Bear of the Day: AMN Healthcare Services (AMN)

Labor shortages and staff burnout among nurses are reasons to be wary of AMN Healthcare Services AMN stock despite the company’s favorable long-term prospects.

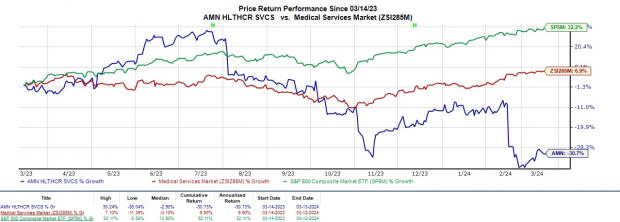

Correlating with this cautious scenario, AMN’s stock currently carries a Zacks Rank #5 (Strong Sell) and lands the Bear of the Day.

Image Source: Zacks Investment Research

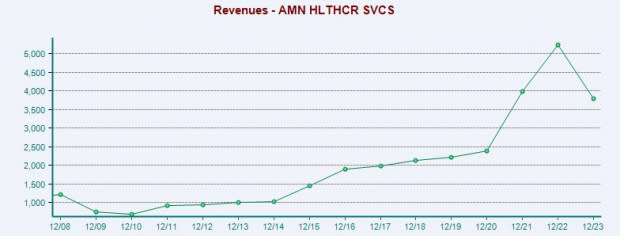

Declining Nurse and Allied Solutions Segment Sales

Providing total talent solutions and staffing networks for healthcare organizations, AMN’s Nurse and Allied Solutions segment revenue fell -38% last quarter to $538 million with the company stating its travel nurse sales fell -40% specifically.

AMN was still able to beat Q4 top and bottom line expectations in February but this is concerning considering the Nurse and Allied Solutions segment makes up more than half of its total revenue.

Image Source: Zacks Investment Research

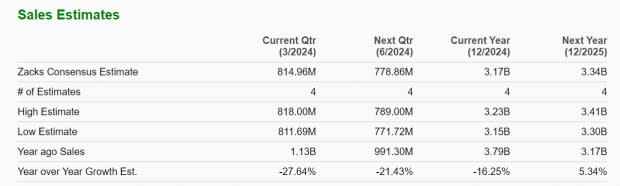

Furthermore, the impact of challenging work conditions and high turnover particularly among "Nurse Leaders" is lingering with AMN forecasting its Nurse and Allied Solutions segment revenue to be down 36-38% for the first quarter. AMN projects its consolidated revenue for Q1 to be 26-28% lower with Zacks estimates of $814.46 million representing a -27% decline.

Image Source: Zacks Investment Research

Bottom Line Effect

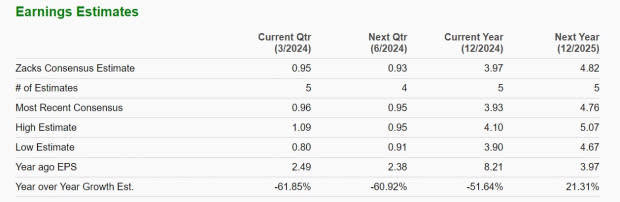

With the proponents of nurse staffing making up such a large chunk of AMN’s core business, the company’s bottom line is expected to be impacted as well. Notably, earnings estimate revisions have declined -20% for fiscal 2024 over the last 30 days from projections of $4.93 per share to $3.97 a share.

Image Source: Zacks Investment Research

Plus, FY25 EPS estimates have fallen -14% in the last month which is starting to put a dent in the hopes of a sharp rebound in AMN’s bottom line next year.

Image Source: Zacks Investment Research

Takeaway

AMN’s stock is already down -20% year to date and a rebound may not come until its Nurse and Allied Solutions segment sales begin to stabilize. This will need to be monitored by investors going forward and for now, AMN’s stock is one to avoid.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report