Beazer Homes USA Inc (BZH) Reports Decline in Q1 Fiscal 2024 Earnings Amidst Market Challenges

Net Income: $21.7 million, a decrease from $24.4 million in Q1 FY 2023.

Homebuilding Revenue: Dropped 14.2% to $380.9 million due to lower closings and average selling price.

Gross Margin: Improved to 19.9%, up 70 basis points from the previous year.

Net New Orders: Increased by 70.7% with a significant rise in sales pace and community count.

Backlog: Slight decrease in dollar value by 0.9%, with a 2.9% increase in backlog units.

Liquidity: Total liquidity at $404.2 million, with an improved total debt to total capitalization ratio.

ESG Initiatives: Progress with Zero Energy Ready homes, representing 54% of new home starts.

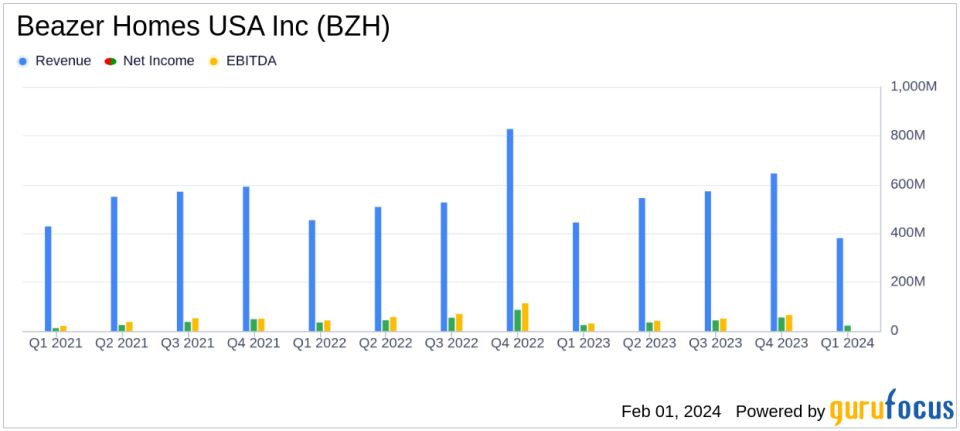

On February 1, 2024, Beazer Homes USA Inc (NYSE:BZH) released its 8-K filing, detailing the financial outcomes for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, a prominent player in the residential construction sector, reported a net income from continuing operations of $21.7 million, or $0.70 per diluted share, a decrease from $24.4 million, or $0.80 per diluted share, in the same quarter of the previous fiscal year.

Beazer Homes, which operates in over 13 states and more than 22 metro markets, specializes in building homes for a range of buyers, including first-time, move-up, and luxury segments. The company also engages in land purchasing and development to support its construction projects and offers mortgage services to its homebuyers.

Financial Performance and Market Challenges

The company's homebuilding revenue fell to $380.9 million, a 14.2% decrease, primarily due to a 10.8% reduction in home closings and a 3.8% decline in the average selling price to $512.7 thousand. Despite these challenges, Beazer Homes saw an improvement in homebuilding gross margin, which rose to 19.9%, up 70 basis points from the previous year. This margin enhancement reflects a decrease in build costs, partially offset by an increase in price concessions and closing cost incentives.

Beazer Homes faced a cybersecurity incident with one of its title insurer providers, which caused delays in closings during the quarter. However, the issue was resolved promptly, and the delayed closings were completed in the early weeks of January. The incident led to slightly lower revenue and earnings for the quarter, but the company's multi-year outlook and growth objectives remain on track.

Operational Highlights and Future Outlook

The company's net new orders saw a significant increase of 70.7%, driven by a higher sales pace and greater community count. The backlog dollar value experienced a marginal decrease of 0.9%, with a slight increase in backlog units. Beazer Homes also reported an improved liquidity position, with unrestricted cash at quarter-end standing at $104.2 million and total liquidity at $404.2 million.

Beazer Homes continues to focus on its environmental, social, and governance (ESG) initiatives, with a commitment to ensuring that by the end of 2025, every new home started will be Zero Energy Ready. As of the first quarter, 54% of new home starts were Zero Energy Ready homes, marking significant progress from the previous year.

Financial Statements and Key Metrics

The company's balance sheet shows a solid land position, with controlled lots increasing by 6.6% to 26,374. The total debt to total capitalization ratio improved to 46.5% at quarter-end, compared to 50.6% a year ago. Additionally, the net debt to net capitalization ratio was reduced to 43.7% from 47.3% in the prior year.

Beazer Homes' commitment to its ESG initiatives is evident in its operational strategy, with a significant increase in the number of Zero Energy Ready homes under construction. This strategic focus not only aligns with the growing consumer demand for energy-efficient homes but also positions the company as a leader in sustainable homebuilding.

Overall, Beazer Homes USA Inc (NYSE:BZH) navigated a challenging quarter with resilience, managing to improve its gross margin and maintain a strong backlog, despite facing revenue headwinds and external cybersecurity challenges. The company's focus on ESG initiatives and its strategic land acquisitions underscore its commitment to long-term growth and value creation for stakeholders.

For a detailed analysis of Beazer Homes USA Inc's financial results and operational strategies, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Beazer Homes USA Inc for further details.

This article first appeared on GuruFocus.