Beacon (BECN) Opens 2 Branches, Fortifies Ambition 2025 Goals

Beacon Roofing Supply, Inc. BECN opened two new locations in Michigan and the Tri-State area of Kansas-Missouri-Oklahoma to serve residential and commercial contractors and lumberyards.

The new Grand Haven, MI, branch, located in the Grand Rapids metropolitan area, will serve the popular lake-side community as part of BECN’s Western Michigan Beacon OTC network.

The new Joplin, MO, branch will serve lumberyard customers in the Tri-State area.

Beacon’s stock inched up 0.84% on Sep 10.

Strategic Efforts to Boost Sales in the Future

Beacon has undertaken several strategic initiatives to drive its long-term ambition of growing and enhancing customers’ experiences, expanding its top line and margin as well as boosting value for customers, suppliers, employees and shareholders.

The company has been focusing on its Ambition 2025 targets (announced on Feb 24, 2022), which emphasize operational excellence, an above-market growth trajectory and accelerated stockholder value creation. The financial targets of Ambition 2025 assume that sales will reach $9 billion (8% CAGR) and $1 billion of EBITDA (10% CAGR), which would translate into an 11% EBITDA margin (up 100 basis points from 2021).

As part of this initiative, Beacon has been focusing on business expansion through bolt-on acquisitions and divestitures. So far, in 2023, the company has expanded its branch footprint through the completion of seven acquisitions and the opening of 16 new locations.

Its second-quarter net sales grew 6.2% on a year-over-year basis, driven by solid execution on the Ambition 2025 growth program, including acquisitions and the opening of greenfield locations, as well as solid pricing.

For the third quarter, Beacon expects net sales to increase approximately 7% on a year-over-year basis and gross margin to be in the mid-to-high 25% range. It has also raised its full-year guidance. For 2023, net sales growth is anticipated to be between 4% and 6%, up from the previously expected range of 2-4%. Adjusted EBITDA is expected to be in the range of $850-$890 million (previously $810-$870 million).

The company plans to invest more in business expansion to yield 20-25 new greenfield locations in 2023.

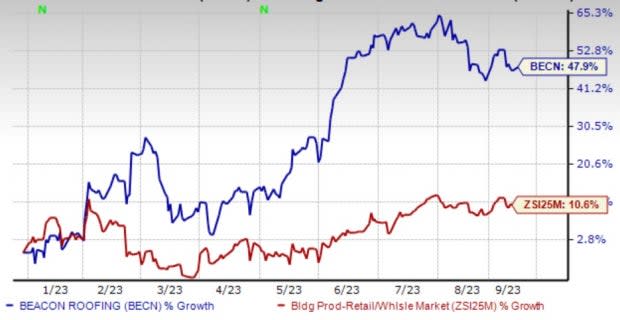

Image Source: Zacks Investment Research

Shares of Beacon — the largest distributor of residential and non-residential roofing materials in the United States and Canada — have strongly outperformed the Building Products - Retail industry so far this year. BECN gained 47.9% in the said period compared with the industry’s 10.6% growth.

A solid residential backdrop, exceptional operating cost management and cash flow, a focus on the e-commerce platform, a new OTC (On-Time and Complete) Delivery Network and a newly designed website will help BECN gain further.

Zacks Rank & Key Picks

Beacon currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the Retail-Wholesale sector include:

Builders FirstSource, Inc. BLDR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BLDR has a trailing four-quarter earnings surprise of 52.2%, on average. The Zacks Consensus Estimate for BLDR’s 2023 sales and EPS indicates a decline of 23.3% and 29.6%, respectively, from the previous year’s reported levels.

Domino’s Pizza, Inc. DPZ currently carries a Zacks Rank #2 (Buy).

DPZ delivered a trailing four-quarter earnings surprise of 4.8%, on average. The Zacks Consensus Estimate for DPZ’s 2023 sales indicates a decline of 0.1%, while earnings per share (EPS) indicate growth of 9.5%, from the previous year’s reported levels.

BJ's Restaurants, Inc. BJRI sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 121.2%, on average.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates 5.6% and 435.3% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report