Bear of the Day: Gap Inc. (GPS)

Gap Inc. (GPS) is a global retailer that sells casual apparel, accessories, and shoes for men, women, and kids under three core brands: Gap, Old Navy, and Banana Republic. The company also owns successful athleisure brands Athleta and Hill City, as well as Intermix, its luxe designer boutique chain.

Weak Q1 Earnings Hurt Shares

Earnings of 24 cents per share missed the Zacks Consensus Estimate of 31 cents per share and decreased 43% year-over-year. Total revenues of $3.7 billion also lagged behind our consensus estimate.

Comparable sales declined 4% from the prior-year period. Even Old Navy, which is the company’s strongest brand, posted a comps decline, while the Gap brand reported a 10% decrease.

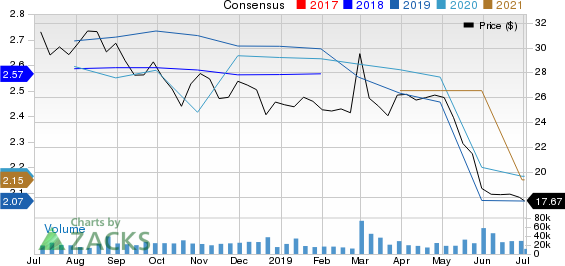

There will likely be more struggles ahead. Management expects a low single-digit decline in full-year comparable sales, which is down from the previous outlook of flat to up slightly. The forecast for adjusted EPS was also reduced to between $2.05 and $2.15, down from $2.40 to $2.55.

"This quarter was extremely challenging, and we are not at all satisfied with our results," CEO Art Peck said in a press release.

Gap shares were already under pressure before releasing its first quarter results; apparel stocks across the board got hit hard in May—as did the rest of the market—due to ongoing trade tensions; China and the U.S. implemented new tariffs that month that threatened retailers.

Falling Estimates

Analysts have since turned bearish on Gap, with 11 cutting estimates in the last 60 days for the current fiscal year. The Zacks Consensus Estimate has dropped 39 cents during that same time period from $2.46 to $2.07 per share; earnings could now see a roughly 20% year-over-year decline for fiscal 2020.

This sentiment has stretched into 2021, and our consensus estimate has dropped 39 cents in the past two months as well.

GPS is now a Zacks Rank #5 (Strong Sell).

Bottom Line

Going forward, Peck said that he is still confident in the company’s plan to make Old Navy and the other brands into two separate publicly traded companies next year. However, the popularity of online shopping and the slow decline away from mall-based retailers will likely still impact Gap and its brands down the line.

If you’re an investor interested in adding a stock from the broad retail sector to your portfolio, consider The Children’s Place (PLCE). PLCE, which is the biggest pure-play children’s appareler in North America, has not been the biggest gainer this year, but the Zacks Consensus estimate for fiscal 2020 has jumped 70 cents, with five analysts revising their estimates higher over the past 60 days. Plus, the company pays a solid dividend with a yield of 2.38%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Children's Place, Inc. (The) (PLCE) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research