BayCom Corp (BCML) Reports Decrease in Q4 Earnings Amidst Market Challenges

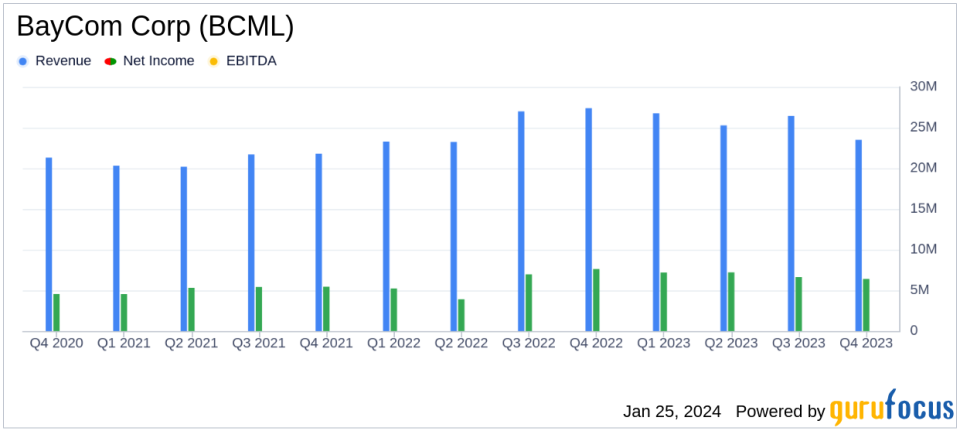

Net Income: Reported $6.4 million for Q4 2023, a decrease from $6.6 million in Q3 2023 and $7.6 million in Q4 2022.

Net Interest Income: Decreased by $1.3 million or 5.2% from the previous quarter and $2.9 million or 11.1% from the same quarter last year.

Provision for Credit Losses: Increased to $2.3 million in Q4 2023, up from $674,000 in Q3 2023 and $617,000 in Q4 2022.

Noninterest Income: Increased by $1.0 million or 61.8% from the previous quarter and $1.8 million or 196.0% from Q4 2022.

Noninterest Expense: Decreased by $1.4 million or 8.7% from Q3 2023 and $1.2 million or 7.6% from Q4 2022.

Loans and Deposits: Loans, net of deferred fees, decreased by $41.0 million from Q3 2023 and $93.3 million from Q4 2022. Deposits totaled $2.1 billion, consistent with the previous year-end.

Shareholders Equity: Increased to $312.9 million at the end of Q4 2023 from $307.3 million in Q3 2023, but decreased from $317.1 million at the end of Q4 2022.

On January 25, 2024, BayCom Corp (NASDAQ:BCML), the holding company for United Business Bank, released its 8-K filing, reporting a net income of $6.4 million, or $0.55 per diluted common share, for the fourth quarter of 2023. This represents a decrease from both the previous quarter and the same quarter in the previous year. The company, which provides financial services to small and medium-sized businesses, individuals, and other entities, faced increased deposit costs, reduced loan demand, and credit quality deterioration in 2023.

Financial Performance and Challenges

BayCom Corp (NASDAQ:BCML) experienced a decline in net interest income, primarily due to a decrease in interest income on loans and an increase in interest expense on deposits. The provision for credit losses also saw a significant increase, mainly driven by a rise in the reserve for individually evaluated loans. Despite these challenges, noninterest income showed a notable increase, largely attributed to a gain on equity securities. Noninterest expense decreased due to adjustments in bonus accruals and a reduction in full-time equivalent employees.

Importance of Financial Metrics

The reported metrics are crucial for understanding BayCom Corp (NASDAQ:BCML)'s financial health and operational efficiency. Net interest income is a key indicator of the bank's core profitability, while the provision for credit losses reflects the bank's assessment of potential risks in its loan portfolio. Noninterest income and expense management are also important for overall profitability. The loan and deposit figures indicate the bank's growth and market position, and shareholders equity is a measure of the company's net value.

Analysis and Commentary

President and CEO George Guarini commented on the results, stating, "Our financial results for the fourth quarter and full year 2023 underperformed our expectations. 2023 presented challenges on various fronts, including increased deposit costs, reduced loan demand and some specific credit quality deterioration. Despite these challenges, our earnings improved over 2022. Overall, our financial condition remains strong, with no observed systemic credit weakness, and our earnings remain stable." Guarini also noted that while market conditions are not expected to improve in the first half of 2024, the second half could be a turning point for loan demand and merger and acquisition opportunities.

Guarini concluded, "While we do not anticipate market conditions improving in the first half of 2024, we are optimistic that the second half of 2024 will be a turning point in loan demand and merger and acquisition opportunities. We remain committed to repurchasing our shares and paying cash dividends to our shareholders with the goal of consistently enhancing value for both our clients and shareholders."

BayCom Corp (NASDAQ:BCML) continues to navigate a challenging economic environment while maintaining a focus on shareholder value and financial stability. The company's performance and strategic outlook will be key areas of interest for investors and stakeholders in the coming quarters.

Explore the complete 8-K earnings release (here) from BayCom Corp for further details.

This article first appeared on GuruFocus.