Is a Beat in Store for VICI Properties (VICI) in Q3 Earnings?

VICI Properties Inc. VICI is slated to report third-quarter 2023 results on Oct 25 after the closing bell. Its quarterly results are expected to exhibit growth in revenues and funds from operations (FFO) per share.

In the last reported quarter, this New York-based experiential REIT, which owns the portfolios of market-leading gaming, hospitality and entertainment destinations, reported adjusted FFO per share of 54 cents, beating the Zacks Consensus Estimate by 1.89%.

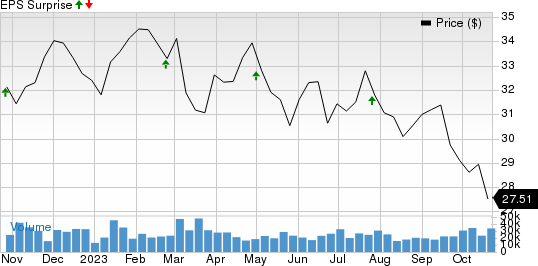

Over the preceding four quarters, the company’s adjusted FFO per share surpassed the Zacks Consensus Estimate on three occasions and met once, the average beat being 1.45%. This is depicted in the graph below:

VICI Properties Inc. Price and EPS Surprise

VICI Properties Inc. price-eps-surprise | VICI Properties Inc. Quote

Factors at Play

VICI Properties owns a geographically diverse portfolio, which includes a mix of gaming, hotel and entertainment assets that are located in the high barriers-to-entry markets across the United States and Canada. It enjoys ownership of three of the most iconic entertainment facilities on the Las Vegas Strip, namely Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas.

The rebound in demand for its gaming facilities and other hospitality and entertainment destinations in the wake of the pandemic is likely to have aided VICI’s Properties performance in the quarter.

VICI’s healthy relationships with the highest quality experiential operators are likely to have paid off well. The long-term triple-net leases with such tenants that are embedded with CPI-based rent escalators are likely to have aided stable revenue generation during the quarter, boosting its top-line growth.

Moreover, continuing with its accretive asset-base expansion, in September, VICI concluded the earlier announced buyout of four real estate assets from Century Casinos, Inc. for C$221.7 million or U$162.4 million. The assets, collectively known as the Century Canadian Portfolio, comprise Century Casino & Hotel Edmonton, Century Casino St. Albert and Century Mile Racetrack and Casino, each in Edmonton, Alberta, and Century Downs Racetrack and Casino in Calgary, Alberta. Post the completion of the transaction, the annualized rent increased by C$17.3 million or US$12.7 million as a result of the addition of the existing triple-net master lease agreement between VICI Properties and Century.

Earlier in July, the company acquired an interest in the land and buildings associated with Rocky Gap Casino Resort in Flintstone, MD, from Golden Entertainment, Inc. for $203.9 million in cash.

Further, the company’s robust balance sheet position is likely to have supported its growth endeavors.

Q3 Projections

The Zacks Consensus Estimate for quarterly revenues is pegged at $899.5 million, suggesting growth of 19.7% from the prior-year quarter’s reported figure.

Income from sales-type leases is currently pegged at $558.8 million, indicating an increase of 12.8% from the prior quarter’s $495.4 million and 48.6% from the year-ago quarter’s $376.1 million.

Income from lease financing receivables and loans stands at $310.3 million, down 16.8% sequentially and 11.6% from the year-ago period.

Revenues from golf operations are estimated at $7.9 million, down 29.3% from prior quarter’s $11.2 million but 17.8% above the year-ago quarter’s $6.7 million.

The Zacks Consensus Estimate for the quarterly FFO per share has been unchanged at 53 cents over the past month. However, the figure indicates growth of 8.2% from the year-ago quarter’s reported figure.

What Our Quantitative Model Predicts

Our proven model predicts an FFO beat for VICI Properties this time. The right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — increases the odds of a beat. That is just the case here.

Earnings ESP: VICI has an Earnings ESP of +1.50%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: VICI currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Consider

Here are some stocks that are worth considering from the broader REIT sector, as our model shows that these, too, have the right combination of elements to deliver a surprise this reporting cycle:

Digital Realty Trust DLR is scheduled to report quarterly figures on Oct 26. DLR has an Earnings ESP of +2.09% and a Zacks Rank #3 currently.

American Tower AMT is slated to report quarterly numbers on Oct 26. AMT has an Earnings ESP of +0.59% and carries a Zacks Rank #3 presently.

SBA Communications SBAC is slated to report quarterly numbers on Nov 2. SBAC has an Earnings ESP of +0.27% and carries a Zacks Rank #3 presently.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report