Beazer Homes (BZH) to Report Q4 Earnings: What's in the Cards?

Beazer Homes USA, Inc. BZH is set to report fourth-quarter fiscal 2023 (ended Sep 30) results on Nov 16, after market close.

In the last reported quarter, the company’s earnings and total revenues topped the Zacks Consensus Estimate by 40.9% and 11.5%, respectively. Earnings declined 19.3% but revenues increased 8.7% on a year-over-year basis.

Beazer Homes’ earnings topped the consensus mark in all the trailing 14 quarters.

Trend in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter fiscal 2023 earnings per share has remained unchanged at $1.39 over the past 60 days. The estimated figure indicates a 50.7% decline from the year-ago quarter’s reported value of $2.82 per share.

For total revenues, the consensus mark is pegged at $627.9 million, suggesting a decline of 24.3% from the year-ago quarter’s reported figure of $827.7 million.

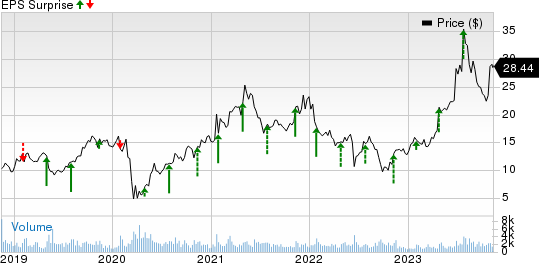

Beazer Homes USA, Inc. Price and EPS Surprise

Beazer Homes USA, Inc. price-eps-surprise | Beazer Homes USA, Inc. Quote

Key Factors at Play

Beazer Homes’ total revenues, which include Homebuilding revenues (accounted for 99.4% of total revenues in fiscal 2022), and Land sales and other revenues, are likely to have declined on a year-over-year basis in fourth-quarter fiscal 2023. Lower demand compared with the year-ago period, given rising mortgage rates and the uncertain economic environment, is likely to have weighed on the results. Consumers have become more selective and price-conscious, reflecting the comparatively lower spending on a year-over-year basis.

For the fourth quarter of fiscal 2023, the Zacks Consensus Estimate for Homebuilding revenues is pegged at $626 million, down 24.1%, while Land sales and other revenues are pegged at $3.5 million, up 51.5%, year over year.

Owing to the aforementioned risks, the company expects total home closings to be approximately 1,200 units in the fiscal fourth quarter, down from the prior-year quarter’s value of 1,616 units. BZH anticipates the average selling price (ASP) from closings to be approximately $520,000, up from $511,000 reported in the prior-year period. The consensus mark for total home closings and ASP is pegged at 1,203 units and $520,000, respectively, for the quarter.

Meanwhile, the bottom line is likely to have been affected by the persisting inflation, increased incentive expenses and high costs.

For the fiscal fourth quarter, the consensus mark for Homebuilding gross profits is pegged at $124 million, down 34% from the prior year quarter’s reported value.

Furthermore, for the quarter, the consensus mark for backlog units is pegged at 1,815 units, down 13.2% year over year.

Nonetheless, the company’s strategic operating initiatives, wage growth, moderating home prices and decreasing cycle times are likely to have offset the risks to some extent.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Beazer Homes for the quarter to be reported. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, this is not the case here, as you will see below.

Earnings ESP: BZH has an Earnings ESP of 0.00%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Recent Construction Releases

D.R. Horton, Inc. DHI reported solid fourth-quarter fiscal 2023 (ended Sep 30, 2023) results as earnings and revenues surpassed their respective Zacks Consensus Estimate.

On a year-over-year basis, DHI’s quarterly top line increased on the back of the supply of both new and existing homes as affordable price points remain limited and robust housing demand supported by favorable demographics.

Meritage Homes Corporation MTH reported better-than-expected results for third-quarter 2023. Both earnings and total closing revenues surpassed the Zacks Consensus Estimate.

Although earnings declined from the year-ago quarter’s levels, revenues improved as the company continued to offer a full range of incentives to help buyers solve for a monthly payment. Despite the elevated interest rate environment, the ongoing shortage of existing home inventory for sale and a housing need for millennials and baby boomers boosted demand.

M.D.C. Holdings, Inc. MDC reported mixed third-quarter 2023 results, wherein earnings topped the Zacks Consensus Estimate while revenues missed the same. Moreover, both metrics declined year over year.

MDC’s uptrend can be attributable to the current new home market, which continues to benefit from the lack of existing home supply. The company witnessed notable improvements in its net new orders, driven by a significant decline in cancelations and its use of financing incentives, which are aimed at reducing the negative impact of higher mortgage rates for its buyers. Given the ongoing market scenario, the company aims to increase its land acquisition efforts and improve its market share position.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report