BD (BDX) Gears Up for Q3 Earnings: What's in the Offing?

Becton Dickinson and Company BDX, popularly known as BD, is scheduled to report third-quarter fiscal 2023 results on Aug 3, before market open.

In the last reported quarter, the company’s earnings per share (EPS) of $2.86 surpassed the Zacks Consensus Estimate by 4%. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on all occasions, delivering an earnings surprise of 5.8%, on average.

Let’s check out the factors that have shaped BDX’s performance prior to this announcement.

Factors to Note

BD Life Sciences

On second-quarter fiscal 2023 earnings call in May, BD confirmed that it continued to witness lower COVID-only testing revenues, which led to a decline in its Life Sciences segment. However, excluding COVID-only testing, an uptick in the Life Sciences segment’s base revenues was solid. Strong growth across both Integrated Diagnostic Solutions (IDS) and Biosciences (BDB) business units was witnessed.

Strength in IDS reflected strong base business revenue growth. This was driven by growth in Microbiology, aided by the adoption of BD Kiestra IdentifA and Total Modular Track solutions, and Specimen Management and continued double-digit growth from Molecular In-Vitro Diagnostic assay leveraging the incremental BD Max installed base. BDB unit has also been recording strong Research Reagents growth and continued strong demand for its BD FACSymphony A1/A5 SE research analyzers combined with improved BD FACSLyric.

These trends are likely to have continued in third-quarter fiscal 2023 as well. This, in turn, is anticipated to have contributed to the strength in base business despite the expected ceaseless fall in COVID-only testing revenues. This is likely to have significantly driven up the segmental revenues.

BD has launched a few products in recent months. In June, the company announced the worldwide commercial launch of a new automated instrument, BD FACSDuet Premium Sample Preparation System.

In May, announced the worldwide commercial launch of a new-to-world cell sorting instrument, BD FACSDiscover S8 Cell Sorter, featuring two breakthrough technologies (BD SpectralFX Technology and BD CellView Image Technology). These products are likely to have witnessed robust customer adoptions, thereby pushing up the segmental revenues in the fiscal third quarter.

In May, BD received the FDA’s 510(k) clearance for the new BD Kiestra Methicillin-resistant Staphylococcus aureus imaging application. This raises our optimism about the stock.

However, the continued decline in COVID-only testing revenues is likely to have weighed on BD’s Life Sciences segment’s revenues in third-quarter fiscal 2023. Despite this, on the fiscal second-quarter earnings call, management stated that its base revenue growth and consistent execution of its margin goals are enabling BD to offset lower COVID-only testing revenues and the latest foreign exchange rates while reinvesting in the business to drive future growth. This looks promising for the stock.

The Zacks Model estimates the BD Life Sciences revenues to be $1.32 billion, suggesting an improvement of 0.5% from the year-ago quarter’s reported figure.

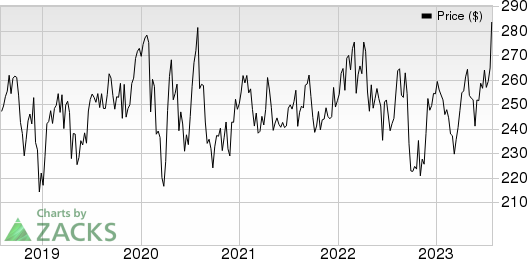

Becton, Dickinson and Company Price and EPS Surprise

Becton, Dickinson and Company price-eps-surprise | Becton, Dickinson and Company Quote

BD Interventional

This segment continued to witness a strong worldwide performance in Advanced Repair and Reconstruction in the second quarter of fiscal 2023. Continued strong market adoption of Phasix hernia resorbable scaffold and double-digit worldwide growth in Biosurgery (aided by Arista AH absorbable hemostat) resulted in the upturn. Strong procedure volumes had also contributed to the Surgery’s performance.

Revenues in Peripheral Intervention were also strong. Double-digit growth in Peripheral Vascular Disease on the back of the Venovo relaunch, global penetration of Rotarex and the strong growth in Oncology in the United States and Greater Asia acted as tailwinds. Robust Urology and Critical Care revenues were driven by double-digit growth in the PureWick franchise (which addresses chronic incontinence) and Endourology.

These trends are likely to have been continued in the fiscal third quarter as well, thereby significantly pushing up the segmental revenues.

A notable announcement in this segment was BD’s inking a definitive agreement to sell its Surgical Instrumentation platform to STERIS. The company will provide additional details about the divestiture, expected to close within BD's fiscal year 2023, subject to customary closing conditions, in its fiscal third-quarter earnings call.

The Zacks Model estimates the BD Interventional revenues to be $1.16 billion, suggesting an uptick of 1.3% from the year-ago quarter’s reported figure.

Other Factors to Note

BD is likely to have witnessed continued momentum in its Medical segment. Continued strong performance in Vascular Access Management and investments in high-growth end markets like Pharmacy Automation, among others, resulted in this uptrend. BD is also likely to have benefited from continued capacity investments in BD Hypak and innovation in products like BD Effivax, BD Hylok and BD Neopak.

In May, BD announced expanded customer availability of an all-in-one prefilled flush syringe with an integrated disinfection unit, BD PosiFlush SafeScrub. On the fiscal second-quarter earnings call, management confirmed the launch of PowerMe midline catheter in China. These products are likely to have witnessed robust adoption in recent months, thereby driving up revenues in the to-be-reported quarter.

However, the current unstable macroeconomic business environment, resulting from the supply-chain constraints and inflationary pressures, is likely to have weighed on the company’s fiscal third-quarter revenues, raising our apprehension.

The Estimate Picture

For third-quarter fiscal 2023, the Zacks Consensus Estimate for revenues is pegged at $4.83 billion, implying an improvement of 4.1% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $2.89, indicating an increase of 8.7% from the prior-year period’s reported number.

What Our Model Suggests

Our proven model predicts an earnings beat for BD this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: BD has an Earnings ESP of +0.48%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #2.

Other Stocks Worth a Look

Here are a few other medical stocks worth considering, as these also have the right combination of elements to beat on earnings this reporting cycle.

AmerisourceBergen Corporation ABC has an Earnings ESP of +0.59% and a Zacks Rank of 2. ABC has an estimated long-term growth rate of 8.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

AmerisourceBergen’s earnings surpassed estimates in all the trailing four quarters, with the average surprise being 3.1%.

McKesson Corporation MCK has an Earnings ESP of +1.93% and is a Zacks #2 Rank stock. MCK has an estimated long-term growth rate of 10.9%.

McKesson’s earnings surpassed estimates in three of the trailing four quarters and missed once, with the average surprise being 4.5%.

Boston Scientific Corporation BSX has an Earnings ESP of +1.04% and a Zacks Rank of 2. BSX has an estimated long-term growth rate of 11.5%.

Boston Scientific’s earnings surpassed estimates in two of the trailing four quarters and missed twice, with the average surprise being 2.7%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report