Bear of the Day: Marriott Vacations Worldwide (VAC)

Company Overview

Zacks Rank #5 (Strong Sell) stock Marriott Vacations Worldwide Corporation (VAC) is a leading global vacation company that offers vacation ownership, exchange, rental, resort, and property management services. Marriott has a portfolio of more than 120 resorts under seven different brand names. Though Marriott is a leader and a household name in the vacation space, the company has several bearish industry catalysts working against it, including:

Higher Expenses Due to COVID-19

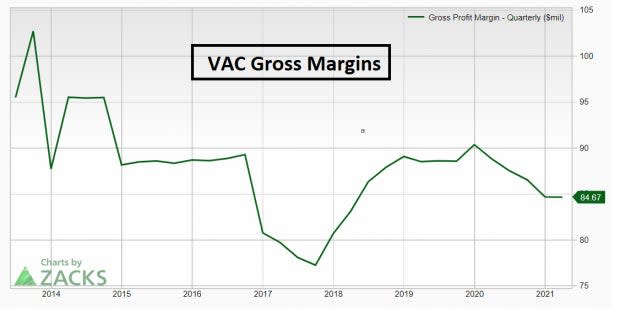

In 2018, Marriott Vacations completed its merger with ILG Inc, a vacation experiences provider, for $4.6 billion. Despite the synergy of the newly formed company, expenses have been increasing. Inflation from the COVID-19 pandemic hangover and several years of rock-bottom interest rates are taking their toll on the company. Furthermore, marketing and sales expenses are increasing, eating into margins.

Image Source: Zacks Investment Research

Cyclical Nature of Travel Industry and International Exposure

The hospitality industry is highly cyclical in nature. Worsening global economic conditions are a risk for Marriott Vacation investors. Just this week, Germany and the Netherlands officially entered a recession. Meanwhile, the Chinese economy, one of the largest in the world, is seeing its real-estate sector on the brink of collapse, while an interest rate cut has done little to stabilize the equity market. A global recession would mean less personal discretionary spending, lower demand, and less traveling for most people. Currently, analysts covering VAC expect top-line growth to slow over the next three quarters. Any worsening in the global economy will only slow earnings further.

Image Source: Zacks Investment Research

More Competition

Airbnb (ABNB) and other newer forms of hospitality can pose potential threats to traditional vacation ownership companies like Marriott Vacations Worldwide because ABNB offers more:

Flexibility: ABNB offers a wide range of accommodation options at various price points, making them more appealing to budget-conscious travelers. Meanwhile, unlike many VAC properties, ABNB offers flexible scheduling.

Diverse Accommodations: ABNB’s unique business model allows the company to offer a more diverse array of accommodations.

Unique and Authentic Experiences: Modern travelers, especially younger generations, prioritize unique and authentic experiences. Airbnb’s emphasis on staying in local neighborhoods and experiencing destinations like a local can be more aligned with these changing travel preferences.

Negative Earnings ESP (Expected Surprise Prediction) Score

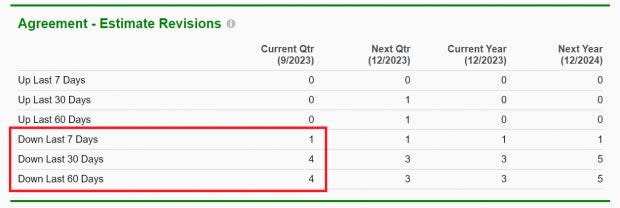

In the past few months, Zacks Consensus Estimates indicate that analysts are becoming more bearish on the VAC. Five analysts have decreased their EPS outlook for the company in the past month.

Image Source: Zacks Investment Research

The bearishness has resulted in a negative Earnings ESP score. A negative Earnings ESP score mixed with a Zacks Rank #5 suggests that the company will likely fall short of earnings expectations the next time it reports.

Relative Weakness & Poor Price Action

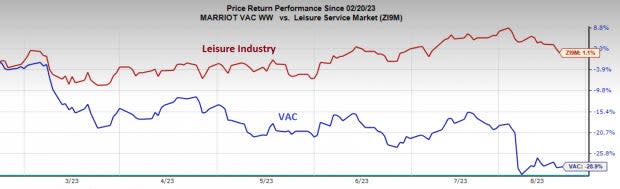

VAC shares are drastically underperforming both the market and its industry. Over the past six months, VAC shares are lower by nearly 30% while the leisure industry is flat.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report