BD's (BDX) ADC System Favored by New Study for Long-Term Care

Becton, Dickinson and Company BDX, popularly known as BD, recently announced positive new data from a research study assessing the impact of deploying automated dispensing cabinets (ADCs) in long-term care facilities and an off-site, long-term care pharmacy. The novel, peer-reviewed study was published in the Journal of the American Pharmacists Association.

The study evaluated various endpoints related to the management of first, missing and emergency dose medications over a 90-day period after replacing manual emergency medication kits with the BD Pyxis MedBank ADC system at two long-term care facilities serviced by an off-site pharmacy.

The latest favorable study result is likely to be a significant stepping stone for BD and boost its Medication Management Solutions (MMS) business unit of the broader Medical segment.

Significance of the Study

Per the study, medication dispensing automation and the associated workflow changes led to a significant (71%) reduction in medication retrieval time over a 90-day period in the long-term care facilities, as compared to manual emergency kits. This led to improvement in medication availability when nurses used automation technology. The study also showed a remarkable (96%) reduction in the cost of unscheduled medication deliveries across the two long-term care facilities, representing $8,900 in cost savings.

Per management, while the adoption of technology has traditionally lagged in long-term care settings, the results of the new study will likely highlight the benefits of automation to enhance patient care and alleviate labor challenges. Management also believes that with a rapidly growing elderly population entering long-term care facilities, technologies like BD Pyxis MedBank automated dispensing cabinets should be encouraged to manage operating costs, reduce the burden on healthcare providers and improve patient care.

Industry Prospects

Per a report by Grand View Research, the global medication management system market was valued at $2.7 billion in 2022 and is anticipated to expand at a CAGR of 10.7% between 2023 and 2030. Factors like the rise in investment by hospitals to improve workflow, the rapid advancement in medical technology and an increase in focus on reducing medication errors are likely to drive the market.

Given the market potential, the latest favorable study result is expected to significantly strengthen BD’s business worldwide.

Notable Developments in Medical Arm

Last month, BD reported its first-quarter fiscal 2024 results, wherein it registered solid top-line results, along with improvements in organic revenues. Robust performances by its Medical segment and both geographic regions were recorded. Strength in most of BD’s Medical segment’s business units during the reported quarter was also witnessed. MMS unit’s performance reflected strong growth in Dispensing and Infusion with a continued focus on innovation within the BD Pyxis portfolio to improve nursing workflows and efficiencies and strong progress in bringing the BD Alaris Infusion System back to market.

During the fiscal first quarter, BD Medical’s Medication Delivery Solutions business unit launched the SiteRite 9 Ultrasound System.

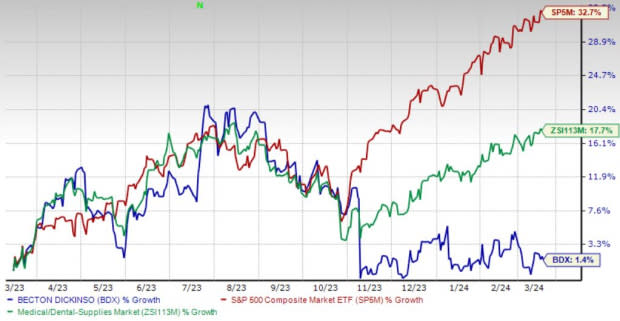

Price Performance

Shares of BD have gained 1.4% in the past year compared with the industry’s 17.7% rise and the S&P 500's 32.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, BD carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 78.4% compared with the industry’s 26.3% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 56.7% compared with the industry’s 17.7% rise in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 57.5% compared with the industry’s 7.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report