The Beauty Health Co Reports Mixed 2023 Financial Results Amidst Global Expansion

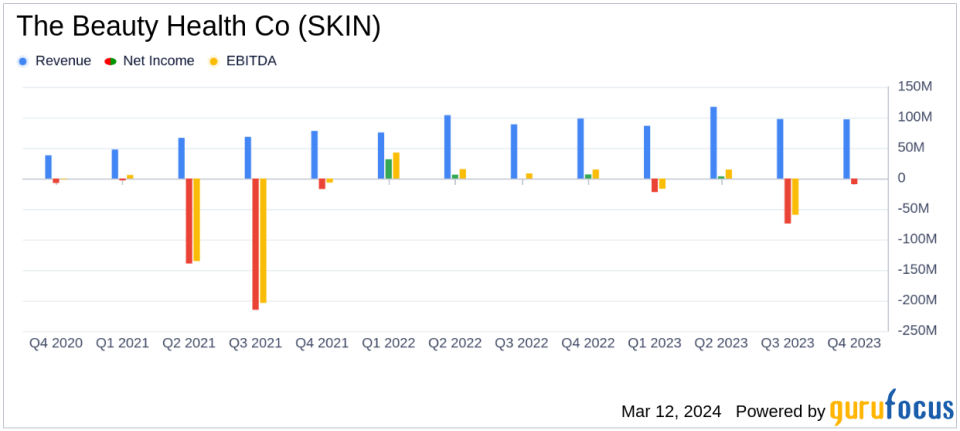

Full Year Net Sales: Increased to $398 million, up by 8.8% from 2022.

Q4 Net Sales: Slight decrease by 1.3% year-over-year to $96.8 million.

Gross Margin: Declined to 39.0% in 2023 from 68.0% in 2022.

Net Loss: Reported a net loss of $(100.1) million in 2023 compared to a net income of $44.2 million in 2022.

Adjusted EBITDA: Decreased to $24.3 million in 2023 from $46.1 million in 2022.

Delivery Systems: Sold 8,287 units in 2023, slightly down from 8,492 units in 2022.

On March 12, 2024, The Beauty Health Co (NASDAQ:SKIN) released its 8-K filing, disclosing its financial results for the full year and fourth quarter ended December 31, 2023. The company, a pioneer in the beauty health industry with its flagship brand HydraFacial, reported a full year net sales increase of 8.8% to $398 million, driven by international market growth. However, the fourth quarter saw a slight decline in net sales by 1.3% year-over-year, totaling $96.8 million, primarily due to lower equipment sales in the Americas, which was substantially offset by growth in consumables net sales and strong device placement in the Asia-Pacific region.

The Beauty Health Co's gross margin experienced a significant decline from 68.0% in 2022 to 39.0% in 2023, with adjusted gross margin also decreasing from 72.6% to 62.8%. This was attributed to inventory write-downs, higher product costs, and charges associated with the Syndeo Program. The company reported a net loss of $(100.1) million for the year, a stark contrast to the net income of $44.2 million in the previous year, primarily due to gross margin pressures and a change in fair value of warrant liabilities.

Adjusted EBITDA also saw a decline, falling to $24.3 million from $46.1 million in 2022. The number of delivery systems placed in 2023 was 8,287, slightly lower than the 8,492 units sold in the prior year. The company's cash and cash equivalents stood at approximately $523.0 million as of December 31, 2023, compared to $568.2 million at the end of 2022. The decrease was primarily due to share repurchases and strategic acquisitions, partially offset by the net impact of the current year net loss and other non-cash adjustments.

Financial Performance Analysis

The Beauty Health Co's performance in 2023 reflects a challenging year with mixed results. While the company managed to grow its full-year net sales, the decline in gross margin and the shift from net income to a significant net loss highlight the pressures faced in product costs and inventory management. The decrease in adjusted EBITDA further underscores the operational challenges during the year.

Despite these challenges, the company's CEO, Marla Beck, remains confident in the untapped global opportunity for BeautyHealth. Beck stated,

To close 2023, we delivered fourth quarter financial results consistent with the expectations we outlined on our last earnings call. While the results reflect a necessary operational reset, the underlying strength of our business remainsa clinically proven treatment, passionate provider community, unique partner portfolio, beloved consumer brand, and growing addressable market."

This sentiment suggests that the company is poised to leverage its strong brand and community to navigate through the current headwinds.

Looking ahead, The Beauty Health Co provided financial guidance for the first quarter of 2024, with net sales expected to be between $77 and $83 million and adjusted EBITDA projected to be between $(6) and $(9) million. For the full year 2024, the company anticipates flat to low-single digit percentage growth in net sales and an adjusted EBITDA of over $40 million.

Investors and stakeholders will be watching closely to see if The Beauty Health Co can execute its strategy to overcome the gross margin pressures and return to profitability. The company's focus on international expansion and the strength of its HydraFacial brand will be key factors in its ability to achieve its financial targets in the coming year.

For a more detailed analysis of The Beauty Health Co's financial results and future outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Beauty Health Co for further details.

This article first appeared on GuruFocus.