Berry Global (BERY) Q3 Earnings & Revenues Miss, Decline Y/Y

Berry Global Group, Inc. BERY reported third-quarter fiscal 2023 (ended Jul 1, 2023) adjusted earnings (excluding 72 cents from non-recurring items) of $1.90 per share, which missed the Zacks Consensus Estimate of $1.97. The bottom line decreased 6.4% year over year, primarily due to weakness in the consumer and industrial end markets.

Net sales of $3,229 million missed the Zacks Consensus Estimate of $3,461.6 million. The top line decreased 13.3% year over year due to a 7% dip in volumes, and lower selling prices, which declined $250 million due to the pass-through of lower resin costs. Reduced demand in the consumer and industrial markets led to the volume decline.

In the fiscal third quarter, Berry Global’s cost of goods sold decreased 14.7% to $2,649 million. Selling, general and administrative expenses remained flat year over year at $215 million. Berry Global reported an operating EBITDA of $522 million, down 5.1% year over year. Adjusted operating income in the quarter declined 9.2% year over year to $315 million.

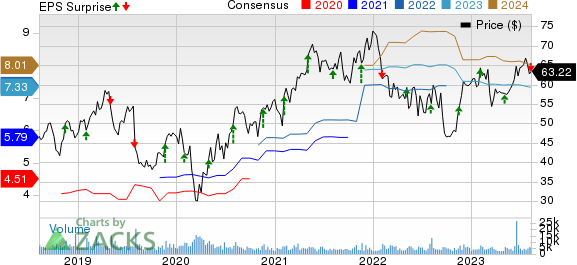

Berry Global Group, Inc. Price, Consensus and EPS Surprise

Berry Global Group, Inc. price-consensus-eps-surprise-chart | Berry Global Group, Inc. Quote

Segmental Discussion

Consumer Packaging – International sales were $1,036 million (accounting for 32.1% of total sales), down 5.5% from the year-ago quarter. Our estimate for segmental revenues was $1056.7 million. The decline in sales was due to lower selling prices and volumes as a result of weakness in the industrial and consumer markets. Operating income of $68 million fell 17.1% year over year.

Consumer Packaging – North America’s sales were $798 million (accounting for 24.7% of total sales), down 13.9% year over year due to a 4% decline in volumes. Our estimate for segmental revenues was $863.8 million. Operating income dropped 14.4% year over year to $89 million.

Revenues generated from the Health, Hygiene & Specialties segment amounted to $657 million (accounting for 20.3% of total sales), down 16.6% year over year due to a 7% decrease in volumes as a result of lower demand in filtration and building and construction, and other specialty markets. Operating income of $22 million dropped 60.7% year over year.

Revenues from the Engineered Materials segment fell 19.3% year over year to $738 million (accounting for 22.8% of total revenues) due to an 11% decline in volumes as a result of inventory destocking, weakness in the European industrial markets and decreased selling prices. Operating income of $88 million decreased 6.4% year over year.

Balance Sheet and Cash Flow

At the end of third quarter of fiscal 2023, Berry Global had cash and cash equivalents of $633 million compared with $1,410 million at the end of fiscal 2022. Current and long-term debt totaled $9,212 million compared with $9,255 million at the end of fiscal 2022.

At the end of fiscal third quarter, Berry Global generated net cash of $490 million from operating activities compared with $345 million in the year-ago period. Capital expenditure totaled $560 million compared with $556 million in the year-ago quarter. Adjusted free cash outflow at the end of fiscal third quarter was $70 million compared with $211 million in the year-ago period.

In the first nine months of fiscal 2023, BERY repurchased 6.9 million shares for approximately $416 million. It also paid dividends of $97 million in the same period. The company expects to repurchase shares worth at least $600 million in fiscal 2023.

FY23 Guidance

Berry Global, carrying a Zacks Rank #4 (Sell), expects adjusted earnings of $7.30 per share in fiscal 2023. The Zacks Consensus Estimate for the same stands at $7.33.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

BERY anticipates cash flow from operations of $1.45 billion in fiscal 2023. It expects free cash flow of $800 in the same period.

Performance of Other Industrial Companies

A. O. Smith Corporation’s AOS second-quarter 2023 adjusted earnings (excluding 3 cents from non-recurring items) of $1.01 per share surpassed the Zacks Consensus Estimate of adjusted earnings of 91 cents per share. The bottom line jumped 23.2% year over year.

A. O. Smith’s net sales of $960.8 million underperformed the consensus estimate of $971 million. The top line dipped 0.5% year over year.

Allegion plc’s ALLE second-quarter 2023 adjusted earnings of $1.76 per share surpassed the Zacks Consensus Estimate of $1.69. The bottom line increased 28.5% year over year.

Allegion’s revenues of $912.5 million missed the Zacks Consensus Estimate of $927 million. However, the top line jumped 18% from the year-ago quarter.

IDEX Corporation’s IEX second-quarter 2023 adjusted earnings of $2.18 per share surpassed the Zacks Consensus Estimate of adjusted earnings of $2.12 per share. On a year-over-year basis, the bottom line increased 7.9%.

IDEX’s net sales of $846.2 million underperformed the Zacks Consensus Estimate of $847 million. However, the top line increased 6.3% year over year. Organic sales in the quarter increased 3% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report