This Beaten-Down Fintech Transformed Itself This Year. Now It's Primed to Soar in 2024

Of all the sectors hammered in the post-pandemic period, the fintech sector has done just about the worst. New digital alternatives to traditional finance products received huge adoption during the pandemic and even higher valuations.

Yet as the interest rate environment turned, investor focus shifted from growth to profits, along with a slowdown in fintech end markets. That led to a violent rerating of most fintech participants, with many such stocks now trading 75% to 95% below their all-time highs.

Thus, the sector may be fertile ground for contrarian value plays these days. One name to watch is Marqeta (NASDAQ: MQ), a modern card-issuing platform that became public in June of 2021 at $27 per share, then fell to an all-time low this year at $3.26 before rebounding to just over $6 today.

But the company made several significant improvements this year, completing a turnaround and setting the stage for a recovery -- potentially, a big one.

Marqeta's platform

Marqeta's tech stack allows customers to seamlessly integrate and tweak properties of virtual and physical debit and credit cards, a refreshing update to the cumbersome manual card-issuing programs of the past. With Marqeta's flexible application programming interface (API) platform, customers can upload cards extremely quickly while altering rewards, incentives, and deposits on the fly.

That flexibility has made Marqeta a favorite of fintech neobanks, such as Block (NYSE: SQ), which uses Marqeta as the backbone for its Cash App consumer and Square business cards. Other early customers were new-age, buy-now-pay-later companies. Marqeta's platform also enables on-demand shopper businesses, such as when an Instacart (NASDAQ: CART) shopper gets an exact amount uploaded to a card for a specific order.

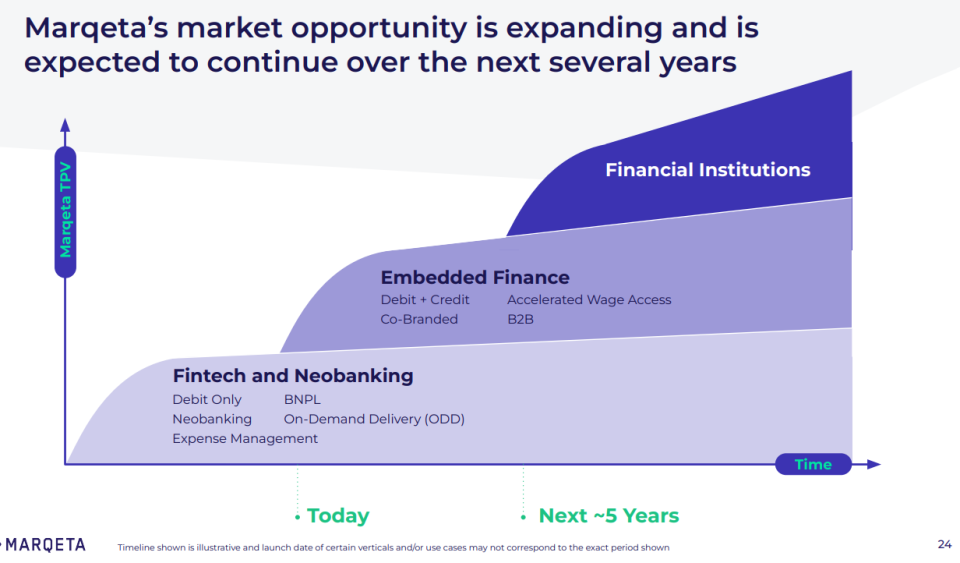

These verticals slowed following the pandemic, but Marqeta deftly pivoted to new use cases for more established companies. For instance, Marqeta has picked up large e-commerce marketplaces and retailers that would like to issue their own branded card without the customer having to go through a third-party bank website. Marqeta also makes expense management easier for employees making business-to-business (B2B) payments to vendors.

Image source: Marqeta.

