Bear of the Day: TTEC Holdings (TTEC)

With the market staging a big comeback in 2023 so far, many companies have seen their earnings outlook shift positively.

However, the outlook hasn’t been as bright for all, including TTEC Holdings. TTEC. The company has seen its bottom line outlook turn sour over the last several months, pushing it down into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

TTEC Holdings (formerly known as TeleTech) is a global customer experience (CX) technology and services company focused on the design, implementation, and delivery of exceptional customer experiences. Let’s take a closer look at how the company currently stacks up.

Share Performance

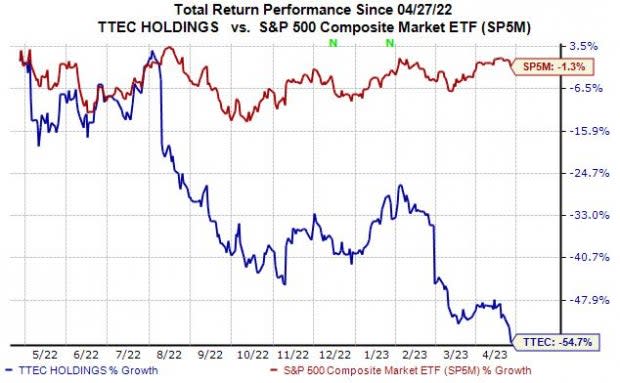

TTEC shares have faced notable selling pressure year-to-date, down roughly 25% and widely underperforming relative to the general market.

Image Source: Zacks Investment Research

And over the last year, the picture primarily remains the same; TTEC shares have struggled to find lasting momentum, down more than 50% and again underperforming relative to the S&P 500.

Image Source: Zacks Investment Research

Valuation

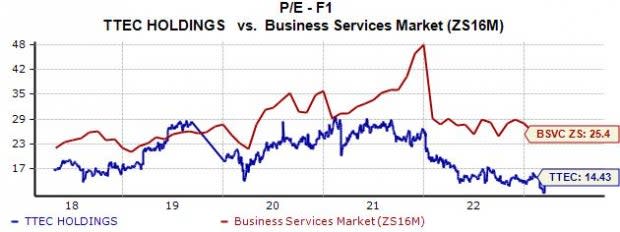

Shares aren’t expensive on a relative basis, with the company’s 14.4X forward earnings multiple sitting well below the 19.3X five-year median and the Zacks Business Services sector average.

Image Source: Zacks Investment Research

In addition, TTEC’s forward price-to-sales ratio of 0.6X resides on the lower end of the spectrum, again well below the 1.2X five-year median.

Image Source: Zacks Investment Research

TTEC carries a Style Score of “B” for Value.

Quarterly Performance

TTEC posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 20% and delivering a positive 4.7% revenue surprise.

However, the market had a poor reaction post-earnings, sending shares on a downward trajectory. This is illustrated in the chart below.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts paint a challenging picture for the company’s shares in the near term.

TTEC Holdings TTEC is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook over the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TeleTech Holdings, Inc. (TTEC) : Free Stock Analysis Report