Basswood Capital Management, L.L.C. Increases Stake in Dime Community Bancshares Inc

On September 8, 2023, Basswood Capital Management, L.L.C., a New York-based investment management firm, added to its holdings in Dime Community Bancshares Inc. This article aims to provide an in-depth analysis of this transaction, the profiles of both entities involved, and the potential implications for investors.

Details of the Transaction

The transaction involved the acquisition of 19,297 shares of Dime Community Bancshares Inc at a trade price of $20.64 per share. This addition increased Basswood Capital Management's total holdings in the company to 649,267 shares, representing 0.99% of the firm's portfolio and 1.67% of the total shares of Dime Community Bancshares Inc. The trade had a minor impact of 0.03% on the firm's portfolio.

Profile of Basswood Capital Management, L.L.C.

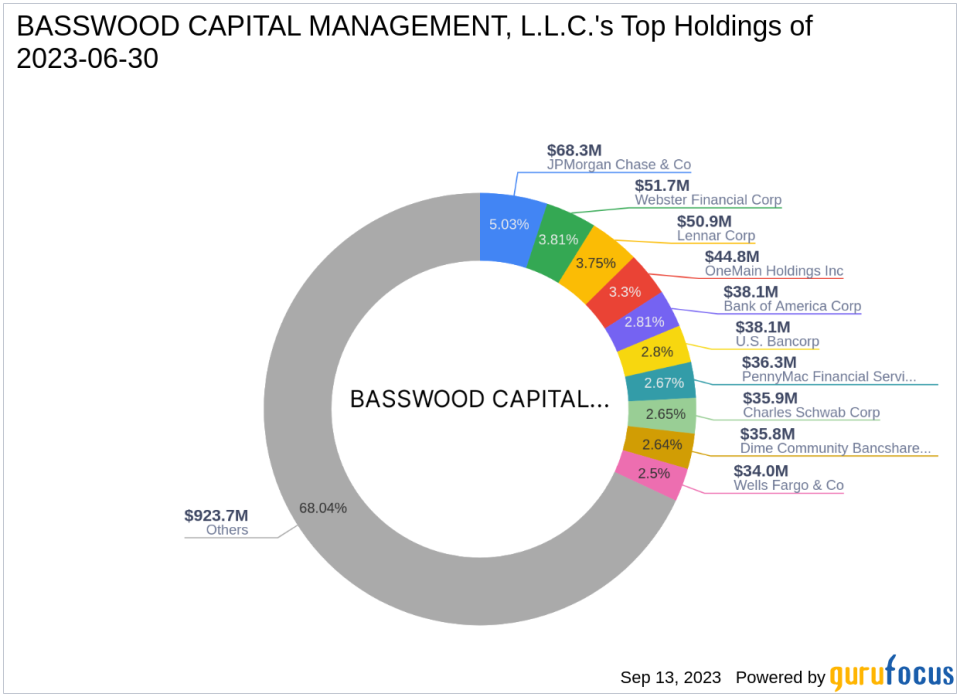

Basswood Capital Management, L.L.C., established in 1998, is an employee-owned investment management firm based in New York City. The firm conducts its research internally, utilizing a fundamental methodology to make its investment decisions. It invests in the value stocks of companies and event-driven strategies, focusing on the public equity and fixed income markets on a global scale. The firm's top holdings include Bank of America Corp(NYSE:BAC), JPMorgan Chase & Co(NYSE:JPM), Lennar Corp(NYSE:LEN), OneMain Holdings Inc(NYSE:OMF), and Webster Financial Corp(NYSE:WBS). The firm manages over $2.2 billion in total assets under management spread across 17 total accounts, all of which are discretionary accounts. The firm's primary sectors of interest are Financial Services and Consumer Cyclical.

Overview of Dime Community Bancshares Inc.

Dime Community Bancshares Inc, with a market capitalization of $806.047 million, operates as a holding company. It gathers deposits from customers within its market area and via the internet, and invests them in multifamily residential, commercial real estate, commercial and industrial (C&I) loans, and one-to-four family residential real estate loans, as well as mortgage-backed securities, obligations of the U.S. government and government-sponsored enterprises (GSEs), and corporate debt and equity securities. The company's stock is currently priced at $20.76, with a PE percentage of 5.85. According to GuruFocus, the stock is significantly undervalued with a GF Value of 33.57 and a Price to GF Value of 0.62.