One novel new use case is accelerated wage access. That's when instead of hourly employees getting paid once every two weeks, they can get a card for expenses as soon as they work a shift. This helps workers save on credit card interest and bank overdraft fees, while increasing employer loyalty and lowering turnover. Meanwhile, Marqeta splits the interchange fee with the employer as well, mitigating the working capital loss if employees spend wages early.

This is a great new case that's a win-win for both employer and employee.

2023 milestones: A new CEO, a big acquisition, and a key contract renegotiation

2023 has been a momentous year for Marqeta, with milestones including:

Simon Khalaf assuming the CEO role, taking over from founder and Chairman Jason Gardner.

Marqeta acquiring Power Finance, a credit-issuing start-up that Marqeta has folded into its platform.

Renewal of its contract with Block through 2028, which accounted for 78% of Marqeta revenues and just over 50% of gross profits prior to renewal.

Khalaf was an internal hire and has been instrumental in righting the ship, pivoting Marqeta's go-to-market strategy away from fintechs and toward embedded finance at larger established companies. Khalaf had prior senior roles at Yahoo!, Verizon, and recently Twilio.

Thus far, Khalaf has been able to reaccelerate Marqeta's bookings, all while cutting personnel and costs to the tune of $40 to $45 million relative to the year 2022. It normally takes 12 to 18 months for a program to ramp up, so Marqeta should see a gross-profit reacceleration in the second half of 2024 thanks to the strong bookings this year.

The Power Finance acquisition came last February at $223 million, payable over three years, with incentives for the founders to earn up to $52 million more over time if certain benchmarks are hit. As comprehensive as Marqeta's platform was, it was still mostly a debit-focused offering, so Power Finance's capabilities in flexible credit programs make it a great fit. This will further enable credit-oriented, embedded-finance products for non-financial companies. Incorporating Power's technology, Marqeta just launched its credit platform in late October, which should help drive growth into next year.

The big Block renewal

But perhaps the biggest milestone of the year was the contract renewal with Block. While the renewal removes a big question mark for Marqeta, the contract did result in a lower take rate, as well as a second accounting change that greatly lowered Marqeta's revenue in a one-time "reset."

The revenue decline due to accounting isn't much to worry about, but the take-rate change will lower Marqeta's gross profit in the near term. In the first partial quarter since Block's contract was renewed in August, Marqeta's gross profit fell 9% despite total payment volume (TPV) growing 33%.

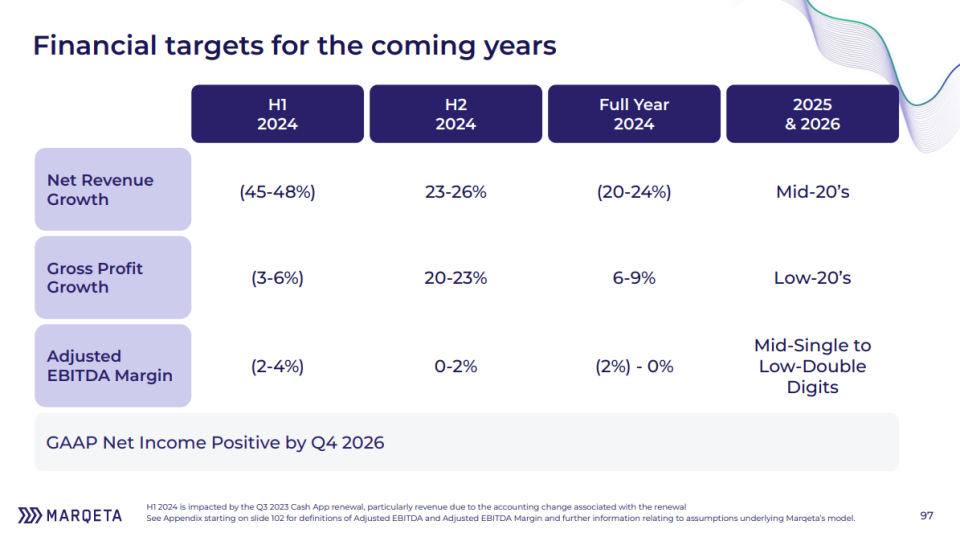

However, Marqeta will begin to lap the renewal in August of 2024 when gross profit should reaccelerate higher. In the first half of 2024, Marqeta expects year-over-year gross-profit declines to narrow to between 3% and 6% before reaccelerating to a low-20s% growth rate thereafter.

