Basswood Capital Management, L.L.C. Reduces Stake in Regional Management Corp

On September 6, 2023, Basswood Capital Management, L.L.C. executed a significant transaction involving Regional Management Corp (NYSE:RM). The firm reduced its holdings by 895,849 shares, representing a 97.55% decrease in its stake. The shares were traded at a price of $26.98 each, leaving Basswood Capital Management with a total of 22,539 shares in Regional Management Corp. This transaction had a -1.78% impact on the firm's portfolio, and the remaining shares now constitute 0.05% of Basswood Capital Management's portfolio and 0.23% of Regional Management Corp's total shares.

Profile of Basswood Capital Management, L.L.C.

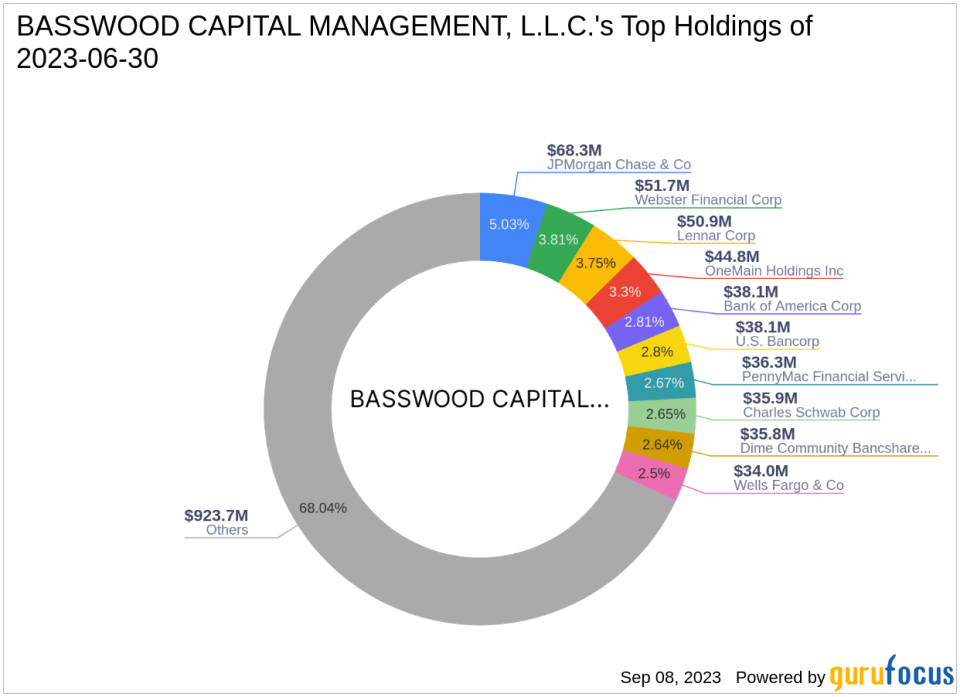

Basswood Capital Management, L.L.C., an investment management firm based in New York City, was established in 1998. The firm, owned by its employees, has grown significantly over the years, now boasting 15 total employees, including nine investment professionals. Basswood Capital Management conducts its research internally, utilizing a fundamental methodology to make its investment decisions. The firm primarily invests in value stocks and event-driven strategies, focusing on the public equity and fixed income markets globally. The finance sector is the firm's most heavily invested sector, accounting for over three-quarters of its total asset allocations. The firm manages over $2.2 billion in total assets spread across 17 discretionary accounts. Its top holdings include Bank of America Corp(NYSE:BAC), JPMorgan Chase & Co(NYSE:JPM), Lennar Corp(NYSE:LEN), OneMain Holdings Inc(NYSE:OMF), and Webster Financial Corp(NYSE:WBS).

