Benign Growth For Esports Entertainment Group, Inc. (NASDAQ:GMBL) Underpins Stock's 72% Plummet

To the annoyance of some shareholders, Esports Entertainment Group, Inc. (NASDAQ:GMBL) shares are down a considerable 72% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 100% share price decline.

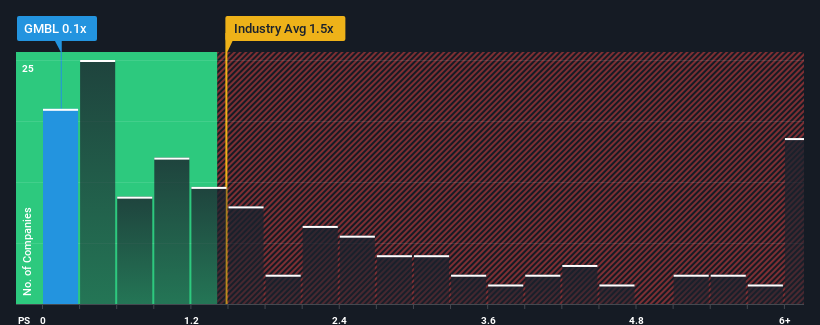

Since its price has dipped substantially, Esports Entertainment Group may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Hospitality industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Esports Entertainment Group

What Does Esports Entertainment Group's Recent Performance Look Like?

Esports Entertainment Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Esports Entertainment Group will help you uncover what's on the horizon.

Is There Any Revenue Growth Forecasted For Esports Entertainment Group?

In order to justify its P/S ratio, Esports Entertainment Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 53% over the next year. With the industry predicted to deliver 23% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Esports Entertainment Group's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Esports Entertainment Group's P/S Mean For Investors?

The southerly movements of Esports Entertainment Group's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Esports Entertainment Group's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Esports Entertainment Group's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Esports Entertainment Group (4 make us uncomfortable!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.