Image source: Marqeta.

Back in August, after the contract was renewed, two of Marqeta's directors purchased significant amounts of stock on the open market. Godfrey Sullivan purchased almost $1.2 million worth of stock at $5.88, and Judson C. Linville purchased $200,000 worth of stock at $5.87. That's a show of confidence after the overhang of the Block contract was removed.

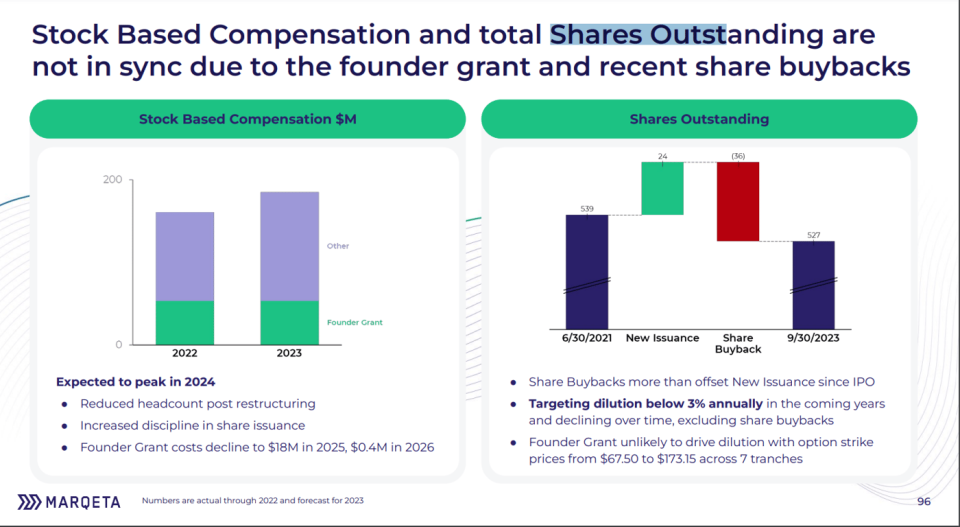

Image source: Marqeta.

Recent and forward financial performance

Not only is Marqeta due for an acceleration next year, it also has a huge amount of cash on its books to the tune of about $1.3 billion. As 40% of Marqeta's market cap, it should act as a solid floor for the stock.

Marqeta had the good fortune of raising money in June 2021 at the top of the fintech market, and that fortuitous timing is enabling it to invest in growth while also repurchasing stock. In fact, Marqeta is actually shrinking its share count despite being a relatively young, early-stage growth company. That's very rare.

Image source: Marqeta.

Marqeta could be a long-term winner at a discount

Looking ahead, Marqeta is a first mover in the tech-enabled card-issuing space, with a capital-light business model, plenty of cash, and a huge addressable market.

At the company's recent investor day, Marqeta said it expects 20%-plus growth in 2025 and 2026, while turning net income profitable in 2026. While the company didn't give any numbers beyond that time frame, it seems as if it will still be a strong compounder for years to come after 2026. Since Marqeta's platform only accounts for a single-digit percentage of card transactions globally, there appears to be quite a lot of room to grow.

With a forward enterprise value-to-sales ratio of just under three, Marqeta's stock still seems far too cheap, given the growth opportunity and highly competent management team at the helm.

More From The Motley Fool

Billy Duberstein has positions in Marqeta and has the following options: short January 2025 $3 puts on Marqeta. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Block and Twilio. The Motley Fool recommends Marqeta and Verizon Communications. The Motley Fool has a disclosure policy.

This Beaten-Down Fintech Transformed Itself This Year. Now It's Primed to Soar in 2024 was originally published by The Motley Fool