Beat the Market Like Zacks: NVIDIA, Oracle, The Home Depot in Focus

The three most widely followed indexes closed a losing week last Friday. The Nasdaq Composite declined 2.9%, while the S&P 500 and the Dow Jones Industrial Average lost 2.3% and 1.1%, respectively.

For the tech-heavy Nasdaq and the S&P 500, this was the heaviest losing week since March. Disappointing earnings numbers, rising treasury yields and a still-strong labor market dampened investor sentiment throughout the week. As a result, the market could not sustain the July momentum.

However, August is traditionally one of the slowest months of the year for the stock market. Investors’ eyes will be firmly set on the consumer-side inflation numbers due this week, which would help them gauge the Fed’s mood.

Regardless of market conditions, we, here at Zacks, provide investors with unbiased guidance on how to beat the market.

As usual, Zacks Research guided investors over the past three months with its time-tested methodologies. Given the prevailing market uncertainty, you may want to look at our feats to prepare better for your next action.

Here are some of our key achievements:

Abercrombie & Fitch and Abcam Surge Following Zacks Rank Upgrade

Shares of Abercrombie & Fitch Co. ANF have soared 37.4% (versus the S&P 500’s 7.8% increase) since it was upgraded to a Zacks Rank #1 (Strong Buy) on May 26.

Another stock, Abcam plc ABCM, which was upgraded to a Zacks Rank #2 (Buy) on May 22, has returned 36.5% (versus the S&P 500’s 6.8% increase) since then.

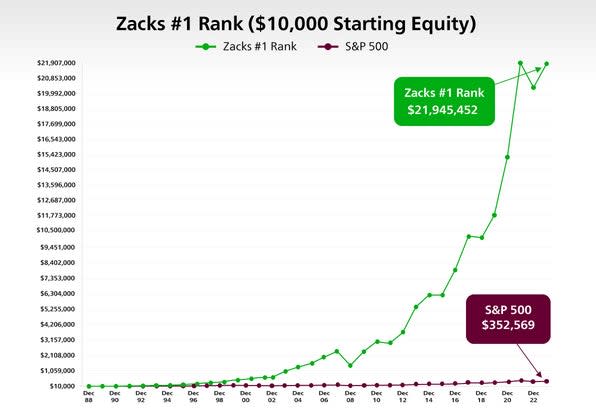

Zacks Rank, our short-term rating system, has earnings estimate revisions at its core. Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

This stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally audited track record, with Zacks Rank #1 stocks generating an average annual return of +24.8% since 1988.You can see the complete list of today’s Zacks Rank #1 stocks here >>>

A hypothetical portfolio of Zacks Rank #1 stocks has returned +10.8% this year (through July 3) versus +16.1% for the S&P 500 Index and +7.7% for the equal-weight S&P 500 Index. The set of Zacks Rank # 1 stocks is an equal-weight portfolio, while the S&P 500 Index is a market-cap-weighted index that has been notably distorted by the strong recent performance of mega-cap stocks.

We are not trying to cherry-pick here. But since this Zacks Model portfolio, consisting of Zacks Rank # 1 stocks, is an equal-weight portfolio, the equal-weight S&P 500 Index is the appropriate benchmark for comparison.

Check Abercrombie & Fitch’s historical EPS and Sales here>>>

Check Abcam’s historical EPS and Sales here>>>

Image Source: Zacks Investment Research

Zacks Recommendation Upgrade Drives Builders FirstSource and Toll Brothers Higher

Shares of Builders FirstSource, Inc. BLDR and Toll Brothers, Inc. TOL have advanced 24.5% (versus the S&P 500’s 6.7% rise) and 16.5% (versus the S&P 500’s 7.8% rise) since their Zacks Recommendation was upgraded to Outperform on May 23 and May 26, respectively.

While the Zacks Rank is our short-term rating system that is most effective over the one- to three-month holding horizon, the Zacks Recommendation aims to predict performance over the next 6 to 12 months. However, just like the Zacks Rank, the foundation for the Zacks Recommendation is trends in earnings estimate revisions.

The Zacks Recommendation classifies stocks into three groups — Outperform, Neutral and Underperform. While these recommendations are determined quantitatively, our analysts have the flexibility to override them for the 1100+ stocks they closely follow based on their better judgment of factors such as valuation, industry conditions and management effectiveness than the quantitative model.