Overview of Regional Management Corp

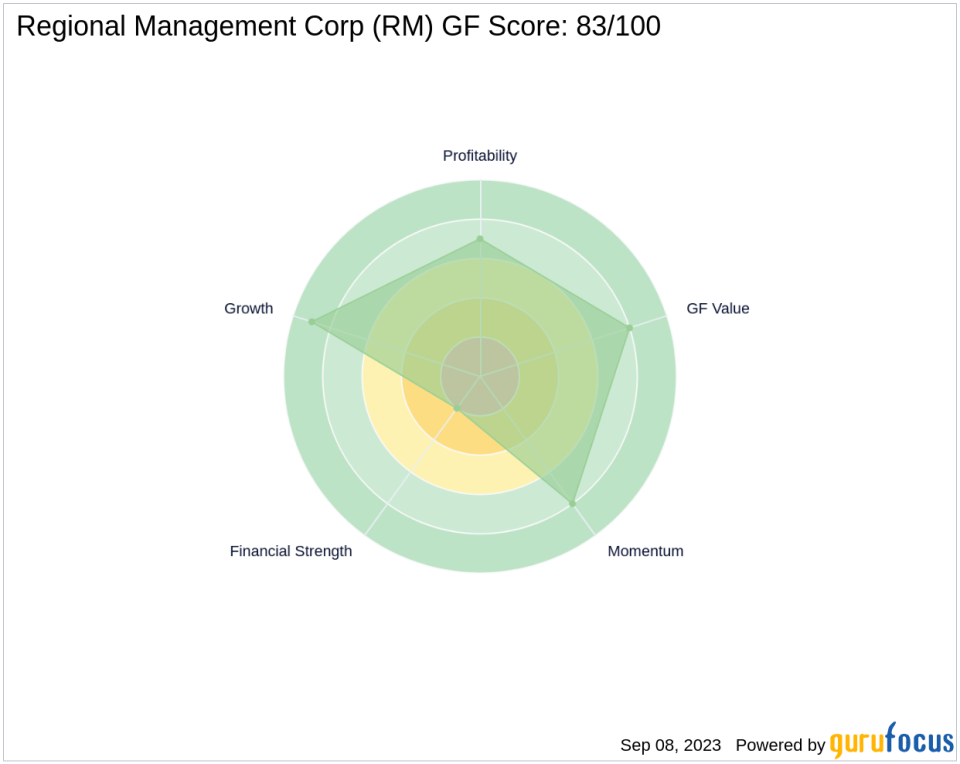

Regional Management Corp (NYSE:RM) is a diversified consumer finance company based in the USA. The company, which went public on March 28, 2012, provides installment loan products to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other lenders. As of September 9, 2023, the company has a market capitalization of $267.275 million and a stock price of $27.17. The company's PE percentage stands at 9.57, indicating profitability. According to GuruFocus valuation, the stock is significantly undervalued with a GF Value of $50.33 and a price to GF Value ratio of 0.54. The company's GF Score is 83/100, suggesting good outperformance potential.

Analysis of Regional Management Corp's Performance

Regional Management Corp's year-to-date price change ratio stands at -6.15%. Since its IPO, the stock has seen a price change ratio of 59.82%. The company's balance sheet rank is 2/10, while its profitability rank is 7/10. The growth rank stands at 9/10, indicating strong growth potential. The company's GF Value rank is 8/10, suggesting that it is undervalued. The momentum rank is 8/10, indicating strong momentum. The company's Piotroski F-Score is 4, and its Altman Z score is 0.00, indicating financial stability. The cash to debt ratio is 0.01, and its rank is 476. The company's ROE and ROA ranks are 210 and 276, respectively.

Examination of Regional Management Corp's Industry Performance

Regional Management Corp operates in the Credit Services industry. The company's revenue growth over the past three years stands at 22.30%, while its earning growth is 11.70%. The company's gross margin growth and operating margin growth are both 0.00. The company's RSI 14 Day rank is 78, indicating a neutral momentum. The company's momentum index 6 - 1 month rank is 276, suggesting a negative momentum.

Conclusion

In conclusion, Basswood Capital Management, L.L.C.'s recent transaction involving Regional Management Corp represents a significant reduction in its stake. Despite this, the remaining shares still constitute a small portion of the firm's portfolio. Regional Management Corp's strong growth potential, good outperformance potential, and undervalued status make it an attractive investment. However, the company's low cash to debt ratio and low balance sheet rank suggest potential financial risks. This transaction and its potential implications should be of interest to value investors and the broader market.

This article first appeared on GuruFocus.