Is a Beat in Store for Matador Resources (MTDR) in Q3 Earnings?

Matador Resources Company MTDR is set to report third-quarter 2023 earnings on Oct 24, after the closing bell.

In the last reported quarter, the company’s earnings of $1.42 per share beat the Zacks Consensus Estimate of $1.28. Since MTDR is a leading upstream player, having a strong foothold on prolific oil and natural gas shale and other unconventional plays, an improvement in oil equivalent production has led to better-than-expected earnings.

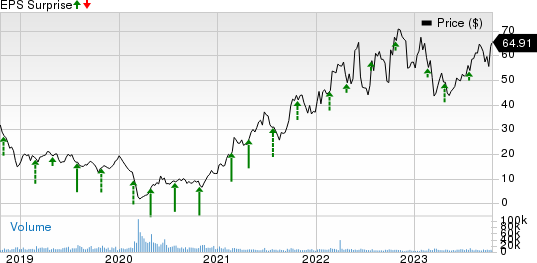

In each of the last four quarters, Matador Resources’ earnings beat the Zacks Consensus Estimate, the average surprise being 11.8%. This is depicted in the graph below:

Matador Resources Company Price and EPS Surprise

Matador Resources Company price-eps-surprise | Matador Resources Company Quote

Estimate Trend

The Zacks Consensus Estimate for third-quarter earnings per share of $1.55 has witnessed three upward revisions over the past 30 days. The estimated figure suggests a decline of 42.2% from the prior-year reported number.

The Zacks Consensus Estimate for third-quarter revenues of $697.3 million indicates a decrease of 17.1% from the year-ago reported figure.

Earnings Whispers

Our proven model predicts an earnings beat for MTDR this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is just the case here.

Earnings ESP: Matador Resources has an Earnings ESP of +6.38%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MTDR currently sports a Zacks Rank #1.

Factors to Note

The pricing scenario of oil and natural gas was impressive in the third quarter. Per data provided by the U.S. Energy Information Administration (“EIA”), the average West Texas Intermediate crude prices per barrel in July, August and September were $76.07, $81.39 and $89.43, respectively. Although the prices were not as high as in the year-ago quarter, the commodity prices were impressive and healthy.

Like oil, natural gas prices in the September quarter were healthier than in the second quarter, aiding the exploration and production activities of Matador Resources. We estimate MTDR’s total oil equivalent daily production volumes to increase 23.8% year over year in the third quarter. Thus, higher production and commodity prices are likely to have aided Matador Resources’ earnings.

Other Stocks to Consider

Here are some other firms that you may want to consider, as these too have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Viper Energy Partners LP VNOM currently has an Earnings ESP of +28.20% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is scheduled to release third-quarter earnings on Nov 6. The Zacks Consensus Estimate for VNOM’s earnings is pegged at 38 cents per share, suggesting a decline from the year-ago figure.

Antero Resources Corporation AR has an Earnings ESP of +91.67% and is currently a Zacks #3 Ranked player.

The company is scheduled to release third-quarter results on Oct 25. The Zacks Consensus Estimate for AR’s loss is pegged at 6 cents per share.

Valero Energy Corporation VLO has an Earnings ESP of +4.05% and is a Zacks #2 Ranked player at present.

Valero Energy is scheduled to release third-quarter results on Oct 26. The Zacks Consensus Estimate for VLO’s earnings is pegged at $7.21 per share, suggesting a marginal year-over-year improvement.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Viper Energy Partners LP (VNOM) : Free Stock Analysis Report