Bell-Boeing Clinches a Contract to Support V-22 Osprey Aircraft

Bell-Boeing, a joint venture between The Boeing Company BA and Bell Helicopter, a unit of Textron Inc. TXT, recently secured a contract involving the V-22 Osprey aircraft. The Naval Air Systems Command, Patuxent River, MD, has awarded the deal.

Details of the Deal

Valued at $19.3 million, the contract is expected to be completed by May 2028. Per the terms of the deal, Bell-Boeing will provide recurring and non-recurring engineering for completing software upgrades to support the V-22 aircraft program.

The majority of the work related to this deal will be carried out in Ridley Park, PA, and Fort Worth, TX. The contract will serve the government of Japan.

Growing Jet Demand & V-22 Jets

A rapid increase in terror attacks across the globe has compelled nations to strengthen their arsenal and bump up their defense budget. With the United States being the largest exporter of defense equipment across the world, the country witnesses a steady flow of contracts for its combat-proven weaponry from both Pentagon and its foreign allies. With military jets and helicopters constituting a major portion of a nation’s armaments, prominent jet manufacturers in the United States, like Textron and Boeing, frequently witness notable contract wins for their combat-proven aircraft.

To this end, it is imperative to mention that Bell-Boeing’s primary product, V-22 Osprey, is a family of multi-mission, tiltrotor military aircraft with both vertical as well as short takeoff and landing capabilities. V-22 Osprey is designed to combine the functionality of a conventional helicopter with the long-range, high-speed cruise performance of a turboprop aircraft.

Considering these features of the aforementioned family of tiltrotors and the growing demand for military aircraft, V-22 enjoys solid demand in the military jet market across the globe. The latest contract win is a bright example of that.

Growth Prospects

Amid geopolitical tensions like the Russian invasion of Ukraine and the ongoing conflict in the Middle East, nations are rapidly augmenting their defense spending to procure more fighter jets. This, in turn, has been bolstering the prospects of the military aviation industry. Per a report by the Mordor Intelligence firm, the global military aviation market is estimated to witness a CAGR of 5.23% in the 2024-2030 period. This will surely benefit major U.S. combat aircraft manufacturers like Textron, Boeing, Lockheed Martin LMT and Northrop Grumman NOC, with North America dominating this market space.

Lockheed is one of the pioneers in the combat aircraft space, with its product portfolio constituting some of the most advanced military aircraft like F-35, C-130, F-16, F-22 and a few more. Of these, F-35 is the company’s largest program.

LMT boasts a long-term earnings growth rate of 4.2%. The Zacks Consensus Estimate for LMT’s 2024 sales indicates an improvement of 2.4% from the 2023 reported figure.

On the other hand, Northrop is a renowned manufacturer of autonomous and manned aircraft like MQ-4C Triton and Global Hawk. These jets are used for battle management, strike and intelligence, surveillance and reconnaissance.

Northrop boasts a long-term earnings growth rate of 10.1%. The Zacks Consensus Estimate for NOC’s 2024 sales indicates an improvement of 4.6% from the 2023 reported figure.

Price Movement & Zacks Rank

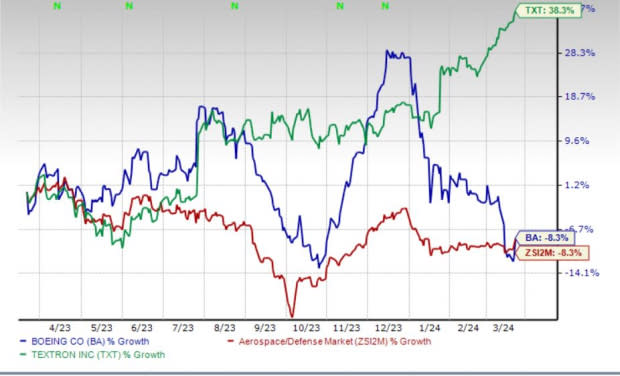

Textron’s shares have risen 38.3% in the past year against the industry’s 8.3% decline. Boeing’s shares have lost 8.3% in the past year.

Image Source: Zacks Investment Research

Textron currently sports a Zacks Rank #1 (Strong Buy), while Boeing carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report