Berkshire Hathaway Earnings Preview: A Historically Cheap Valuation

Even at 92 years old Warren Buffett is as involved as ever at Berkshire Hathaway BRK.B. There is one word to describe the performance of Berkshire Hathaway over the last two years, resilience. Steady performance in the good times, and outperformance in the bad times are exactly the reason investors choose to invest with Buffett.

Over the last two years the S&P 500 is flat, while Berkshire has managed to climb 16.5%. During 2022, when the broad market was down -20%, Berkshire posted a 3% return.

Warren Buffett’s conglomerate Berkshire Hathaway reports earnings Friday where we can expect insights into the company, economy, and investing broadly.

Image Source: Zacks Investment Research

Earnings Estimates

Berkshire Hathaway currently boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Earnings estimates have seen considerable upgrades over the last two months, with FY23 earnings being revised higher by 17% over that time.

Because of how diversified Berkshire is, in many ways it is a direct reflection of the economy, so this bullish development is very interesting. Do these expectations reflect a possibility of the market completely avoiding a recession?

Image Source: Zacks Investment Research

Q1 sales estimates are projected to grow 5% YoY to $74.5 billion. Earnings growth is expected to fall -12.3% to $2.79 per share, however Q2 is expected to rebound massively. Q2 is projecting 53% YoY growth to $6.43 per share.

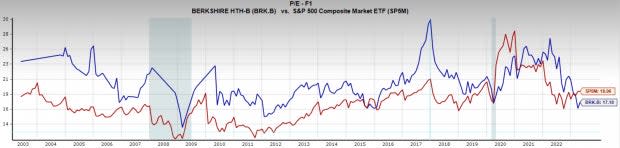

Valuation

The most compelling factor regarding Berkshire Hathaway today is its valuation. Currently trading at a one-year forward earnings multiple of 17x, it is below its 20-year median of 20x and below the broad market average of 19x.

It is a very rare event that Berkshire’s earnings multiple dips below the broad market average, and on every occasion in the past, it was a buying opportunity.

Image Source: Zacks Investment Research

Buffett

In last year’s annual report Berkshire Hathaway listed the historical returns of its stock. Since 1965 Berkshire has returned an unfathomable 3,787,464% vs the S&P 500 24,700% over the same period. How was that accomplished?

It was achieved because of Warren Buffett of course. Buffett is the best living investor, and possibly best of all-time with a track record like that.

Admittedly, the returns have mostly mimicked those of the broad market in more recent years. From 1965 the annualized returns are 20%, double that of the broad market. However, over the last 20 years BRKB has almost perfectly matched the returns of the market, putting up annualized returns of 9.95% vs the market’s 9.89%.

The resiliency during the tough times is why investors pick Berkshire though.

Key Man Risk

The exceptional nature of Buffett is exactly why there may be a historical discount on BRKB shares. The fact of the matter is, he isn’t going to be around much longer and that is scary for investors. But what he has built over a lifetime isn’t going anywhere. It seems unlikely that Buffett would set Berkshire up to not continue to succeed after him.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report