BD (BDX) Launches Advanced Vascular Access Management System

Becton, Dickinson and Company BDX, popularly known as BD, recently launched its advanced ultrasound system, SiteRite 9, for better vascular access management. The system is designed to enhance clinician efficiency and equipped with features tailored to improve the insertion process of peripherally inserted central catheters (PICCs), central venous catheters, IV lines, and other vascular access devices.

The SiteRite 9 Ultrasound System received 510(k) clearance in September, marking a pivotal moment as the system became commercially available to customers in the United States.

The latest launch is expected to significantly strengthen BD’s foothold in the vascular access business, which is part of the company’s broader Medical business.

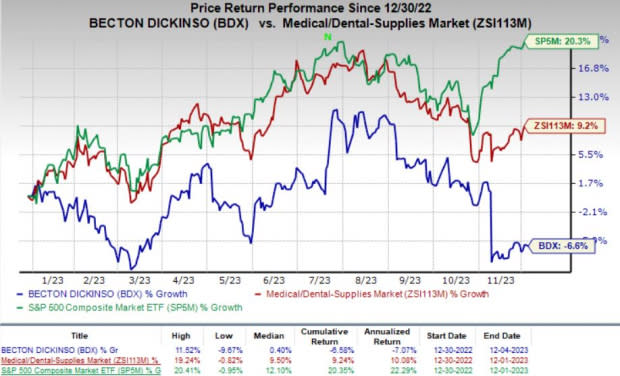

Price Performance

Shares of BDX have lost 6.6% year to date against the industry’s 9.2% growth. The S&P 500 has increased 20.3% in the said time frame.

Image Source: Zacks Investment Research

User-friendly Design and Enhanced Image Quality

The SiteRite 9 boasts an updated 15.6-inch touchscreen, offering a user-friendly experience. The enhanced image quality sets a new industry standard, providing clinicians with unparalleled catheter placement tools and technologies.

One of the primary features is the integrated Cue Needle Tracking System, providing real-time needle tracking for continuous monitoring during the insertion process. Additionally, the Sherlock 3CG+ Tip Confirmation System ensures accurate catheter tip navigation and location, further contributing to the system's precision.

SiteRite 9 incorporates smart, connected technology with vessel assessment tools that automatically detect vessels. The system, which is paired with measurement tools, can help clinicians make informed decisions regarding the selection of the appropriate catheter, thereby reducing the need for repeated needle sticks and streamlining workflow.

As a global leader in vascular access solutions, BD's SiteRite 9 aligns with the company's vision of a "One-Stick Hospital Stay." By leveraging ultrasound technology, BD aims to increase first-attempt insertion success, ultimately reducing the use of needle sticks.

Industry Prospects

Per a report by Grand View Research, the global vascular access devices market was estimated to be $1.77 billion in 2022 and is anticipated to reach $2.64 billion by 2030 at a CAGR of 5%. Factors like increased incidences of chronic diseases, growing elderly population, rising prevalence of cancer, and metabolic, respiratory and cardiovascular disorders are likely to drive the market.

Given the market potential, the latest regulatory approval is expected to significantly strengthen BD’s business worldwide.

Notable Developments in Medical Arm

Last month, BD reported its third-quarter fiscal 2023 results, wherein it registered a solid uptick in its top and bottom-line results, along with improvements in the overall base revenues. Robust performances by each of its segments and geographic regions were encouraging. Strength in BD’s segmental business units during the reported quarter was also promising.

However, lower COVID-only testing revenues were discouraging from a business perspective. MDS unit’s softness in China, driven by market dynamics, and the Pharmaceutical Systems unit’s slowdown in the country’s exports of anticoagulants, were also concerning.

In July, the company received the FDA’s 510(k) clearance for its updated BD Alaris Infusion System. This is expected to enable both remediation and a return to full commercial operations for the comprehensive infusion system in the United States.

In May, BD announced expanded customer availability of an all-in-one pre-filled flush syringe with an integrated disinfection unit, BD PosiFlush SafeScrub. The syringe has been designed to reinforce compliance with infection prevention guidelines and simplify nursing workflow.

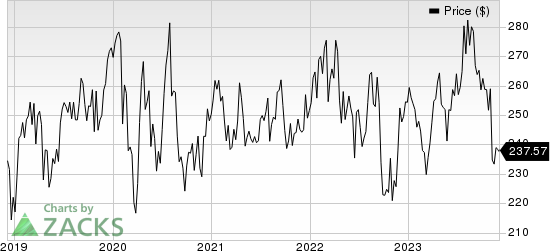

Becton, Dickinson and Company Price

Becton, Dickinson and Company price | Becton, Dickinson and Company Quote

Zacks Rank & Stocks to Consider

Currently, BD carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Biodesix BDSX and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.55%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have risen 42.7% year to date compared with the industry’s 3.9% growth.

Biodesix, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 9.76%.

Biodesix’s shares have lost 34.8% year to date compared with the industry’s 9.4% decline.

Integer Holdings, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 30.6% year to date against the industry’s 3.5% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report