Is a Beat Likely for Cardinal Health (CAH) in Q4 Earnings?

Cardinal Health, Inc. CAH is scheduled to report fiscal fourth-quarter 2023 results on Aug 15, before the opening bell.

In the last reported quarter, the company delivered an earnings surprise of 17.6%. The bottom line beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one, delivering an average surprise of 12.28%.

Q4 Estimates

For the fiscal fourth quarter, the consensus mark for earnings is pegged at $1.48 per share, indicating an improvement of 41% from the prior-year quarter’s reported figure. The same for revenues is pinned at $52.41 billion, implying growth of 11.3% year over year.

Factors to Note

Cardinal Health's Pharmaceutical segment is one of the largest pharmaceutical distributors in the United States. In the third quarter, revenues from this segment amounted to approximately $46.8 billion, up 14% on a year-over-year basis. The performance reflects branded pharmaceutical sales growth in the Pharmaceutical Distribution and Specialty Solutions segment. This segment’s profit was also up 23%. This momentum is likely to have continued in the fiscal fourth quarter as well.

The company’s generics program sales were also strong during the last reported quarter and its upcoming results are expected to gain from this trend.

In April, Cardinal Health opened two new distribution centers in Central Ohio to support U.S. Medical Products and Distribution, and at-Home Solutions businesses. Last year, the company had opened a new distribution center in the Columbus, OH area, lending support to its at-Home Solutions business.

CAH is also focused on improving patient engagement and clinical pharmacy solutions. In June, it signed an agreement to contribute its Outcomes business to BalcRock’s Transaction Data Systems for integrated offering of pharmacy workflow software using patient engagement and clinical solutions. The idea was to create additional opportunities for pharmacists and enable better access for payers. In May, Cardinal Health launched modern payment solutions to increase the operational efficiency of independent pharmacies.

These developments are likely to have favored CAH’s fiscal fourth-quarter performance. Moreover, new distribution centers might have helped alleviate supply-chain challenges.

For the Medical segment, a decrease in product and distribution volumes as well as pricing led to lower revenues in the previously reported quarter. Earnings were also hurt by net inflationary impacts. The company expects profit for this segment to decline 50% in fiscal 2023. Earnings and revenues are expected to have declined in the soon-to-be-reported quarter.

However, demand for CAH’s at-Home Solutions remained strong during the past couple of quarters. The company had launched a supply-chain network and last-mile fulfillment solution — Velocare — for providing critical products and services required for hospital-level care at home. This strong performance is likely to have continued in the fiscal fourth quarter.

Earnings Beat Likely

Our proven model predicts an earnings beat for Cardinal Health this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here as you will see below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is +0.10% for Cardinal Health.

You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Cardinal Health currently carries a Zacks Rank #3.

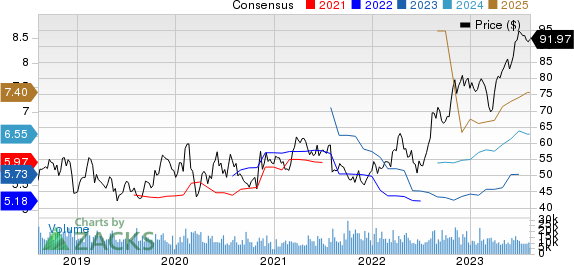

Cardinal Health, Inc. Price and Consensus

Cardinal Health, Inc. price-consensus-chart | Cardinal Health, Inc. Quote

Other Stocks Worth a Look

Here are a few other medical stocks worth considering, as these too have the right combination of elements to come up with an earnings beat this reporting cycle:

Patterson Companies PDCO has an Earnings ESP of +5.66% and a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

PDCO has an estimated long-term growth rate of 9.2%.

Patterson Companies’ earnings surpassed estimates in three of the trailing four quarters and missed the same once, delivering an average surprise of 4.52%.

Definitive Healthcare DH has an Earnings ESP of +55.55% and a Zacks Rank of 3 at present. DH has an estimated long-term growth rate of 18.3%.

Definitive Healthcare’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 33.75%.

National Vision EYE has an Earnings ESP of +8.18% and a Zacks Rank of 3 at present. EYE has an estimated long-term growth rate of 21.9%.

National Vision’s earnings surpassed estimates in three of the trailing four quarters and missed the same once, delivering an average surprise of 69.96%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report

Definitive Healthcare Corp. (DH) : Free Stock Analysis Report