Bear Of The Day: Lending Tree (TREE)

Lending Tree (TREE) is a Zacks Rank #5 (Strong Sell) and has seen estimates slide over the last few weeks following an earnings miss. This is an interesting case because while a miss is a bad thing and estimates do tend to move lower as a result, there is a silver lining here for TREE. That said, it is the Bear Of The Day, so let's take a look at why this stock has lowest Zacks Rank.

Description

LendingTree is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings.

Recent Miss

The most recent quarter was a miss of the Zacks Consensus Estimate. The company posted EPS of $0.84 when $0.88 was expected. The four-cent miss translated into a negative earnings surprise of 4.5%.

This was the third miss in the last four quarters and that plays a role in how the Zacks Rank is assigned to stocks.

Estimate Revisions

So I see a few moves here and about 30 days the estimate for the current quarter was $1.21, but it has since slid to $1.17. The same movement happened for the next quarter over that time horizon, sliding from $1.46 to $1.33

Silver Lining

Those negative revisions added to the misses are likely the strongest contributors to this stock sliding to a Zacks Rank #5 (Strong Sell). Common sense doesn't play into an algorithm, but the clear idea here is that analysts could be lowering their numbers as the Fed moves interest rates higher. Higher rates probably don't help the chances of more refinances.

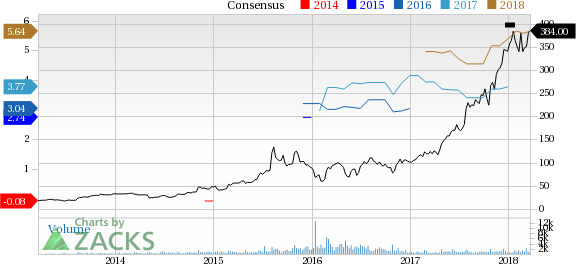

That said, I see positive year over year earnings growth for TREE. The current Zacks Consensus Estimate for 2018 is $5.64 and next year I see $7.81. That sort of earnings growth makes it easy to overlook the near term estimate drawdowns.

LendingTree, Inc. Price and Consensus

LendingTree, Inc. Price and Consensus | LendingTree, Inc. Quote

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research