Bear of the Day: Tronox Holdings plc (TROX)

Tronox Holdings plc (TROX) is one of the leading producers of high-quality titanium products. Tronox’s earnings outlook started fading quickly last year.

Tronox fell short of our second quarter earnings estimates by a wide margin on July 26. TROX’s EPS outlook has slipped even further since its big miss and disappointing outlook.

The Tronox Basics

Tronox mines and processes titanium ore, zircon, and other minerals. Tronox also manufactures titanium dioxide pigments that help add brightness and durability to paints, plastics, paper, and other everyday products.

Tronox capped off a nice stretch of revenue growth between fiscal 2017 and 2021, with 30% sales expansion in FY21. Tronox’s revenue then slipped 3% YoY in 2022 against that tough to compete-against-stretch. Tronox on July 26 fell short of both our adjusted earnings and revenue estimates for Q2 FY23.

Image Source: Zacks Investment Research

The firm’s adjusted Q2 earnings tumbled 81% YoY to $0.16 a share, which missed our estimate by 41%. Tronox’s earnings outlook took another hit following its release.

Zacks estimates currently call for TROX’s sales to slide 8.7% in FY23. Meanwhile, its adjusted earnings are projected to fall 47% YoY in 2023.

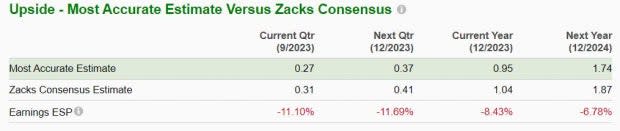

TROX’s FY23 consensus estimate has dropped 27% over the last two months, with FY24’s estimate 19% lower. And its most recent/most accurate estimates came in far lower. Tronox’s downward earnings revisions help it land a Zacks Rank #5 (Strong Sell) right now.

Image Source: Zacks Investment Research

Bottom Line

Tronox stock is down roughly 40% over the last decade vs. the Zacks Basic Materials sector’s 22% climb. This run included some huge swings, with TROX shares down roughly 45% from their 2021 highs.

TROX stock has fallen 3% in 2023, including a significant fall since its Q2 release to take it back under its 21-day moving average. Tronox shares also slipped back below their 50-week moving average after being rejected by their 200-week not too long ago.

Tronox is part of the Chemical – Diversified industry that currently ranks in the bottom 12% of over 250 Zacks industries. And it might be best for investors to stay away from Tronox at the moment and look elsewhere for winners.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tronox Holdings PLC (TROX) : Free Stock Analysis Report