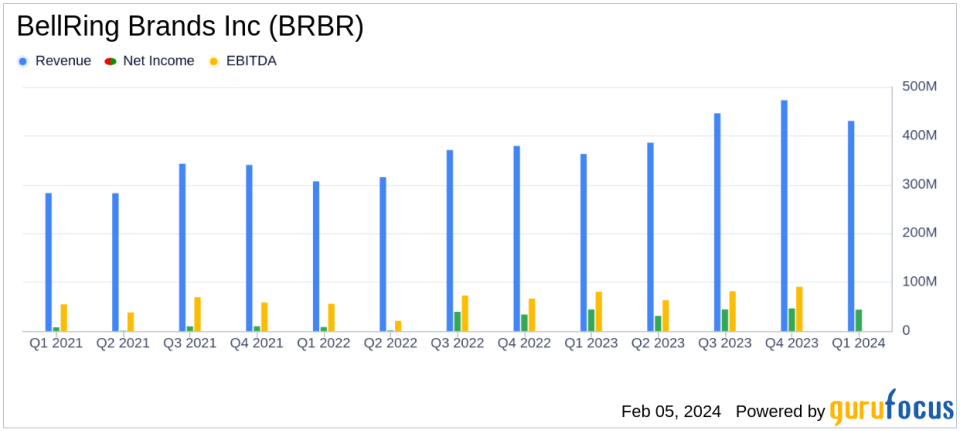

BellRing Brands Inc (BRBR) Reports First Quarter Fiscal 2024 Results, Raises Full-Year Guidance

Net Sales: $430.4 million, an 18.7% increase from the previous year.

Operating Profit: $73.0 million, despite a slight decrease of 2.9% due to accelerated amortization.

Net Earnings: $43.9 million, marginally down by 0.7% year-over-year.

Adjusted EBITDA: $100.5 million, up 18.4% from the prior year, reflecting strong operational performance.

Cash Flow: Generated $74.2 million in cash from operations, indicating healthy liquidity.

Outlook: Raised fiscal year 2024 net sales outlook to $1.87-$1.95 billion and Adjusted EBITDA outlook to $375-$400 million.

Share Repurchases: Repurchased 0.2 million shares for $9.4 million, with $13.7 million remaining under the authorization.

On February 5, 2024, BellRing Brands Inc (NYSE:BRBR) released its 8-K filing, announcing results for the first fiscal quarter ended December 31, 2023. The company, a leader in the global convenient nutrition category, reported an 18.7% increase in net sales to $430.4 million, driven by a 19.0% increase in volume, slightly offset by a 0.3% decrease in price/mix.

BellRing Brands Inc, known for its Premier Protein, Dymatize, and PowerBar brands, offers a range of nutrition products such as ready-to-drink protein shakes, powders, and nutrition bars. The company's products are widely distributed across various channels, including club, food, drug, mass, eCommerce, convenience, and specialty.

Financial Performance and Challenges

The company's operating profit was reported at $73.0 million, a slight decrease of 2.9% from the prior year, primarily due to $17.4 million of accelerated amortization related to the discontinuance of the North American PowerBar business. Despite this, net earnings were relatively stable at $43.9 million, only a 0.7% decrease compared to the previous year. Adjusted EBITDA, a non-GAAP measure, saw a significant increase of 18.4% to $100.5 million, indicating strong underlying operational performance.

BellRing's financial achievements are particularly important in the Consumer Packaged Goods industry, where consistent innovation and efficient supply chain management are key to maintaining growth and profitability. The company's ability to raise its full-year outlook reflects confidence in its operational efficiency and market strategy.

Key Financial Metrics

Key metrics from the Income Statement show that gross profit increased by 21.5% to $148.0 million, or 34.4% of net sales, due to net input cost deflation, partially offset by incremental promotional activity. Selling, general and administrative (SG&A) expenses increased to $52.8 million, or 12.3% of net sales, due to higher employee costs and increased distribution and warehousing expenses on higher volumes.

From the Balance Sheet, BellRing reported total assets of $715.5 million as of December 31, 2023, with a notable increase in cash and cash equivalents to $85.0 million from $48.4 million at the end of the previous quarter. The company's long-term debt stood at $832.1 million, slightly down from $856.8 million as of September 30, 2023.

Cash Flow Statement highlights include $74.2 million generated from operating activities, a substantial increase from $36.3 million in the same period last year, showcasing BellRing's ability to convert earnings into cash effectively.

"Our first quarter performance was strong, coming in ahead of our expectations as we continued to ramp up our shake supply and began to drive demand," said Darcy H. Davenport, President and Chief Executive Officer of BellRing.

The company's management has raised its guidance for fiscal year 2024, now expecting net sales to be between $1.87 and $1.95 billion and Adjusted EBITDA to be between $375 and $400 million. This updated outlook reflects a growth of 12%-17% and 11%-18%, respectively, over fiscal year 2023.

BellRing's performance demonstrates its resilience and adaptability in a competitive market. The company's strategic focus on expanding its product offerings and distribution channels, coupled with effective cost management, positions it well for continued growth in the nutrition sector.

For more detailed financial information and the full earnings report, investors and interested parties are encouraged to review the complete 8-K filing.

Explore the complete 8-K earnings release (here) from BellRing Brands Inc for further details.

This article first appeared on GuruFocus.