levels. Earlier, on Mar 11, 2022, the company announced a special dividend of $1.50 per share of common stock.

During the the first half of fiscal 2023, cash provided by operations were $6,413 versus cash used in operations of $8,946 reported in a year ago period. The company expects to aggressively use operating cash flow and balance sheets in its business.

Apart from dividend distribution, Bassett regularly buys back its shares to boost shareholders’ value. In the first half of fiscal 2023, it repurchased 209,337 shares of its stock for $3,450 under the share repurchase program.

Investors always prefer a return-generating stock. A high-dividend-yielding one is highly coveted. Stockholders are always looking for companies with a track record of consistent and incremental dividend payments.

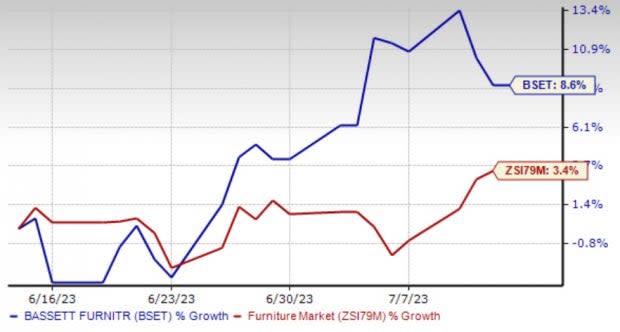

Image Source: Zacks Investment Research

Shares of the company have gained 8.6% compared with the Zacks Furniture industry’s 3.4% growth in a month.

Zacks Rank

Currently, BSET carries a Zacks Rank #4 (Sell).

Stocks to Consider

American Woodmark AMWD, which is the third-largest manufacturer of kitchen and bath cabinets, currently sports a Zacks Rank #1 (Strong Buy). The expected EPS growth rate for three to five years is 13%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for American Woodmark’s current-quarter EPS suggests growth of 22.8% from the year-ago reported figure. American Woodmark has a trailing four-quarter earnings surprise of 26.8%, on average.

GIII Apparel Group GIII, which is a manufacturer, designer and distributor of apparel and accessories, flaunts a Zacks Rank #1 at present. The expected EPS growth rate for three to five years is 15%.

The Zacks Consensus Estimate for GIII Apparel Groups’ current financial-year sales and earnings suggests growth of 1.9% and 0.4% from the year-ago period. GIII has a trailing four-quarter earnings surprise of 47.4%, on average.

Virco Mfg. Corporation VIRC: Headquartered in Torrance, CA, this company designs, produces and distributes furniture in the United States.

The Zacks Consensus Estimate for Virco’s current financial-year earnings suggests a fall of 20.6% from the year-ago period's reported figure. Yet, it has a trailing four-quarter earnings surprise of 172.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Woodmark Corporation (AMWD) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Virco Manufacturing Corporation (VIRC) : Free Stock Analysis Report

Bassett Furniture Industries, Incorporated (BSET) : Free Stock Analysis Report