Baxter International Inc (BAX) Posts Mixed 2023 Financial Results Amid Strategic Shifts

Reported Sales: $14.81 billion for full-year, a 2% increase on a reported basis.

Adjusted Diluted EPS: $2.60 from continuing operations for the full year.

Net Income: $2.66 billion on a U.S. GAAP basis, including $5.40 from discontinued operations.

Operating Cash Flow: $1.70 billion from continuing operations for the full year.

Free Cash Flow: $1.01 billion after capital expenditures of $692 million.

Constant Currency Basis: Sales increased by 3% for both the fourth quarter and full year.

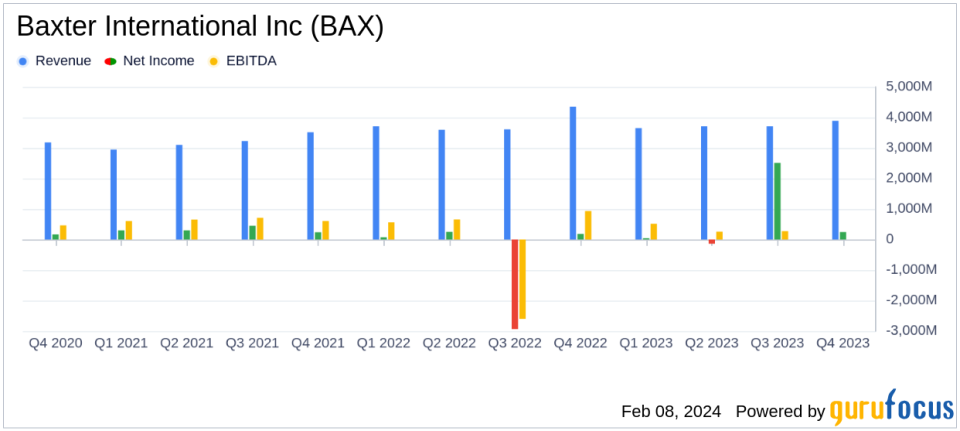

Baxter International Inc (NYSE:BAX) released its 8-K filing on February 8, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading provider of medical instruments and supplies, reported a modest increase in sales, with full-year sales from continuing operations totaling $14.81 billion, marking a 2% increase on a reported basis and a 3% rise on a constant currency basis. Despite the growth, Baxter's full-year U.S. GAAP diluted earnings per share (EPS) from continuing operations showed a loss of $0.15, while adjusted diluted EPS from continuing operations stood at $2.60.

Baxter's performance in 2023 was influenced by strategic initiatives, including the implementation of a new operating model, the sale of the BioPharma Solutions business, and progress on the proposed separation of its Kidney Care segment. The fourth quarter saw worldwide sales from continuing operations at approximately $3.89 billion, a 4% increase on a reported basis and 3% on a constant currency basis. U.S. sales in the fourth quarter increased by 2%, while international sales rose by 6% on a reported basis and 4% at constant currency rates.

The company's financial achievements are particularly noteworthy given the challenges faced in the medical devices and instruments industry, including supply chain disruptions and evolving healthcare regulations. Baxter's solid demand for medically essential products and improved macroeconomic conditions contributed to its performance.

For the full year, Baxter generated $1.70 billion in operating cash flow from continuing operations and $1.01 billion in free cash flow. Joel Grade, executive vice president and chief financial officer, highlighted the company's focus on advancing its transformation journey and creating value for stakeholders, with significant progress in line with capital allocation priorities.

Baxter's preparations for the proposed separation of its Kidney Care segment into a standalone company, Vantive, are progressing. The separation is expected to provide strategic focus and investment priorities, potentially accelerating growth and innovation.

Looking ahead to 2024, Baxter expects sales growth of approximately 2% on both a reported and constant currency basis, with adjusted earnings before special items projected to be between $2.85 and $2.95 per diluted share. For the first quarter of 2024, the company anticipates sales growth of approximately 1% on a reported basis and 1% to 2% on a constant currency basis, with adjusted earnings before special items expected to be between $0.59 and $0.62 per diluted share.

The company's focus on corporate responsibility and sustainable practices aligns with the United Nations Sustainable Development Goals (UN SDGs), as Baxter continues to be recognized for its leadership in these areas.

Value investors and potential GuruFocus.com members may find Baxter's steady performance, strategic initiatives, and commitment to sustainability and corporate responsibility to be of interest as they consider the company's prospects for future growth and value creation.

Explore the complete 8-K earnings release (here) from Baxter International Inc for further details.

This article first appeared on GuruFocus.