Is a Beat in Store for Simon Property (SPG) in Q2 Earnings?

Simon Property Group SPG is slated to report second-quarter 2023 results on Aug 2 after market close. While the company’s quarterly results are likely to display year-over-year revenue growth, funds from operations (FFO) per share are expected to decline from the prior-year quarter’s reported figure.

This Indianapolis, IN-based retail real estate investment trust (REIT) reported a first-quarter 2023 FFO per share of $2.74, which missed the Zacks Consensus Estimate of $2.80. While results reflected better-than-anticipated revenues on healthy leasing activity, higher operating expenses acted as a dampener.

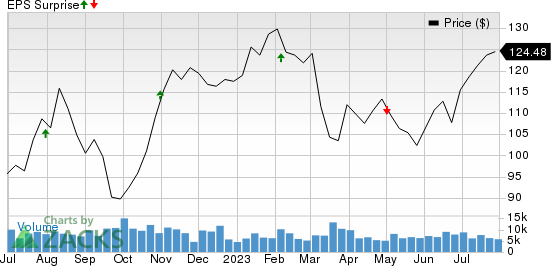

Over the preceding four quarters, Simon Property’s FFO per share surpassed the Zacks Consensus Estimate on three occasions and missed on the other, the average beat being 0.32%. This is depicted in the graph below:

Simon Property Group, Inc. Price and EPS Surprise

Simon Property Group, Inc. price-eps-surprise | Simon Property Group, Inc. Quote

In this article, we will dive deep into the U.S. retail real estate market environment and the company's fundamentals and analyze the factors that may have contributed to its second-quarter 2023 performance.

US Retail Real Estate Market in Q2

Per a report from CBRE Group CBRE, in the U.S. retail real estate market, rent growth has recommenced in the second quarter of 2023 despite the lower demand for space.

During the quarter, the net absorption of U.S. retail space amounted to 5.9 million square feet, representing the lowest level of demand since the sector experienced a negative net absorption of 10.1 million square feet in the third quarter of 2020. However, due to elevated construction costs and economic concerns, construction completions remained at historically low levels.

Amid these, the overall availability rate declined by 10 basis points (bps) in the second quarter to a record low of 4.8%. Additionally, the average asking rent experienced a year-over-year increase of 2.1%, reaching $23.21 per square foot. This growth was primarily driven by significant gains in Raleigh and various Florida markets, per the CBRE Group report.

Factors at Play

Simon Property's portfolio of premium assets, both in the United States and internationally, is expected to have benefited from the favorable retail real estate environment. Amid growing consumers’ preference for in-person shopping experiences following the pandemic downtime, the demand for SPG’s properties is likely to have remained healthy, aiding occupancy levels and leasing activity in the quarter. We estimate total portfolio ending occupancy of 94.5% in the second quarter, reflecting a 10 bps improvement sequentially.

Simon Property’s adoption of an omnichannel strategy and successful tie-ups with premium retailers are likely to have paid off well. Moreover, its efforts to explore the mixed-use development option, which has gained immense popularity in recent years, are anticipated to have enabled it to tap growth opportunities in areas where people prefer to live, work and play.

The Zacks Consensus Estimate for second-quarter lease income is pegged at $1.24 billion, up from $1.19 billion reported in the year-ago quarter. The consensus mark for management fees and other revenues stands at $28.8 million, marginally below the prior-year quarter’s reported figure of $28.81. In addition, the consensus estimate for quarterly revenues is presently pegged at $1.33 billion, indicating an increase of 3.64% year over year.

We expect the company’s robust balance sheet position to have supported its strategic expansions during the quarter to be reported.

However, the economic slowdown amid macroeconomic uncertainty and higher e-commerce adoption might have cast a pall on SPG’s performance in the to-be-reported quarter. Also, rising interest rates might have raised expenses in the to-be-reported quarter. We estimate a 7.5% year-over-year increase in interest expenses in the second quarter.

The Zacks Consensus Estimate for FFO per share has remained unrevised at $2.91 over the past month. The figure indicates a decrease of 1.69% from the year-ago quarter’s reported figure.

Here Is What Our Quantitative Model Predicts:

Our proven model predicts a surprise in terms of FFO per share for Simon Property this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an FFO beat, which is the case here.

Simon Property currently has a Zacks Rank of 3 and an Earnings ESP of +1.42 %. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks to Consider

Here are two other stocks from the retail REIT sector — Federal Realty Investment Trust FRT and Acadia Realty Trust AKR — that you may want to consider as our model shows that these also have the right combination of elements to report a surprise this quarter.

Federal Realty is slated to report quarterly numbers on Aug 2. FRT has an Earnings ESP of +0.31% and carries a Zacks Rank of 3 presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Acadia Realty Trust, scheduled to report quarterly numbers on Aug 1, has an Earnings ESP of +2.11% and carries a Zacks Rank of 3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Acadia Realty Trust (AKR) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report