Is a Beat in the Offing for Ventas (VTR) in Q3 Earnings?

Ventas, Inc. VTR is scheduled to report third-quarter 2023 results on Nov 2, after market close. While the quarterly revenues are likely to display year-over-year growth, funds from operations (FFO) per share might exhibit a decline.

In the last reported quarter, this Chicago, IL-based healthcare real estate investment trust (REIT) delivered normalized FFO per share of 75 cents, beating the Zacks Consensus Estimate by 1.35%. The quarterly results reflected better-than-anticipated revenues. Also, the same-store cash net operating income (NOI) increased year over year on strong performance across the portfolio.

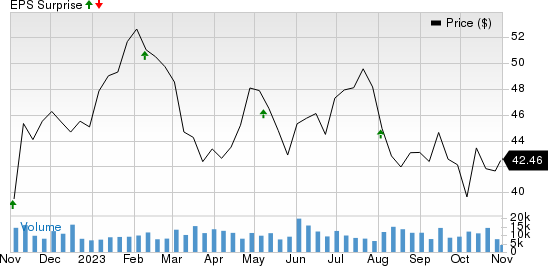

Ventas’ normalized FFO per share surpassed the Zacks Consensus Estimate in three of the trailing four quarters and met in the remaining one, with the average beat being 2.11%. The graph below depicts this surprise history:

Ventas, Inc. Price and EPS Surprise

Ventas, Inc. price-eps-surprise | Ventas, Inc. Quote

Factors at Play

During the third quarter, Ventas’ senior housing operating portfolio (SHOP) is likely to have benefited from an aging U.S. population and a rise in healthcare expenditure by this age cohort, which is generally higher than the average population. In addition, with the segment witnessing positive net move-ins, occupancy is expected to have remained high.

Further, strong pricing power and moderating operating expenses are likely to have driven NOI growth for this segment during the quarter. We expect third-quarter SHOP’s NOI to increase 12.5% year over year.

The demand for life-science assets is booming on the back of the increasing life expectancy of the U.S. population and biopharma drug development growth opportunities. Ventas’ research portfolio is anticipated to have fared well, benefiting from this positive trend.

A well-diversified tenant base, which includes several industry bellwethers, is expected to have contributed to stable rental revenue generation, boosting the top line.

The Zacks Consensus Estimate for third-quarter resident fees and services is pegged at $736.1 million, suggesting an increase from $724.6 million reported in the prior quarter and $668.6 million in the year-ago period. Our estimate for quarterly resident fees and services stands at $716.6 million, indicating a rise of 7.2% from the year-ago quarter.

The consensus mark for the quarterly rental income from VTR’s office buildings stands at $217.7 million, indicating an 8.4% rise from the prior-year quarter’s reading. We expect quarterly rental income from the company’s office buildings to grow 5.6% year over year to $212.0 million.

The Zacks Consensus Estimate for third-quarter revenues is currently pegged at $1.12 billion, implying a 7.6% increase from the prior-year quarter’s reported figure.

Ventas is likely to have continued with its accretive investments in the research portfolio during the quarter, backed by a robust balance sheet position.

Nonetheless, higher interest expenses during the quarter are likely to have cast a pall on the company’s performance to some extent. We expect third-quarter interest expenses to rise 9% year over year.

The Zacks Consensus Estimate for third-quarter FFO per share has been revised 1.3% downward over the past two months to 74 cents. Moreover, the figure implies a decline of 2.6% from the year-ago quarter’s reported number.

What Our Quantitative Model Predicts

Our proven model predicts a surprise in terms of FFO per share for Ventas this season. The combination of a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — increases the odds of a beat. That is just the case here.

Earnings ESP: Ventas has an Earnings ESP of +0.08%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: VTR currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Performance of Other REITs

Healthpeak Properties, Inc. PEAK reported third-quarter 2023 FFO as adjusted per share of 45 cents, beating the Zacks Consensus Estimate by a whisker. The reported figure rose 4.6% from the prior-year quarter.

Results reflected better-than-anticipated revenues. Moreover, growth in same-store portfolio cash (adjusted) NOI was witnessed across the portfolio. PEAK raised its outlook for the current year.

Welltower Inc.’s WELL third-quarter 2023 normalized FFO per share of 92 cents surpassed the Zacks Consensus Estimate of 89 cents. The reported figure improved 9.5% from the prior-year quarter’s actual.

Results reflected better-than-anticipated revenues. The total same-store net operating income (SSNOI) increased year over year, driven by SSNOI growth in the seniors housing operating portfolio. WELL also raised its guidance for 2023 normalized FFO per share.

Alexandria Real Estate Equities, Inc. ARE reported third-quarter 2023 adjusted FFO per share of $2.26, surpassing the Zacks Consensus Estimate of $2.24. The reported figure climbed 6.1% from the year-ago quarter.

Results reflected year-over-year revenue growth, aided by decent leasing activity and solid rental rate growth. ARE also increased the midpoint of its 2023 AFFO per share outlook by 2 cents.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report