Bear of the Day: Ashland Inc. (ASH)

Ashland Inc. ASH is a leading specialty chemicals company serving various consumer and industrial markets, including automotive, construction, architectural coatings, adhesives, energy, food & beverage, and pharmaceutical.

Analysts have taken a bearish stance on the company’s earnings outlook across the board, pushing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

In addition, the company resides in the Zacks Chemical – Specialty industry, which is currently ranked in the bottom 22% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

Current Standing

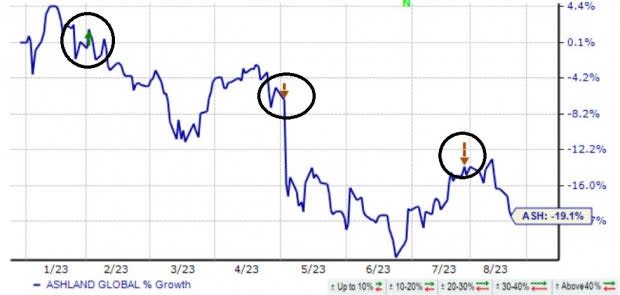

Ashland shares have struggled to find their footing in 2023, down roughly 19% and widely underperforming relative to the general market. As we can see below, recent quarterly results haven’t impressed the market, with ASH shares remaining on a downward trajectory.

Image Source: Zacks Investment Research

Regarding the most recent quarterly release, ASH fell short of the Zacks Consensus EPS Estimate by more than 12% and reported revenue marginally below expectations. It reflected the company’s second consecutive quarter of missing on both the top and bottom lines.

Top line growth has remained somewhat stagnant over the last several years, as we can see below.

Image Source: Zacks Investment Research

Shares do pay a solid dividend, currently yielding 1.8% annually paired with a payout ratio sitting at 30% of the company’s earnings. Dividend growth is there, too, with the payout growing by an annualized 8% over the last five years.

Image Source: Zacks Investment Research

The company’s growth is slated to taper in its current year, with Zacks Consensus Estimates suggesting an 18% pullback in earnings on 7.5% lower revenues. Still, growth resumes in FY24, with expectations suggesting 20% higher earnings and a 5% revenue bump.

Bottom Line

Negative earnings estimate revisions from analysts and recent negative quarterly results paint a challenging picture for the company’s shares in the near term.

Ashland Inc. ASH is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Inc. (ASH) : Free Stock Analysis Report