Baudax Bio (BXRX) Up 125% on Acquiring TeraImmune

Baudax Bio BXRX acquired TeraImmune, a privately held company that’s focused on the discovery and development of Treg-based cell therapies for autoimmune diseases. Shares of Baudax Bio soared almost 125% on Jun 30, following the news.

The acquisition will add TeraImmune's TI-168 asset to Baudax Bio's portfolio. TI-168 is a next-generation, autologous FVIII TCR-Treg cell therapy candidate designed to eliminate clotting factor VIII (FVIII) inhibitors in patients with hemophilia A.

An investigational new drug application for TI-168 has been recently approved by the FDA. Baudax Bio believes that with a modest initial budget, it can initiate the phase I/IIa clinical study of TI-168 for the treatment of hemophilia A.

Hemophilia A is a rare genetic bleeding disorder caused by a lack of FVIII.

Shares of Baudax Bio have plunged 63.2% year to date compared with the industry’s 2.7% decline.

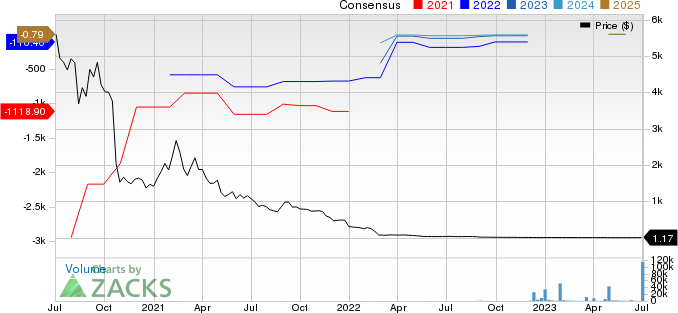

Image Source: Zacks Investment Research

The company will continue to advance its existing neuromuscular blockade (NMB) portfolio. It has two clinical-stage NMB candidates — BX1000 and BX2000. BX1000 has recently completed the phase II study, while BX2000 is currently undergoing a dose escalation phase I clinical study.

Additionally, BXRX has developed a proprietary chemical reversal agent that is specifically designed for these NMBs. The candidate is currently undergoing nonclinical and manufacturing studies. The company aims is to file an investigational new drug application for the candidate in the summer of 2023.

The acquisition of TeraImmune was structured as a stock-for-stock transaction. Under the agreement, all outstanding equity interests of TeraImmune were exchanged for a combination of Baudax Bio common stock and newly designated convertible series X non-voting convertible preferred stock.

Subject to shareholders’ approval, each share of the abovementioned preferred stock will automatically convert into 1,000 shares of common stock. Based on these transactions, Baudax Bio equity holders will own approximately 18% of the combined company (following the acquisition) on a pro forma basis.

The potential merger is expected to benefit the shareholders of both companies.

Baudax Bio, Inc. Price and Consensus

Baudax Bio, Inc. price-consensus-chart | Baudax Bio, Inc. Quote

Zacks Rank & Stocks to Consider

Baudax Bio currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Novartis NVS, Akero Therapeutics AKRO and Omega Therapeutics OMGA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Novartis’ 2023 earnings has gone up from $6.56 per share to $6.74 in the past 90 days. Shares of Novartis have risen 11.2% year to date.

NVS’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 5.15%.

The consensus estimate for Akero Therapeutics has narrowed from a loss of $2.96 per share to a loss of $2.80 for 2023 in the past 90 days. Shares of Akero Therapeutics have nosedived 14.8% year to date.

AKRO’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.13%.

The consensus mark for Omega Therapeutics has narrowed from a loss of $2.49 per share to a loss of $2.05 for 2023 in the past 90 days. Shares of the company have rallied 0.2% year to date.

OMGA’s earnings beat estimates in two of the trailing four quarters, met the mark in one and missed in another, delivering an average surprise of 8.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Baudax Bio, Inc. (BXRX) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report