Bear of the Day: Guess (GES)

The fashion brand Guess GES has been struggling in recent years, unable to move its stock price higher. Unfortunately, the current outlook is not much improved as sales are forecast to remain flat in the coming years, and earnings estimate revisions are decidedly lower, giving the stock a Zacks Rank #5 (Strong Sell) recommendation.

Because of the lackluster company expectations, and inherent challenges of the fashion and apparel business, Guess stock should be avoided until a significant turn in the data.

Company Summary

Guess is an American fashion brand known for its clothing, accessories, and footwear. Founded in 1981, it is recognized for its iconic denim products and distinctive style. Guess operates globally and has a reputation for its trendy and edgy youthful designs.

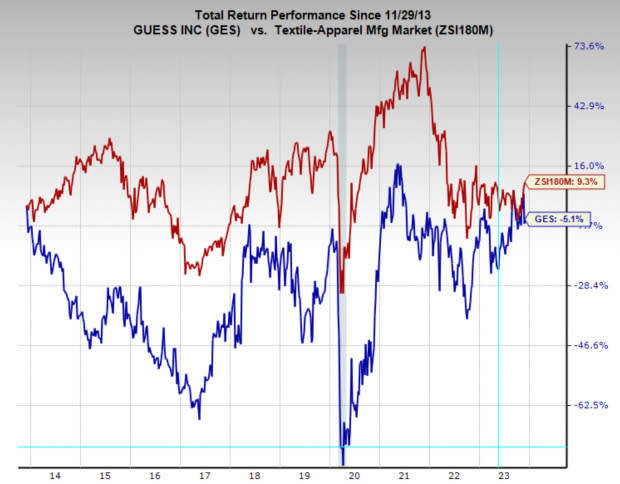

Over the last ten years Guess stock is essentially unchanged, down -5% over that period. This is below the industry returns, which should be noted are not much better at just 9% over the last ten years, and significantly worse than the broad market. However, GES has paid a dividend since 2008, which today stands at a hefty 5.6% yield.

The poor industry performance speaks to the inherent challenges associated with the fashion industry. Because trends regularly come and go, it is hard for the brands to maintain steady and enduring sales growth. As is seen in GES, where sales growth is flat over the last 11 years, these instances can be brutal for shareholders.

Image Source: Zacks Investment Research

Sales and Earnings

Sales this year and next are expected to continue mostly unchanged, with FY24 expecting 2.2% YoY growth and FY25 forecasting 1.9% YoY growth. With no sales growth prospects, I think it is likely that Guess stock will continue to languish as is has the last decade.

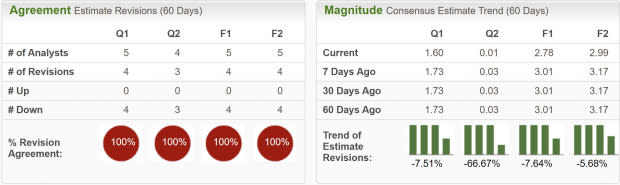

Earnings estimates aren’t encouraging either, reflected by the Zacks #5 (Strong Sell Rating). Current quarter earnings have been revised lower by -7.5% and are expected to drop -8% YoY to $1.6 per share. FY23 earnings have been lowered by -7.6% and are projected to grow just 1.4% YoY to $2.78 per share.

Guess is a part of the Textile – Apparel Industry, which sits in the Bottom 30% (175 out of 251) of the Zacks Industry Rank.

Image Source: Zacks Investment Research

Bottom Line

This year has been an exceptional one in the stock market, and thus there are a litany of exciting companies to pick from. This makes Guess a stock that is very much worth avoiding, as it has few if any bullish catalysts currently.

However, Guess does have a well-known brand, and still does over $2.7 billion in annual sales indicating it still maintains some relevance in the fashion world. Furthermore, it is trading at a forward earnings multiple of 8x, which is below the industry average of 14.6x and its 10-year median of 17.5x.

Thus, if Guess can instigate a growth campaign and sway analysts to improve earnings estimates, it could at some point be an interesting investment. However, for now investors should look elsewhere for opportunities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guess?, Inc. (GES) : Free Stock Analysis Report