Is a Beat in Store for CNH Industrial's (CNHI) Q4 Earnings?

CNH Industrial CNHI is expected to release fourth-quarter 2021 results on Feb 2. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 21 cents per share on revenues of $7.81 billion.

This Italian-American vehicle maker delivered better-than-anticipated earnings in the last reported quarter. The bottom line also surpassed the year-ago profit level. This outperformance was driven by the higher-than-anticipated revenues across all segments, except for Powertrain.

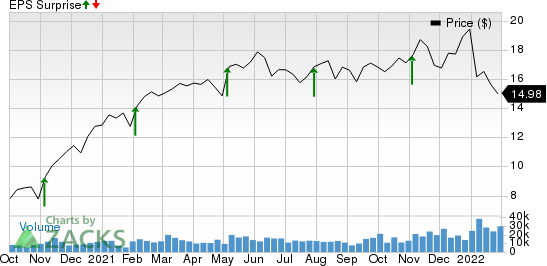

Over the trailing four quarters, CNH Industrial outpaced estimates on all occasions, the average surprise being 83.1%. This is depicted in the graph below:

CNH Industrial N.V. Price and EPS Surprise

CNH Industrial N.V. price-eps-surprise | CNH Industrial N.V. Quote

Trend in Estimate Revisions

The Zacks Consensus Estimate for CNH Industrial’s fourth-quarter earnings per share has moved south by 12 cents in the past 90 days. Moreover, this compares unfavorably with the year-ago quarter’s earnings of 30 cents per share, calling for a year-over-year plunge of 30%. The Zacks Consensus Estimate for quarterly revenues also suggests a year-over-year decline of 8.1%.

Earnings Whispers

Our proven model predicts an earnings beat for CNH Industrial this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This has been elaborated below.

Earnings ESP: CNH Industrial has an Earnings ESP of +1.01%. This is because the Most Accurate Estimate is pegged a penny higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: CNH Industrial currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Key Factors

CNH Industrial’s fourth-quarter results will likely reflect the favorable impact of upgraded product offerings as well as advanced technologies, thereby boosting its quarterly performance.

Markedly, the Zacks Consensus Estimate for quarterly revenues from the Financial Services segment is pegged at $497 million, suggesting a rise from the $485 million recorded in fourth-quarter 2020 as well as the $450 million recorded in the prior quarter.

The Zacks Consensus Estimate for quarterly revenues from the Commercial and Specialty Vehicles segment is pinned at $3,043 million, indicating a rise from the $2,879 million reported in the prior quarter. Further, the consensus mark for the segment’s operating profit is pinned at $99 million, calling for a jump from the $51 million seen in the last quarter.

The Zacks Consensus Estimate for quarterly revenues from the Powertrain segment is pinned at $1,096 million, indicating a rise from the $953 million reported in the prior quarter. Further, the consensus mark for the segment’s operating profit is pinned at $82 million, calling for a surge from the $44 million recorded last quarter.

During the quarter in discussion, CNH Industrial entered into an exclusive, multi-year licensing agreement with Monarch Tractor to launch a scalable, modular electrification platform focusing on low horsepower tractors. Also, in December, CNH Industrial acquired NX9 – a software engineering company with expertise in ISOBUS technology – in a bid to rev up digital innovation in its agricultural unit. Moreover, during the quarter, CNH Industrial completed its purchase of 90% stock of Sampierana. CNH industrial also signed a cooperation agreement with Israel Innovation Authority. The latter will support the vehicle maker in identifying Israeli technological developments and companies within its sphere of activity. This will help the company leverage the power of Israeli innovations to bring customer-oriented solutions to the sectors in which it operates.

The above-mentioned series of events aimed at enhancing CNH Industrial’s product offerings and technological capabilities is likely beneficial for the company’s performance during the December-end quarter.

Other Stocks With Favorable Combination

Here are a few other stocks in the auto sector which are worth considering, as these too have the right combination of elements to come up with an earnings beat this time around:

Cummins CMI has an Earnings ESP of +1.26% and carries a Zacks Rank #3 at present. It is scheduled to report earnings results on Feb 3.

The Zacks Consensus Estimate for Cummins’ to-be-reported quarter’s earnings and revenues is pegged at $3.08 per share and $5.78 billion, respectively. CMI surpassed earnings estimates in three of the preceding four quarters, delivering an average surprise of 8%.

BorgWarner BWA has an Earnings ESP of +3.92% and currently carries a Zacks Rank #3. The company is slated to release quarterly numbers on Feb 15.

The Zacks Consensus Estimate for BorgWarner’s to-be-reported quarter’s earnings and revenues is pegged at 74 cents per share and $3.46 billion, respectively. Encouragingly, BWA surpassed earnings estimates in the preceding four quarters, delivering an average surprise of 30.9%.

Allison Transmission Holdings ALSN has an Earnings ESP of +1.45% and currently carries a Zacks Rank of 3. The company is set to announce quarterly figures on Feb 16.

The Zacks Consensus Estimate for Allison’s to-be-reported quarter’s earnings and revenues is pegged at 92 cents per share and $597.9 million, respectively. ALSN surpassed earnings estimates in three of the preceding four quarters, delivering an average surprise of 3.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

CNH Industrial N.V. (CNHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research