Beacon (BECN) Beats on Q2 Earnings & Revenues, Ups 2023 View

Beacon Roofing Supply, Inc. BECN reported decent results for second-quarter 2023, with earnings and revenues surpassing the Zacks Consensus Estimate. Both metrics increased on a year-over-year basis.

The upside was backed by strong residential demand and a solid Coastal Construction Product segment contribution. Also, the emphasis on Ambition 2025 growth initiatives, strategic investments in greenfields and acquisitions drove top-line growth. The company also lifted its expectations for the year.

Shares of the company rose 1% in the after-hours trading session on Aug 3, post the earnings release.

Earnings & Revenue Discussion

This distributor of building products reported adjusted earnings of $2.66 per share, which topped the consensus mark of $2.27 by 17.2% and increased 10.4% from the year-ago adjusted level of $2.41 per share.

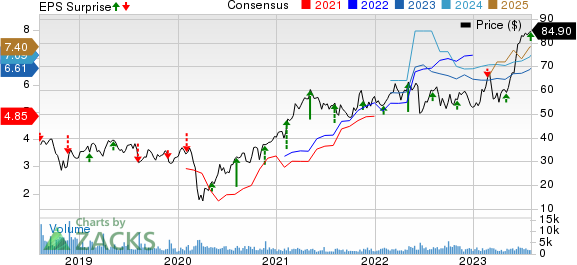

Beacon Roofing Supply, Inc. Price, Consensus and EPS Surprise

Beacon Roofing Supply, Inc. price-consensus-eps-surprise-chart | Beacon Roofing Supply, Inc. Quote

For the quarter, net sales of $2,503.7 million topped the consensus mark of $2,476 million by 1.1%. The top line grew 6.2% on a year-over-year basis, driven by solid execution on the Ambition 2025 growth program, including acquisitions and opening of greenfield locations, as well as solid pricing.

During the quarter, the weighted-average selling price increased approximately 2-3%, but volumes dropped 0-1%.

Sales According to Line of Business

Residential Roofing Product: For the reported quarter, sales of this product line (comprising 51.8% of quarterly net sales) were $1,298 million, up 8.5% from the prior year. Our model predicted the metric to be $1,212.7 million.

Non-Residential Roofing Product: Sales (comprising 26.8% of the quarterly net sales) declined 1.7% from the year-ago quarter to $670.8 million. Our estimate was $693.4 million.

Complementary Product: For the quarter, sales of this product line (comprising 21.4% of quarterly net sales) increased 11.6% year over year to $534.9 million. Our model predicted the metric to be $532.6 million.

Operating Highlights

The gross margin of 25.4% was down 220 basis points (bps) year over year due to higher product costs, reflective of inventory profit roll-off, majorly offset by higher average selling prices of the company’s products.

Adjusted operating margin declined to 15.1 % from 15.7% a year ago, owing to decreased payroll and benefits costs, primarily due to lower incentive compensation and decreases in selling, general and administrative expenses.

Adjusted EBITDA declined 5.7% on a year-over-year basis to $290.3 million due to lower gross margin and higher operating expenses. Adjusted EBITDA margin contracted 140 bps year over year to 11.6%.

Other Financial Details

As of Jun 30, 2023, the company had cash and cash equivalents of $65.8 million compared with $67.7 million at 2022-end and $54.6 million at June 2022-end. Long-term debt, net was $1,603.2 million, slightly down from the 2022-end value of $1,606.4 million and $1,609.6 million as of Jun 30, 2022.

Net cash provided by operating activities was $358.7 million in the first half of 2023 versus $187 million net cash used in operating activities in the prior year.

Q3 View

In the third quarter of 2023, the company expects net sales to increase approximately 7% on a year-over-year basis. The gross margin is expected to be in the mid-to-high 25%.

2023 Guidance Raised

For 2023, net sales growth is anticipated to be between 4% and 6%, up from the previously expected range of 2-4%.

Adjusted EBITDA is expected to be in the range of $850-$890 million (previously $810 million to $870 million).

Continuous investments in greenfield locations are expected to yield 20-25 new locations in 2023.

Zacks Rank & Key Picks

Beacon sports a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Retail and Wholesale sector are:

Dave & Buster's Entertainment, Inc. PLAY sports a Zacks Rank #1 (Strong Buy).

PLAY has a trailing four-quarter earnings surprise of 6.9%, on average. Shares of PLAY have gained 38.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for PLAY’s 2024 sales and EPS indicates a rise of 17% and 29%, respectively, from the year-ago period’s levels.

Abercrombie & Fitch Co. ANF flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 480.6%, on average. Shares of ANF have increased by 116.5% in the past year.

The Zacks Consensus Estimate for ANF’s 2024 sales and EPS indicate an increase of 3.4% and 732%, respectively, from the year-ago period’s levels.

BJ's Restaurants, Inc. BJRI sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 121.2%, on average. Shares of BJRI have increased 56.8% in the past year.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates 5.6% and 405.9% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY) : Free Stock Analysis Report