Bear of the Day: RH (RH)

RH RH, also known as Restoration Hardware, is a luxury home furnishings company known for its high-end and curated collections of furniture, lighting, textiles, and décor. RH is well known for its impressive retail locations and commitment to extremely high quality craftmanship.

However, uber-luxury furniture shopping has fallen off considerably since the post-Covid boom, and sales and earnings have taken a hit along with the share price.

Based on these trends, earnings estimates have fallen precipitously over the last two years, and more so in recent months, indicating the potential for more downside ahead. Additionally, with an earnings multiple well above historical averages and falling EPS expectations, there is considerable downside risk.

Because of this setup, I think investors should avoid RH and look for other opportunities in the market.

Earnings Estimates

Earnings estimates have clearly been falling over the last 18 months and more recently, giving RH a Zacks Rank #5 (Strong Sell) rating. Analysts have unanimously downgraded earnings estimates, with the current quarter being revised lower by -34.2% and the current year by -18.7%.

Sales this year are expected to drop -14.6% YoY to $3.07 billion. Earnings during the same period are anticipated to fall a brutal -60% YoY to $8.02 per share. Because of such weak expectations I think there is a distinct possibility that RH share price will fall below $200.

Image Source: Zacks Investment Research

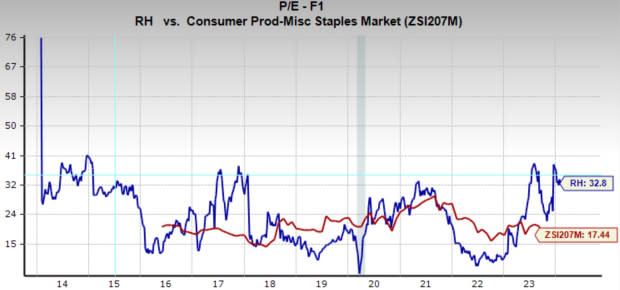

Valuation

Further increasing the risk of another plunge in the stock price is its relatively premium valuation. RH is trading at a one year forward earnings multiple of 32.8x, well above the industry average, and its 10-year median of 22.9x. And with annual EPS growth forecasts of just 8.4% over the next 3-5 years, the valuation appears even more overpriced.

Image Source: Zacks Investment Research

Bottom Line

Although the current situation is grim, RH is still a fantastic company, with industry leading products, and will likely someday be a compelling investment option, but that time is not now. As mentioned, I think the stock price may flush below $200, but that could be a potential opportunity given the right circumstances.

However, as the situation presents today, RH is a stock that investors would be best to avoid.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RH (RH) : Free Stock Analysis Report