Belite Bio (BLTE) Stock Surges 72% in a Month: Here's Why

Belite Bio’s BLTE lead product candidate, Tinlarebant (LBS-008), is currently being evaluated in late-stage studies for the treatment of eye diseases like geographic atrophy (GA) and autosomal recessive Stargardt disease type 1 (STGD1). Tinlarebant is an oral, once-daily retinol-binding protein 4 antagonist, which works by early intervention for maintaining the health and integrity of retinal tissues in STGD1 and GA patients.

Currently, there are no FDA-approved treatments for STGD1 and no approved orally administered treatments for GA, which represent a high unmet medical need. If approved, Tinlarebant holds the potential to quench a serious unmet need in both STGD1 and GA.

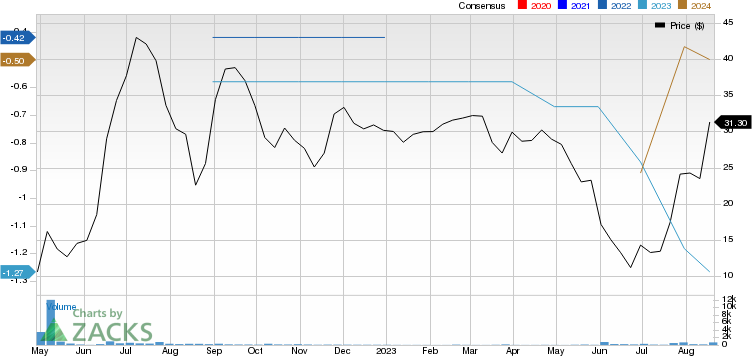

In the past 30 days, shares of BLTE have shot up 72% against the industry’s 2.6% fall. The soaring of the stock price during this period was fueled by encouraging progress on the development of Tinlarebant for eye diseases.

Image Source: Zacks Investment Research

In July, Belite completed enrollment in its pivotal global phase III DRAGON study, evaluating Tinlarebant to treat patients with STGD1. Per management, the phase III study was initiated after observing sustained slowing of disease progression in the ongoing 18-month phase II study for patients with STGD1. Management believes that Tinlarebant has the potential to be the first FDA-approved treatment option for STGD1.

The late-stage DRAGON study is a randomized and worldwide study to evaluate the safety and efficacy of Tinlarebant in adolescent STGD1 patients. Additionally, 100 patients have been enrolled in the above-mentioned study across 11 countries. The primary endpoint of the study is slowing the disease progression as measured by the slowing of lesion growth rate. The safety and tolerability profile of the drug also falls under the study’s primary endpoint.

Notably, Tinlarebant enjoys the FDA’s Fast Track Designation and Rare Pediatric Disease Designation in the United States and Orphan Drug Designation in both the United States and EU for STGD1 indication.

Belite Bio expects to report top-line results from the phase II study of Tinlarebant in STGD1 in the fourth quarter of 2023, followed by interim data from the phase III DRAGON study by mid-2024.

In the second half of July, the company announced successfully dosing the first subject in its late-stage pivotal PHOENIX study of Tinlarebant to treat patients with GA in the United States. The phase II study of Tinlarebant in STGD1 also provided proof-of-concept for the candidate’s potential to treat GA orally, sharing similar pathophysiology as GA.

The two-year global phase III PHOENIX study began enrollment in the third quarter of 2023. This study’s primary endpoint is also the slowing of the rate of lesion growth from baseline to month 24 compared with placebo. Midway through the PHOENIX study, Belite Bio anticipates conducting an interim safety and efficacy analysis of Tinlarebant.

The company expects to enroll approximately 430 patients with early-stage GA to be randomly divided into two treatment arms, one receiving Tinlarebant and the other receiving placebo, in the ratio of 2:1.

Earlier this month, Belite reported its second-quarter 2023 financial results. The company reported a loss of 26 cents per share, wider than the Zacks Consensus Estimate of a loss of 24 cents per share. BLTE’s research and development expenses in the reported quarter also increased 249% year over year due to expenses incurred for conducting the PHOENIX study along with expenses related to the expanded workforce.

General and administrative expenses also increased 46% year over year on the back of increased professional service fees along with wages and salaries.

In the absence of any marketed products, Belite Bio is yet to generate revenues. The company also currently does not have a clinical-stage pipeline candidate beyond Tinlarebant.

Belite Bio, Inc. Sponsored ADR Price and Consensus

Belite Bio, Inc. Sponsored ADR price-consensus-chart | Belite Bio, Inc. Sponsored ADR Quote

Zacks Rank and Stocks to Consider

Belite Bio currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the pharma/biotech sector are J&J JNJ, Corcept Therapeutics CORT and Dynavax Technologies DVAX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for J&J’s 2023 earnings per share has increased from $10.67 to $10.75. During the same period, the estimate for JNJ’s 2024 earnings per share has increased from $11.01 to $11.29. Shares of JNJ have gained 0.8% in the past month.

JNJ beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.58%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has gone up from 66 cents to 78 cents. The estimate Corcept’s 2024 earnings per share has also improved from 64 cents to 83 cents. Shares of CORT have climbed 27.3% in the past month.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

In the past 90 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 56 cents to 24 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 2 cents. Shares of DVAX have risen by 1.9% in the past month.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Belite Bio, Inc. Sponsored ADR (BLTE) : Free Stock Analysis Report