Benchmark Electronics Inc (BHE) Posts Mixed Results for Q4 and Full Year 2023

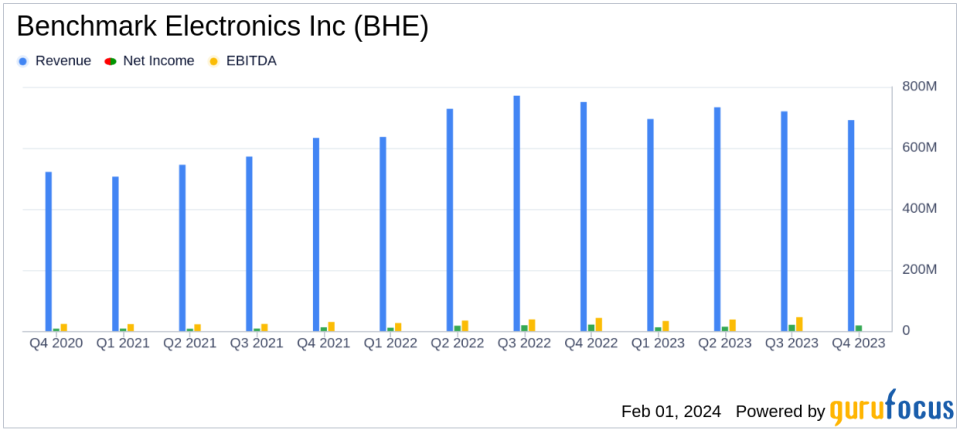

Revenue: Q4 revenue decreased to $691 million from $751 million in the prior year.

Net Income: Full-year net income dropped to $64 million from $68 million in 2022.

Earnings Per Share: GAAP and non-GAAP EPS for the year were $1.79 and $2.04, respectively.

Gross Margin: Full-year gross margin improved to 9.5%, a 70 basis point increase year-over-year.

Free Cash Flow: Generated $97 million in free cash flow for the full year 2023.

On January 31, 2024, Benchmark Electronics Inc (NYSE:BHE) released its 8-K filing, announcing its financial results for the fourth quarter and full fiscal year ended December 31, 2023. The company, known for its product design, engineering services, technology solutions, and advanced manufacturing services across various industries, reported a decline in revenue for both the quarter and the year. However, it also saw an improvement in gross and operating margins and maintained a strong free cash flow.

Financial Performance Overview

Benchmark Electronics Inc's fourth-quarter revenue came in at $691 million, a decrease from the $751 million reported in the same quarter of the previous year. Despite the revenue decline, the company generated net cash from operations of $137 million and positive free cash flow of $126 million during the quarter. The gross margin remained stable at 10.3% for both GAAP and non-GAAP measures. Operating margins showed improvement, with GAAP operating margin at 4.6% and non-GAAP operating margin at 5.1%. Earnings per share for the quarter were $0.49 on a GAAP basis and $0.58 on a non-GAAP basis.

For the full year, Benchmark Electronics Inc's revenue was $2.8 billion, slightly down from $2.9 billion in 2022. The company delivered net cash from operations of $174 million and positive free cash flow of $97 million. The annual gross margin increased by 70 basis points to 9.5%, reflecting the company's operational discipline in a dynamic environment. Full-year GAAP operating margin was 3.9%, with non-GAAP operating margin at 4.4%. The GAAP and non-GAAP earnings per share were $1.79 and $2.04, respectively.

Challenges and Industry Sector Performance

President and CEO Jeff Benck acknowledged the challenges faced by Benchmark Electronics Inc, including demand softness in several end-markets expected to persist through the first half of 2024. Benck cited inventory management by customers as a contributing factor but expressed confidence in the company's ability to deliver further margin expansion and positive free cash flow in 2024.

"Benchmark delivered another solid year of performance in 2023 as we continued to execute to our strategic plan. Im particularly pleased with our free cash flow performance which was aided by inventory reductions. At the same time, our operational discipline allowed us to expand both gross and operating margin despite the dynamic environment," said Jeff Benck, Benchmarks President and CEO.

The fourth quarter saw a decrease in revenue across several industry sectors, with Next Gen Communications and Medical experiencing the most significant declines of 35% and 13%, respectively. However, Aerospace & Defense (A&D) saw a 13% increase in revenue.

Forward Guidance and Cash Conversion Cycle

For the first quarter of 2024, Benchmark Electronics Inc expects revenue to be between $625 million and $665 million, with diluted GAAP earnings per share between $0.32 and $0.38, and non-GAAP earnings per share between $0.42 and $0.48. The company anticipates restructuring charges to range between $3.1 million and $3.5 million, with amortization of intangibles expected to be $1.2 million.

The cash conversion cycle days for the end of 2023 stood at 98, an increase from 96 days at the end of 2022, reflecting a slight elongation in the time it takes to convert inventory and other resources into cash flow.

Conclusion

Benchmark Electronics Inc's mixed financial results for the fourth quarter and full year 2023 highlight the company's resilience in the face of industry challenges. With a focus on operational efficiency and cash flow management, the company is positioned to navigate the anticipated market softness and continue its strategic growth initiatives.

Investors and stakeholders can access the full earnings conference call and additional financial details on the company's website at www.bench.com.

For more detailed financial analysis and insights on Benchmark Electronics Inc (NYSE:BHE) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Benchmark Electronics Inc for further details.

This article first appeared on GuruFocus.