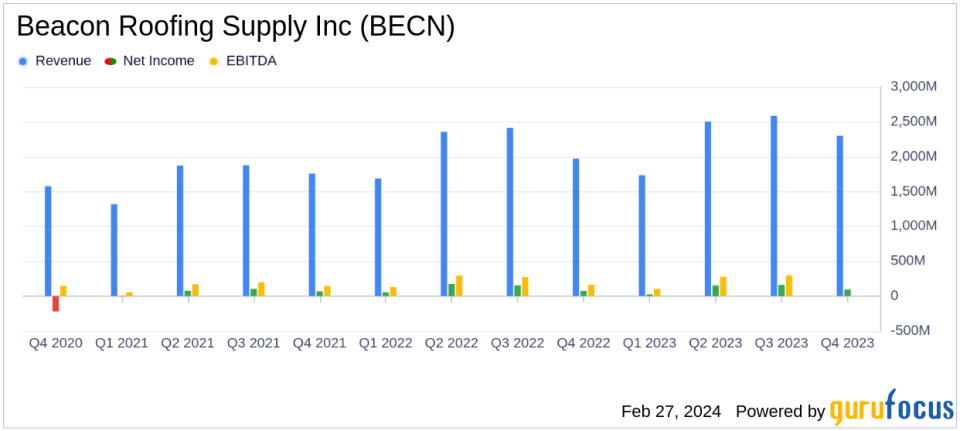

Beacon Roofing Supply Inc (BECN) Posts Record Sales and Strong Net Income in Q4 and Full Year 2023

Net Sales: Achieved record fourth quarter and full year net sales of $2.30 billion and $9.12 billion, respectively.

Net Income: Reported strong net income of $95.1 million in Q4 and $435.0 million for the full year.

Adjusted EBITDA: Attained the highest Adjusted EBITDA in company history at $216.7 million for Q4 and $929.6 million for the full year.

Gross Margin: Gross margin slightly decreased to 25.7% in Q4 and full year, compared to the previous year.

Share Repurchase: Repurchased and retired $11.0 million of common stock in Q4; $110.9 million for the full year.

Strategic Growth: Acquired 21 branches and opened 28 greenfield locations, enhancing customer reach and service.

Balance Sheet Strength: Maintained net debt leverage at 2.4 times as of year-end.

On February 27, 2024, Beacon Roofing Supply Inc (NASDAQ:BECN) released its 8-K filing, detailing a robust financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading distributor of roofing and building materials in the United States and Canada, has demonstrated resilience and strategic prowess in a competitive market.

Beacon Roofing Supply Inc's product portfolio, catering to contractors, home builders, and various other customers, has driven significant revenue primarily from residential and non-residential roofing products. The company's Ambition 2025 strategy has been pivotal in achieving growth through enhanced sales capabilities, greenfield investments, and mergers and acquisitions.

Financial Performance and Strategic Execution

The company's record fourth quarter and full year net sales reflect a 16.8% and 8.2% increase, respectively, compared to the prior year. This growth was fueled by organic volume growth, including greenfields, and contributions from acquired branches. Notably, residential roofing product sales saw a significant uptick due to higher volumes, while complementary product sales were bolstered by the acquisition of Coastal Construction Products.

Despite facing higher product costs, Beacon Roofing Supply Inc managed to maintain a strong net income margin and double-digit Adjusted EBITDA margin for the third consecutive full year. This achievement underscores the company's diligent pricing execution, productivity, and improvements from the bottom quintile branch initiative.

Beacon Roofing Supply Inc's financial achievements are particularly noteworthy in the Industrial Distribution industry, where managing costs and maximizing operational efficiency are critical for sustaining profitability and shareholder value.

Key Financial Metrics

Key financial details from the Income Statement, Balance Sheet, and Cash Flow Statement reveal the company's solid financial position. The gross margin percentage experienced a slight decrease, attributed to higher product costs, which were not fully offset by higher average selling prices. Operating expenses as a percentage of net sales improved, reflecting the company's effective cost management strategies.

Adjusted Net Income and Adjusted EBITDA margins also improved, indicating the company's ability to enhance profitability through strategic initiatives and operational excellence. The strength of Beacon Roofing Supply Inc's balance sheet is further evidenced by its ability to invest in growth while maintaining a healthy net debt leverage ratio.

Beacon Roofing Supply Inc's performance is further illustrated by the following financial tables:

Management's Commentary

"Our 2023 results demonstrate that our Ambition 2025 strategy has multiple paths to growth and can deliver results in a variety of conditions," said Julian Francis, Beacons President & CEO. "We delivered record fourth quarter and full year sales, strong net income, and our highest Adjusted EBITDA in history."

The company's strategic direction, as articulated by the CEO, has not only delivered impressive financial results but also positioned Beacon Roofing Supply Inc for sustainable long-term growth. The company's investment in growth capital, including the highest capex in its history, and the return of significant capital to shareholders through share repurchases, reflect a balanced approach to capital allocation.

Looking Ahead

Beacon Roofing Supply Inc's performance in 2023 sets a solid foundation for the future. With a winning culture and a dedicated team of over 8,000 members, the company is well-equipped to unlock its long-term potential and continue thriving in a large, attractive, and growing market.

Investors and stakeholders can anticipate continued execution of the Ambition 2025 strategy, with a focus on growth, operational efficiency, and customer service excellence. The company's robust financial health and strategic investments suggest a promising outlook for Beacon Roofing Supply Inc in the years to come.

For more detailed information on Beacon Roofing Supply Inc's financial performance, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Beacon Roofing Supply Inc for further details.

This article first appeared on GuruFocus.