To access our research reports with Zacks Recommendations for the 1100+ stocks we cover, click here>>>

Zacks Focus List Stocks NVIDIA, Caterpillar Shoot Up

Shares of NVIDIA Corporation NVDA, which belongs to the Zacks Focus List, have risen 57.7% over the past 12 weeks. The stock was added to the Focus List on May 20, 2019. Another Focus-List holding, Caterpillar Inc. CAT, which was added to the portfolio on April 18, 2017, has returned 31.9% over the past 12 weeks. The S&P 500 has gained 8.7% over this period.

The Zacks Focus List is a model portfolio of 50 hand-picked stocks that possess the right fundamental ingredients to outperform the market over the next 12 months. These 50 stocks are picked from a long list of stocks with the highest Zacks Rank.

The 50-stock Zacks Focus List model portfolio has returned +17.15% in 2023 (through June 30) versus +16.90% for the S&P 500 Index. In 2022, the portfolio produced -15.2% versus the S&P 500 Index’s -17.96%.

Since 2004, the Focus List portfolio has produced an annualized return of +11.10% through June 30, 2023. This compares to a +9.52% annualized return for the S&P 500 Index in the same time period.

On rolling one-, three- and five-year bases, the Zacks Focus List returned +29.36%, +16.74% and +12.45% versus +19.57%, +14.59% and +12.30% for the S&P 500 Index, respectively.

Unlock all of our powerful research, tools and analysis, including the Focus List, Zacks #1 Rank List, Equity Research Reports, Zacks Earnings ESP Filter, Premium Screener and more, as part of Zacks Premium. Gain full access now >>

Zacks ECAP Stocks Oracle and Automatic Data Processing Make Significant Gains

Oracle Corporation ORCL, a component of our Earnings Certain Admiral Portfolio (ECAP), has jumped 17% over the past 12 weeks. Automatic Data Processing, Inc. ADP has followed Oracle with 15.5% returns.

ECAP, which consists of 30 concentrated, ultra-defensive, long-term Buy and Hold stocks, has returned +6.67% in 2023 (through June 30) versus +16.90% for the S&P 500 Index. The portfolio returned -4.7% in 2022 versus the S&P 500 Index’s -17.96%.

With little to no turnover and annual rebalance periodicity, the ECAP seeks to minimize capital loss by holding shares of companies whose earnings streams exhibit a proven 20+ year track record of surviving recessionary periods with minimal impact on aggregate earnings growth relative to the overall S&P 500.

The ECAP and many other model portfolios are available as part of Zacks Advisor Tools, a cloud-based solution to access Zacks award-winning stock, mutual fund and ETF research. Click here to schedule a demo.

Zacks ECDP Stocks Home Depot and Illinois Tool Works Outperform Peers

The Home Depot, Inc. HD, which is part of our Earnings Certain Dividend Portfolio (ECDP), has returned 12.4% over the past 12 weeks. Another ECDP stock, Illinois Tool Works Inc. ITW, has climbed 7.9% over the same time frame. Of course, the inclination of investors toward quality dividend stocks to secure an income stream amid heightened market volatility contributed to this performance.

Check Home Depot’s dividend history here>>>

Check Illinois Tool Works’ dividend history here>>>

With an extremely low Beta and a history of minimum earnings variability over the last 20+ years, this 25-stock portfolio helps significantly mitigate risk.

ECDP has returned +0.18% in 2023 (through June 30) versus +16.90% for the S&P 500 Index. The portfolio returned -2.3% in 2022 versus -17.96% for the S&P 500 Index and -8.34% for the ProShares S&P 500 Dividend Aristocrats ETF NOBL.

Click here to access this portfolio on Zacks Advisor Tools.

Zacks Top 10 Stocks — Hubbell Delivers Solid Returns

Hubbell Incorporated HUBB, from the Zacks Top 10 Stocks for 2023, has gained 29.6% year to date, which compares to a 17.7% gain for the S&P 500 Index.

The portfolio returned +15.9% through the end of June 2023 versus +16.9% for the S&P 500 (the equal-weighted index, a more appropriate benchmark, returned +7% in the same period). The portfolio returned -15.8% in 2022 versus -18.1% for the S&P 500 Index. Since 2012, the Top 10 portfolio has generated an annualized return of +22.4% versus +12.5% for the S&P 500 Index.

Since the start of 2012 through May 31st, 2023, the Zacks Top 10 Stocks has produced a cumulative return of +827.6% through the end of 2022 vs. +265% cumulative return for the S&P 500 index.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Hubbell Inc (HUBB) : Free Stock Analysis Report

ProShares S&P 500 Dividend Aristocrats ETF (NOBL): ETF Research Reports

Abcam PLC Sponsored ADR (ABCM) : Free Stock Analysis Report