Analysis of Dime Community Bancshares Inc.'s Financial Health

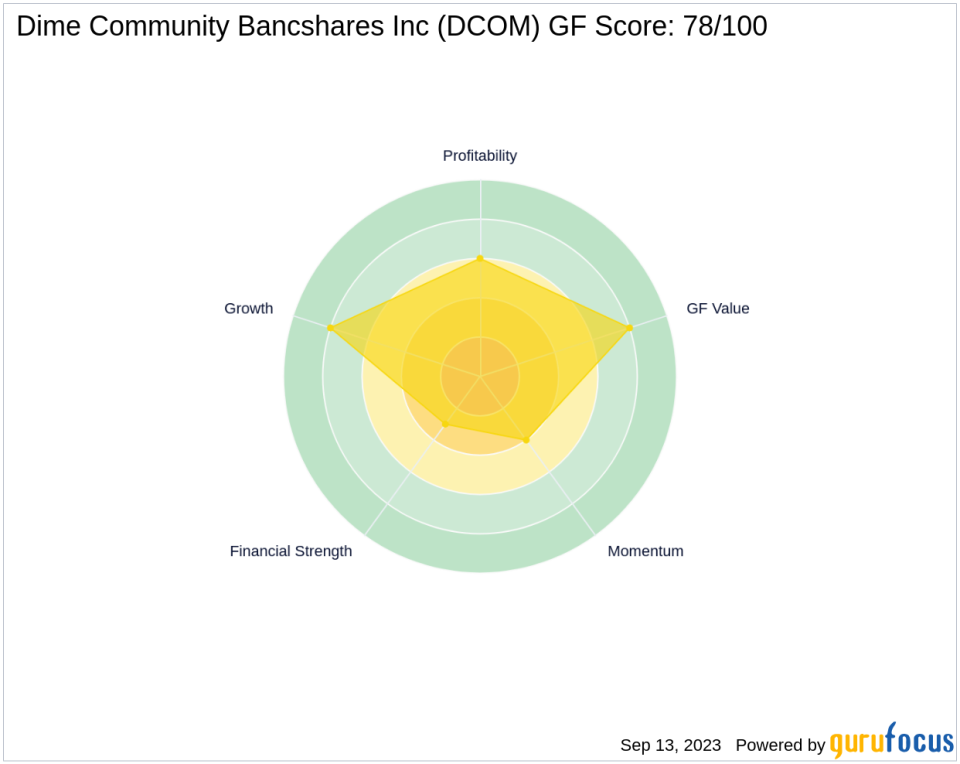

Dime Community Bancshares Inc. has a Financial Strength rank of 3/10, a Profitability Rank of 6/10, a Growth Rank of 8/10, a GF Value Rank of 8/10, and a Momentum Rank of 4/10. The company's Piotroski F-Score is 7, indicating a healthy situation. However, its Altman Z score is 0.00, and its cash to debt ratio is 0.27, which may indicate potential financial distress.

Performance of Dime Community Bancshares Inc.'s Stock

Since its Initial Public Offering (IPO) in 1996, Dime Community Bancshares Inc.'s stock has gained 500%. However, the stock has declined by 34.82% year-to-date. The stock's GF Score is 78/100, indicating a likely average performance in the future. The stock's RSI 14 Day is 42.40, and its Momentum Index 12 - 1 Month is -26.40.

Conclusion

In conclusion, Basswood Capital Management, L.L.C.'s recent acquisition of additional shares in Dime Community Bancshares Inc. aligns with its investment strategy of focusing on value stocks and event-driven strategies. Despite the recent decline in the stock's price, the company's financial health and growth potential make it an attractive investment. However, investors should be aware of the potential risks associated with the company's financial distress indicators. This transaction further solidifies Basswood Capital Management's position in the financial services sector and could potentially yield significant returns in the future.

This article first appeared on GuruFocus.