Bayer (BAYRY) Cuts 2023 Outlook, Reports Preliminary Q2 Results

Bayer Aktiengesellschaft BAYRY reported its adjusted full-year outlook for 2023, earlier this week. The company lowered its 2023 guidance due to a significant decline in sales of glyphosate-based products.

BAYRY now expects sales for the full-year 2023 in the range of €48.5-49.5 billion (previously €51 billion to €52 billion) based on the average monthly exchange rates in 2022, which is also known as currency-adjusted basis.

EBITDA in 2023, excluding special items, is now anticipated in the range of €11.3-11.8 billion (previously €12.5-13.0 billion) on a currency-adjusted basis. Additionally, Bayer expects its core earnings per share between €6.20 and €6.40 (previously €7.20-7.40), on a currency-adjusted basis.

The company has also downgraded its free cash flow estimation to approximately €0, which was previously pegged at approximately €3 billion.

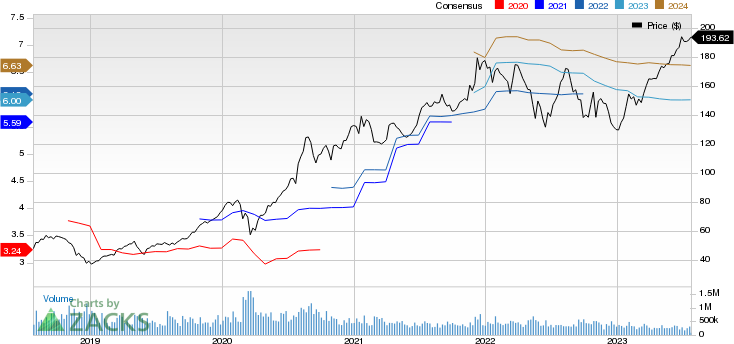

Year to date, shares of Bayer have gained 10.4% compared with the industry’s 2.5% growth.

Image Source: Zacks Investment Research

In the same press release, BAYRY reported its preliminary and unaudited financial performance in the second quarter of 2023. Total sales are expected to be approximately €11.0 billion in the to-be-reported quarter. EBITDA, excluding special items, is expected to be approximately €2.5 billion.

Bayer expects its core earnings per share to be approximately €1.20, along with a negative free cash flow of approximately €0.5 billion.

BAYRY’s preliminary earnings figures for second-quarter 2023 are based on exchange rates as of Jun 30, 2023.

The company further reiterated that the guidance toward the lower end of its Group sales and earnings forecast for 2023 was already communicated during the first-quarter earnings release. Since first-quarter earnings release, further price declines along with lower volumes due to channel de-stocking, especially for glyphosate-based products, have negatively impacted Bayer’s financial performance. Adverse weather conditions have also contributed to the cause, per the company.

Additionally, BAYRY also expects to record a goodwill impairment of approximately €2.5 billion, based on anticipated developments in the market, especially for glyphosate-based products. The company reports this as the cause for a negative Group net income of approximately €2 billion for the second quarter of 2023.

Bayer is scheduled to release its second-quarter financial results on Aug 8, 2023.

Bayer Aktiengesellschaft Price and Consensus

Bayer Aktiengesellschaft price-consensus-chart | Bayer Aktiengesellschaft Quote

Zacks Rank and Stocks to Consider

Bayer currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are J&J JNJ, ADC Therapeutics ADCT and Acadia Pharmaceuticals ACAD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for J&J’s earnings per share has increased from $10.65 to $10.73. During the same period, the estimate for JNJ’s earnings per share has increased from $11.01 to $11.28. Year to date, shares of JNJ have lost 2.6%.

JNJ beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.58%.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics’ 2023 loss per share has widened from $2.60 to $2.61. During the same period, the estimate for ADC Therapeutics’ 2024 loss per share narrowed from $2.75 to $2.45. Year to date, shares of ADCT have lost 66.4%.

ADCT beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for Acadia Pharmaceuticals’ 2023 loss per share has narrowed from 58 cents to 31 cents. The estimate for Acadia Pharmaceuticals’ 2024 earnings per share is pegged at 47 cents. Year to date, shares of ACAD have rallied 85.9%.

ACAD beat estimates in two of the trailing four quarters, missing the mark on other two occasions, delivering an average negative earnings surprise of 2.75%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report