Baxter's (BAX) Q4 Earnings Top, Sales Rise on Strong Demand

Baxter International Inc. BAX reported fourth-quarter 2023 adjusted earnings per share (EPS) from continuing operations of 88 cents, which beat the Zacks Consensus Estimate of 86 cents by 2.3%. The bottom line improved 13% from the year-ago quarter’s level.

On a GAAP basis, the EPS from continuing operations was 14 cents, down 50% from the prior-year quarter’s level. The company recorded $2.79 billion as goodwill impairment in the prior-year quarter.

Continuing operations exclude Baxter's BioPharma Solutions business, which was divested during the third quarter.

Adjusted EPS, including discontinued operations during the fourth quarter, was 85 cents, down 3% year over year.

Revenue Details

Revenues from continued operation totaled $3.89 billion, up 4% on a reported basis and 3% at constant currency (cc). The figure beat the Zacks Consensus Estimate by 2.4%.

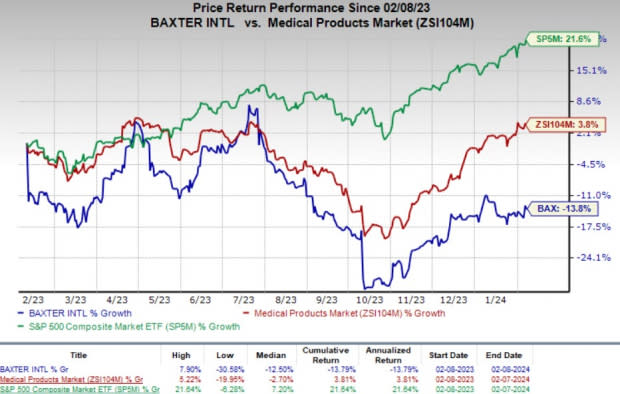

Despite better-than-expected results, shares of BAX were down 1% in pre-market trading. The company’s shares have lost 13.8% in the past year against the industry’s growth of 3.8%. The broader S&P 500 Index has moved up 21.6% in the same period.

Image Source: Zacks Investment Research

Segmental Details

As part of its transformation plan announced in February, Baxter established its new operating model, integrating its prior matrixed structure of nine businesses operating across three geographic regions into the aforementioned four verticalized global segments. The company started reporting under a new model, beginning third-quarter 2023.

Medical Products & Therapies

The segment includes Advanced Surgery and a new category, Infusion Therapies & Technologies. Total sales at this segment during the fourth quarter totaled $1.32 billion, up 6% year over year reportedly and 4% at cc.

Infusion Therapies and Technologies’ sales totaled $1.04 billion, up 5% year over year reportedly, and 4% at cc. Advanced Surgery category sales amounted to $278 million, up 7% year over year reportedly and 6% at cc.

Healthcare Systems and Technologies

The segment includes the Front Line Care category. It also includes the Patient Support Systems and Surgical Solutions categories, which are clubbed as Care & Connectivity Solutions. Total sales in this segment during the quarter were $795 million, up 8% year over year reportedly and 7% at cc.

Front Line Care category sales totaled $303 million, up 3% year over year reportedly and 2% at cc. Care & Connectivity Solutions category sales amounted to $492 million, up 12% year over year reportedly and 11% at cc.

Pharmaceuticals

The segment was reported as one of the product categories till the last quarter. This segment’s report presently includes two product categories — Injectables & Anesthesia and Drug Compounding. Total sales during the fourth quarter were $596 million, up 8% year over year reportedly and 7% at cc.

Injectables and Anesthesia category sales totaled $359 million, up 4% year over year reportedly and 5% at cc. The Drug Compounding category sales amounted to $237 million, up 14% year over year reportedly and 11% at cc.

Kidney Care

This segment includes BAX’s Renal Care category, which is now reported under the Chronic Therapies category. The segment also includes the Acute Therapies category. Total sales in this segment during the fourth quarter were $1.16 billion, down 1% year over year reportedly as well as at cc.

Chronic Therapies category sales totaled $950 million, down 2% year over year reportedly and 3% at cc. Acute Therapies category sales amounted to $206 million, up 7% year over year reportedly and 6% at cc.

Baxter plans to spin-off this segment, which will trade as an independent, publicly traded company under the proposed tradename of Vantive. The spin-off is expected to be completed by July 2024.

Other

Revenues in the segment amounted to $18 million, down 63% on a year-over-year basis and 58% at cc.

Margin Analysis

Baxter reported an adjusted gross profit of $1.63 billion for the fourth quarter, up 5.7% year over year. As a percentage of revenues, the gross margin improved 80 basis points (bps) to 42% in the same quarter.

Selling, general and administrative expenses amounted to $985 million, up 9% from the year-ago quarter’s figure. Research and development expenses totaled $172 million, up 12% on a year-over-year basis.

Adjusted operating income from continuing operations totaled $449 million, up 13% year over year. As a percentage of revenues, the operating margin improved 90 bps to 11.6%. Adjusted income from discontinued operations, net of tax, amounted to $49 million during the reported quarter.

Full-Year Results

Baxter recorded total revenues of $14.81 billion in 2023, up 2% year over year. Adjusted EPS from continuing operations for the year was $2.60, down 14% from the prior-year level.

2024 Guidance

For first-quarter 2024, Baxter anticipates sales to grow approximately 1% on a reported basis and 1-2% at cc. The Zacks Consensus Estimate for the same is pegged at $3.61 billion, implying a decline of 1% reportedly.

Adjusted EPS is expected between 59 cents and 62 cents. The Zacks Consensus Estimate for the same is pegged at 63 cents.

For full-year 2024, sales growth is expected to be nearly 2% on a reported basis as well as at cc. The Zacks Consensus Estimate for the same is pegged at $15.19 billion, implying an improvement of 3% reportedly. Adjusted EPS is projected in the band of $2.85-$2.95. The Zacks Consensus Estimate for the same is pegged at $2.93 billion.

Baxter International Inc. Price, Consensus and EPS Surprise

Baxter International Inc. price-consensus-eps-surprise-chart | Baxter International Inc. Quote

Zacks Rank and Stocks to Consider

Currently, Baxter carries a Zacks Rank #4 (Sell).

Some better-ranked stocks to consider in the broader medical space are Universal Health Services UHS, Integer Holdings Corporation ITGR and Cardinal Health CAH.

Universal Health Services, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 4.4% for 2024. UHS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 5.47%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UHS’ shares have risen 11.9% in the past year compared with the industry’s 17.3% growth.

Integer Holdings, presently carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 44.3% in the past year compared with the industry’s 4.6% growth.

Cardinal Health, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.3%. CAH’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 15.64%.

Cardinal Health’s shares have risen 32.2% in the past year compared with the industry’s growth of 9.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report