BD (BDX) Gears Up for Q1 Earnings: What's in the Offing?

Becton Dickinson and Company BDX, popularly known as BD, is scheduled to report first-quarter fiscal 2024 results on Feb 1, before market open.

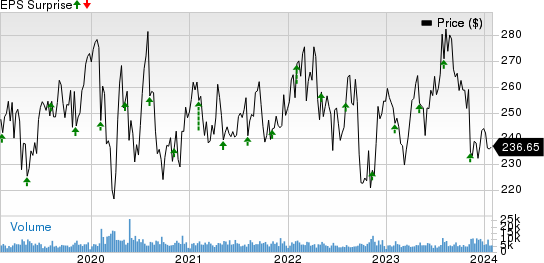

In the last reported quarter, the company’s earnings per share (EPS) of $3.42 matched the Zacks Consensus Estimate. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on three occasions and matched once, delivering an earnings surprise of 4.5%, on average.

Let’s check out the factors that have shaped BDX’s performance prior to this announcement.

Factors to Note

BD Life Sciences

On fourth-quarter fiscal 2023 earnings call in November, BD confirmed that it continued to witness lower COVID-only testing revenues. However, excluding COVID-only testing, the Life Sciences segment’s base revenues witnessed growth driven by strength in the Biosciences (BDB) business unit.

The segment’s base revenues also grew on an underlying basis, which reflected the Integrated Diagnostic Solutions business unit’s base business growth. This was driven by the continued adoption of BD KIESTRA microbiology lab automation solution, strong IDAST instrument placements and continued growth of BD’s molecular In Vitro Diagnostic assays, leveraging the BD core system and expanded BD MAX installed base.

BDB’s performance reflected growth in Research Instruments driven by strong demand for the company’s BD FACSDiscover S8 Cell Sorter and strength in Clinical Reagents leveraging its growing installed base of FACSLyric analyzers and FACSDuet automation.

These trends are likely to have continued in first-quarter fiscal 2024. This, in turn, is anticipated to have contributed to the strength in base business despite the expected ceaseless fall in COVID-only testing revenues. This is likely to have significantly driven up the segmental revenues.

In December 2023, BD received the FDA’s 510(k) clearance for the BD MiniDraw Capillary Blood Collection System. This raises our optimism about the stock.

The Zacks Model estimates the BD Life Sciences revenues to be $1.25 billion in the fiscal first quarter.

Becton, Dickinson and Company Price and EPS Surprise

Becton, Dickinson and Company price-eps-surprise | Becton, Dickinson and Company Quote

BD Interventional

In June 2023, BD signed a definitive agreement to sell its Surgical Instrumentation platform to STERIS. Per management, the value-creating transaction will likely support the achievement of BD 2025 financial goals and advance the segment’s focus on high-growth end markets. Management also believes that the divestiture will allow it to focus on BD Surgery’s strategic investments In Advanced Repair and Reconstruction and surgical complications, which are driving results and helping to address unmet needs in healthcare. The company is likely to have benefited from the divestiture in the first quarter of fiscal 2024.

During the fiscal fourth quarter, the segment continued to witness strong growth, driven by continued market adoption of BD’s products. These trends are likely to have continued in the first quarter of fiscal 2024 as well, thereby significantly pushing up the segmental revenues.

The Zacks Model estimates the BD Interventional revenues to be $1.16 billion, suggesting an uptick of 2.5% from the year-ago quarter’s reported figure.

Other Factors to Note

In November 2023, BD launched the SiteRite 9 Ultrasound System. It is a new and advanced ultrasound system designed to help improve clinician efficiency when placing peripherally inserted central catheters, central venous catheters, IV lines and other vascular access devices. The same month, BD launched a new needle-free blood draw technology compatible with integrated catheters, the PIVO Pro Needle-free Blood Collection Device. These products are likely to have witnessed robust adoption in recent months, thereby driving up the Medical segment’s revenues in the to-be-reported quarter.

Continued strong growth in Pharmacy Automation (led by Parata and BD ROWA solutions), strength in Dispensing driven by BD Pyxis and strong demand for pre-fillable solutions for biologics such as BD Hypak and innovative products like BD Neopak are likely to have benefited the company in the to-be-reported quarter as well.

However, the current unstable macroeconomic business environment, continued inflationary pressures, and labor dynamics are likely to have weighed on the company’s fiscal first-quarter revenues, raising our apprehension.

The Estimate Picture

For first-quarter fiscal 2023, the Zacks Consensus Estimate for revenues is pegged at $4.74 billion, implying an improvement of 3.3% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $2.39, indicating a decrease of 19.8% from the prior-year period’s reported number.

What Our Model Suggests

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: BD has an Earnings ESP of -0.09%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

Stocks Worth a Look

Here are a few other medical stocks worth considering, as these also have the right combination of elements to beat on earnings this reporting cycle.

Hologic, Inc. HOLX has an Earnings ESP of +2.88% and a Zacks Rank of 2. HOLX has an estimated long-term growth rate of 7.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hologic’s earnings surpassed estimates in all the trailing four quarters, with the average surprise being 12.4%.

Merit Medical Systems, Inc. MMSI has an Earnings ESP of +3.68% and is a Zacks #2 Rank stock. MMSI has an estimated long-term growth rate of 11.5%.

Merit Medical’s earnings surpassed estimates in all the trailing four quarters, with the average surprise being 14.4%.

HCA Healthcare, Inc. HCA has an Earnings ESP of +6.39% and a Zacks Rank of 2. HCA has an estimated long-term growth rate of 9.6%.

HCA Healthcare’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, with the average surprise being 4.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report