Bassett Furniture Industries Inc (BSET) Reports Fiscal Q4 Earnings Amidst Market Challenges

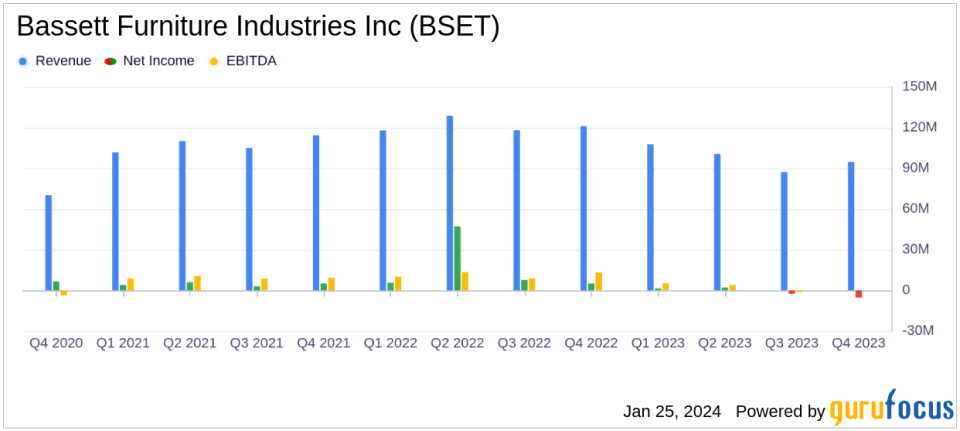

Net Sales: Decreased to $94.7 million in Q4 2023, a 21.7% drop from $121.0 million in Q4 2022.

Operating Income: Reported an operating loss of $4.5 million in Q4 2023 compared to an operating income of $6.7 million in Q4 2022.

Goodwill Impairment: A noncash goodwill impairment charge of $5.4 million was recorded in the quarter.

Gross Margin: Improved to 54.3% in Q4 2023 from 53.1% in Q4 2022.

Balance Sheet: Ended the quarter with $70.2 million in cash and cash equivalents and no debt.

Dividends: Paid a regular quarterly dividend of $0.18 per share and approved the next installment payable on March 1, 2024.

E-commerce: Launched a new e-commerce platform leading to increased engagement and higher average order value.

Bassett Furniture Industries Inc (NASDAQ:BSET) released its 8-K filing on January 25, 2024, detailing its financial performance for the fourth quarter ended November 25, 2023. The company, a prominent manufacturer, importer, and retailer of home furnishings in the United States, faced a challenging quarter with a significant decline in net sales and an operating loss, primarily due to a noncash goodwill impairment charge.

The company's consolidated net sales saw a sharp decline of 21.7% to $94.7 million in the fourth quarter of 2023, down from $121.0 million in the same period last year. This decrease was reflected across its business segments, with the Wholesale and Retail segments experiencing a drop in sales of 18.8% and 22.3%, respectively. The operating loss for the quarter stood at $4.5 million, a stark contrast to the operating income of $6.7 million reported in the fourth quarter of 2022.

Despite the downturn in sales, Bassett Furniture Industries Inc (NASDAQ:BSET) reported an improvement in gross margin to 54.3%, up from 53.1% in the prior year's quarter. This improvement is indicative of the company's ability to manage costs effectively amidst a challenging sales environment. The company also highlighted its strong balance sheet, ending the quarter with $70.2 million in cash and cash equivalents and no outstanding debt, which positions it well for future growth and stability.

One of the significant factors impacting the quarter's earnings was a noncash goodwill impairment charge of $5.4 million related to the acquisition of Noa Home Inc. This charge was a result of the softer e-commerce furniture sales environment and the decision to exit the Australian market to focus on North America.

Operational and Strategic Highlights

From an operational standpoint, the company made adjustments to its manufacturing footprint to align with current demand and backlogs. It also reported a reduction in wholesale inventory by 38.7% compared to year-end 2022, which is a positive step towards improving operational efficiency.

Strategically, Bassett Furniture Industries Inc (NASDAQ:BSET) completed the migration to a new e-commerce platform, which has shown promising results in customer engagement and sales. The company also remains focused on product innovation, sales technology improvements, store updates, margin enhancement, and talent acquisition to navigate through the current market challenges and capitalize on the anticipated upswing in the home furnishings space.

Chairman and CEO Robert H. Spilman, Jr. expressed optimism for the future, citing favorable demographics and the potential for interest rate reductions later in the year as reasons for a positive outlook. The company's focus on innovation and prudent balance sheet management is expected to position it well for when the market conditions improve.

For investors and potential GuruFocus.com members, the detailed financial performance of Bassett Furniture Industries Inc (NASDAQ:BSET) provides a comprehensive view of the company's current position and strategic direction. While the fourth quarter of 2023 presented its challenges, the company's efforts to strengthen its balance sheet, improve gross margins, and innovate in both product offerings and sales technology demonstrate a commitment to long-term growth and resilience.

About Bassett Furniture Industries, Inc.: Bassett Furniture Industries, Inc. (NASDAQ:BSET) operates through a network of 88 company- and licensee-owned stores, focusing on high-quality home furnishings and a customer-friendly buying environment. The company also maintains a traditional wholesale business with over 700 accounts globally and specializes in logistics for home furnishings. More information can be found at bassettfurniture.com.

Explore the complete 8-K earnings release (here) from Bassett Furniture Industries Inc for further details.

This article first appeared on GuruFocus.