Is Baxter International Inc (BAX) Set to Underperform? Analyzing the Factors Limiting Growth

Long-established in the Medical Devices & Instruments industry, Baxter International Inc (NYSE:BAX) has enjoyed a stellar reputation. However, it has recently witnessed a daily loss of 9.1%, juxtaposed with a three-month change of -25.99%. Fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Baxter International Inc.

What Is the GF Score?

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Financial strength rank: 4/10

Profitability rank: 7/10

Growth rank: 5/10

GF Value rank: 4/10

Momentum rank: 2/10

Based on the above method, GuruFocus assigned Baxter International Inc the GF Score of 68 out of 100, which signals poor future outperformance potential.

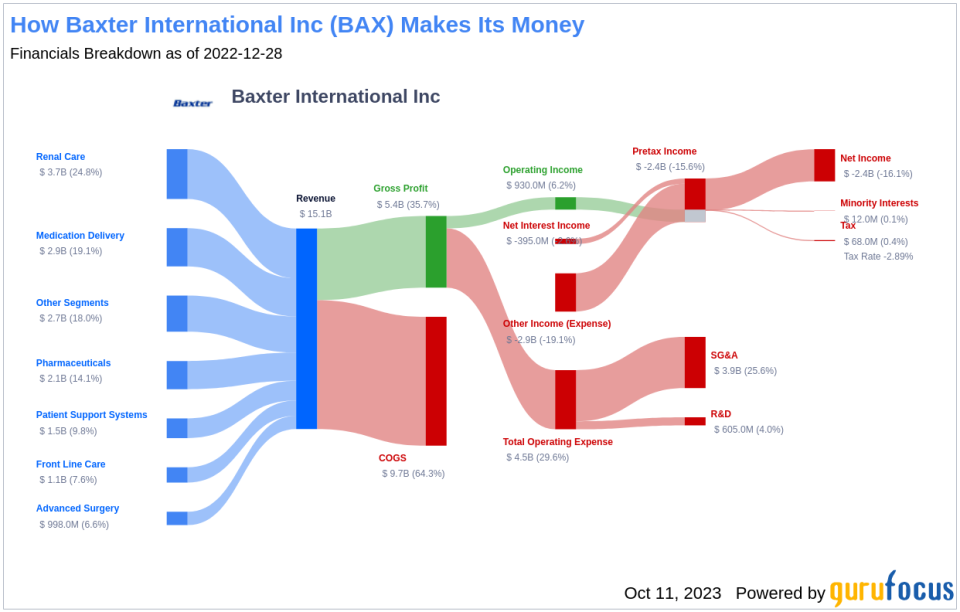

Understanding Baxter International Inc Business

Baxter International Inc, with a market cap of $17.18 billion, is a prominent player in the Medical Devices & Instruments industry. The company, which reported sales of $15.02 billion, offers a variety of medical instruments and supplies to caregivers. It enhanced its portfolio of hospital-focused offerings by acquiring Hillrom in late 2021. Legacy Baxter offers tools to help patients with acute and chronic kidney failure. It also sells a variety of injectable therapies for use in care settings, such as IV pumps, administrative sets, and solutions; nutritional products; and surgical sealants and hemostatic agents. The company offers contract manufacturing services to pharmaceutical companies. The Hillrom transaction has added basic equipment, including hospital beds, to the portfolio, although about half of Hillrom's 2021 revenue came from more digitally connected offerings like its smart beds and Voalte medical communications app.

Financial Strength Breakdown

Baxter International Inc's financial strength indicators present some concerning insights about the company's balance sheet health. The company's interest coverage ratio of 1.16 positions it worse than 94.76% of 420 companies in the Medical Devices & Instruments industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. It's worth noting that the esteemed investor Benjamin Graham typically favored companies with an interest coverage ratio of at least five.

The company's Altman Z-Score is just 1.56, which is below the distress zone of 1.81. This suggests that the company may face financial distress over the next few years. Additionally, the company's low cash-to-debt ratio at 0.1 indicates a struggle in handling existing debt levels. The company's debt-to-equity ratio is 3.04, which is worse than 98.18% of 659 companies in the Medical Devices & Instruments industry. A high debt-to-equity ratio suggests over-reliance on borrowing and vulnerability to market fluctuations.

Next Steps

Given the company's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. While Baxter International Inc has a rich history and a diverse portfolio, its financial indicators suggest that it may struggle to maintain its past performance. Therefore, investors should exercise caution and conduct thorough research before making investment decisions.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.