Is a Beat in Store for Marsh & McLennan (MMC) in Q3 Earnings?

Marsh & McLennan Companies, Inc. MMC is scheduled to release third-quarter 2022 results on Oct 20, before the opening bell.

Q3 Estimates

The Zacks Consensus Estimate for MMC’s third-quarter earnings per share is pegged at $1.16, which indicates an improvement of 7.4% from the prior-year quarter’s reported figure.

The consensus mark for revenues stands at $4.9 billion, suggesting 5.8% growth from the year-ago quarter’s tally.

Earnings Surprise History

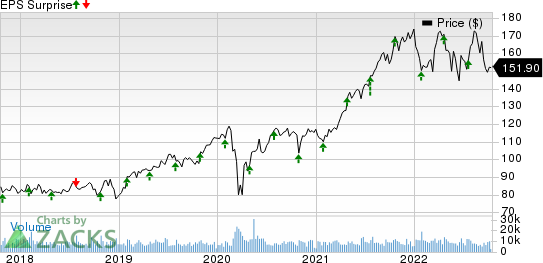

Marsh & McLennan boasts an impressive earnings surprise history. Its bottom line beat estimates in each of the trailing four quarters, the average being 5.04%. This is depicted in the chart below:

Marsh & McLennan Companies, Inc. Price and EPS Surprise

Marsh & McLennan Companies, Inc. price-eps-surprise | Marsh & McLennan Companies, Inc. Quote

What Our Quantitative Model Unveils

Our proven model predicts an earnings beat for Marsh & McLennan this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here.

Earnings ESP: Marsh & McLennan has an Earnings ESP of +0.25%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Marsh & McLennan currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors to Note

Marsh & McLennan’s third-quarter performance is likely to have received a boost from continued rate increases across the commercial property and casualty (P&C) insurance marketplace. Quarterly results are expected to have benefited from sound performances of MMC’s Risk and Insurance Services, and Consulting segments.

Solid performances of the units of Risk and Insurance Services segment, namely Marsh and Guy Carpenter might have favored the to-be-reported quarter’s performance of Marsh & McLennan. Results of both sub-units are likely to have received a boost from new business generation and solid retention rates.

The Zacks Consensus Estimate for revenues at the Risk and Insurance Services segment of Marsh & McLennan is pegged at $2.9 billion, indicating a rise of 6.9% from the prior-year quarter’s level. The consensus mark for Marsh and Guy Carpenter revenues stands at $2.5 billion and $332 million each, suggesting respective increases of 6.4% and 5.7%, from the prior-year quarter’s corresponding reported figures.

MMC’s Consulting segment is likely to have been driven by solid results of its divisions, such as Mercer and Oliver Wyman. The Zacks Consensus Estimate for the Consulting segment’s revenues is pegged at $2 billion, indicating 4.2% growth from the prior-year quarter’s tally.

The Mercer unit is likely to have gained from solid demand for its solutions, new business growth, improved retention rates and a decent rise in defined benefits in the third quarter. Contribution from those geographies wherein MMC operates is likely to have acted as a mutual tailwind in boosting revenues of the Consulting segment’s branches. The consensus estimate for revenues of Mercer and Oliver Wyman stands at $1.4 billion and $655 million each, suggesting a rise of 3.1% and 7.4%, respectively, from the year-ago quarter’s comparable reported numbers.

As one of the factors is expected to have driven the bottom line of Marsh & McLennan in the third quarter, the Zacks Consensus Estimate for adjusted operating income of Risk and Insurance Services and Consulting segments indicates an improvement of 7.2% and 10%, respectively, from the prior-year quarter’s corresponding reported figures.

However, elevated expenses stemming from continued investments to boost capabilities and recruitment efforts coupled with inflationary pressure on loss costs are likely to have dampened the margins of Marsh & McLennan in the to-be-reported quarter.

Per the last earnings call, foreign exchange is expected to have an adverse impact of a penny on MMC’s margins in the third quarter. Management anticipated an interest expense of around $118 million in the to-be-reported quarter.

Other Stocks to Consider

Here are some other companies worth considering from the insurance space, as our model shows that they too have the right combination of elements to beat on earnings this time around:

Horace Mann Educators Corporation HMN has an Earnings ESP of +28.21% and a Zacks Rank #2, currently. The Zacks Consensus Estimate for Horace Mann’s third-quarter 2022 earnings is pegged at 59 cents per share, indicating an improvement of 18% from the prior-year reported number.

HMN’s earnings beat estimates in three of the trailing four quarters and missed the mark once.

Reinsurance Group of America, Incorporated RGA has an Earnings ESP of +5.32% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for Reinsurance Group’s third-quarter 2022 earnings is pegged at $3.06 per share. A loss of $1.11 per share was reported in the prior-year quarter.

RGA’s earnings beat estimates in two of the trailing four quarters and missed the mark twice.

CNO Financial Group, Inc. CNO has an Earnings ESP of +1.72% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for CNO Financial’s third-quarter 2022 earnings stands at 49 cents per share. The consensus mark for third-quarter earnings has moved 2.1% north over the past 30 days.

CNO’s earnings beat estimates in three of the trailing four quarters and missed the mark once.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research