Bear Of The Day: Chico's (CHS)

Chico’s (CHS) participated in the recent brick-and-mortar retail rally driven by speculative retail traders from a Reddit message board called WallStreetBets. This cohort of Gen Zs and Millennials targeted some of the most shorted stocks on the market and were followed in by hedge funds and prop trading firms that propagated a historic short-squeeze, which seems to have moved a number failing business amid the retail apocalypse, which included CHS.

This stock is trading far above the most optimistic price targets and I would liquidate any positions that I had in CHS, thanking god that I was able to get such a good price for them. I would recommend not taking on any position in this company.

Retail Apocalypse

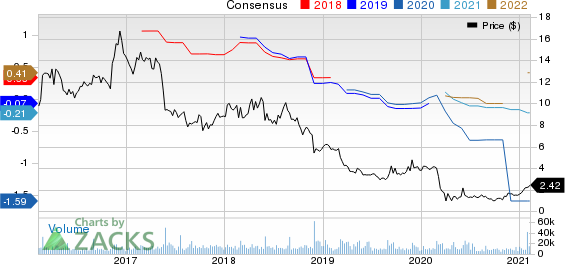

The retail apocalypse is exploding amid this global pandemic, and no brick-and-mortar business is safe. Chico’s is one such business that has not been immune to the COVID driven economic downturn. CHS has lost 85% of its value since its 2016 highs, and it continues to disappoint investors with a 39% break down in the past 52-weeks. Sell-side analysts are becoming more pessimistic about this stock and continue to lower expectations pushing this stock down to a Zacks Rank #5 (Strong Sell).

Chicos FAS, Inc. Price and Consensus

Chicos FAS, Inc. price-consensus-chart | Chicos FAS, Inc. Quote

The Business

Chico’s is a women’s fashion brand that began out of Sanibel, Florida 36 years ago. The company operates three separate retailers, branded Chico’s, White House Black Market, and Soma.

The peak of this retailer’s performance was back in 2014 but has since fallen prey to the changing digital commerce landscape. Amazon and the other large online retailers have left less versatile firms like Chico’s in the dust. Chico’s operated 1,547 stores in 2014 and has since closed 129 stores and expects to close another 250 over the next three years.

This once women’s fashion icon’s inability to adapt to the digitalizing world has led to a sales decline in the past 19 out of 20 quarters and shareholders have suffered. Chico’s revenue decline is expected to continue in the years to come.

Chico’s bottom line has flipped negative, and its losses are accelerating seemingly every quarter. The business is quickly running out money, and this pandemic may be the straw that broke the camel’s back for Chico’s.

The best thing that could happen to Chico’s at this point is an acquisition. Otherwise, I see this archaic enterprise fizzling into bankruptcy, and that is what investors & traders have

CHS is soon to be a penny stock trading at $2.60. This low share price causes accentuated volatility, adding more risk to any investor holding these shares.

Take Away

The retail apocalypse is real, and the COVID-crisis is pushing brick-and-mortar retailers that haven’t adapted to the evolving consumer out of the market. Chico’s is just another teetering retail domino getting ready to fall. There are significant systemic issues with this company, and I would not put any position on this stock at this time.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chicos FAS, Inc. (CHS) : Free Stock Analysis Report

To read this article on Zacks.com click here.