Bentley Systems Inc (BSY) Reports Solid Growth in 2023, Eyes Expansion in AI-Driven Asset Analytics

Total Revenues: Increased to $1,228.4 million, up 11.8% year-over-year.

Net Income: Grew significantly to $326.7 million, with diluted EPS at $1.00 compared to $0.55 in 2022.

Annualized Recurring Revenues (ARR): Reached $1,174.8 million, a 12.5% growth in constant currency.

Cash Flow from Operations: Improved to $416.7 million, up from $274.3 million in the previous year.

Adjusted Operating Income Margin: Increased to 26.4% for the full year, reflecting operational efficiency.

Dividend: Quarterly dividend raised to $0.06 per share for Q1 2024.

2024 Outlook: Revenue expected to be in the range of $1,350 million to $1,375 million with a 10.5% to 13% ARR growth rate.

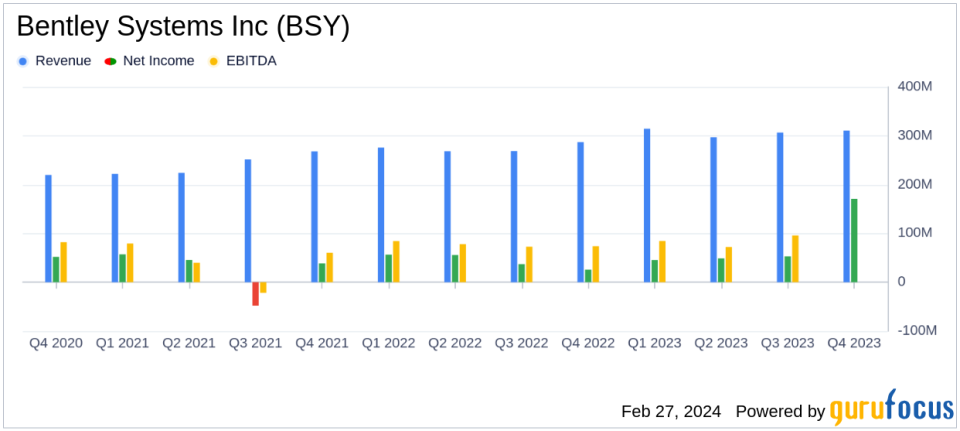

Bentley Systems Inc (NASDAQ:BSY), a leading infrastructure engineering software company, released its 8-K filing on February 27, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, known for its comprehensive software solutions for professionals and organizations involved in infrastructure projects, reported an 8.3% increase in total revenues for Q4 2023, amounting to $310.6 million. This growth is attributed to a robust 8.3% increase in subscription revenues, which totaled $272.5 million for the quarter.

Bentley Systems operates globally, with a significant portion of its revenue coming from outside the U.S., including 28% from EMEA and 18% from APAC. The company's software solutions are delivered through cloud, desktop, and hybrid environments, and it has a strong presence in the public works and utilities sector, which represents approximately two-thirds of its revenue.

The company's performance in 2023 was marked by several financial achievements, including a substantial increase in net income to $326.7 million, up from $174.8 million in the previous year. This translates to a net income per diluted share of $1.00, a significant increase from $0.55 in 2022. The Annualized Recurring Revenues (ARR) also saw a notable rise to $1,174.8 million, representing a constant currency ARR growth rate of 12.5%. The last twelve-month recurring revenues dollar-based net retention rate was 109%, slightly down from 110% for the same period last year.

BSY's operational efficiency is evident in its improved cash flow from operations, which reached $416.7 million, and an Adjusted Operating Income (OI w/SBC) margin that increased to 26.4% for the full year, compared to 24.9% in 2022. These metrics underscore the company's ability to generate cash and maintain profitability, which are critical for sustaining growth and shareholder value in the competitive software industry.

CEO Greg Bentley expressed confidence in the company's financial outlook for 2024, citing consistent organic growth and operational margin improvement. He highlighted the company's focus on acquisitions in asset analytics, such as OpenTower and Blyncsy, which leverage AI to enable 'instant-on' infrastructure digital twins at scale. COO Nicholas Cumins credited the company's solid financial results to growth drivers such as North America, enterprise accounts, and competitive differentiation through Virtuosity subscriptions and license sales.

CFO Werner Andre emphasized the strong cash conversion, which allowed BSY to repay its revolving line of credit and raise its dividend. The company's board of directors declared a $0.06 per share dividend for Q1 2024, reflecting its financial health and commitment to shareholder returns.

For the full year 2024, Bentley Systems anticipates total revenues in the range of $1,350 million to $1,375 million, with a constant currency growth of 10% to 12%. The company expects a constant currency ARR growth rate of 10.5% to 13%, and an Adjusted OI w/SBC margin annual improvement of approximately 100 basis points. The effective tax rate is projected to be around 20%, with cash flow from operations representing a conversion rate from Adjusted EBITDA of approximately 80%, and capital expenditures of about $22 million.

Overall, Bentley Systems Inc (NASDAQ:BSY) has demonstrated a strong financial performance in 2023, with significant growth in key metrics such as revenue, net income, and ARR. The company's strategic focus on AI-driven asset analytics and its positive financial outlook for 2024 position it well for continued success in the infrastructure engineering software market.

Explore the complete 8-K earnings release (here) from Bentley Systems Inc for further details.

This article first appeared on GuruFocus.